Plume CEO Questions RWA Market Size, Cites Institutional Hesitation

The tokenization of real-world assets (RWAs) is a hot topic, but Chris Yin, CEO of Plume, a Galaxy-backed RWA platform, believes the market is still in its early stages and not ready for widespread institutional adoption. He argues that the commonly cited $21 billion market size is inaccurate and that institutions are primarily driven by profit, not efficiency, when considering RWA investments.

RWA Market Still Nascent for Institutional Adoption

Yin made his remarks on the sidelines of Token2049 in Dubai, stating that institutions are taking a cautious approach to RWAs. He draws parallels to the early days of Bitcoin and stablecoins, noting that it took years for institutions to embrace those technologies. “These things move incredibly slowly, you have to show value, you have to show adoption first,” Yin explained.

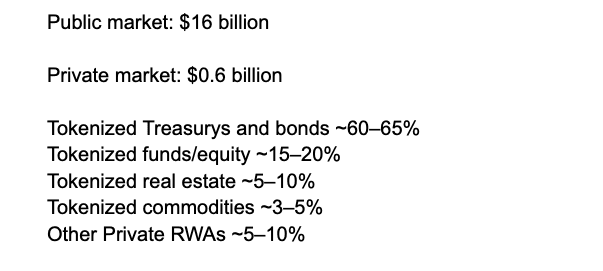

One of the key issues, according to Yin, is the overestimation of the RWA market’s current size. He believes the actual figure is closer to $10 billion, primarily comprised of Treasury bills and gold, with a smaller allocation to private credit. This contrasts with the frequently cited $21 billion valuation.

Discrepancies in RWA Market Size Estimates

Several factors contribute to the difficulty in accurately assessing the RWA market size. Data is often fragmented and inaccessible, especially concerning the private side of the market. Stobox co-founder Ross Shemeliak acknowledges these challenges, but estimates that tokenized Treasuries and bonds constitute the majority (60-65%) of RWAs.

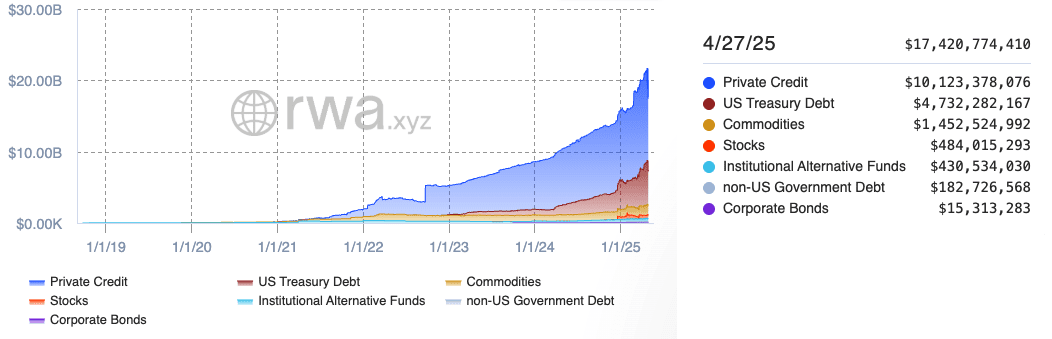

According to RWA.xyz, the total market capitalization of the RWA market was around $17.4 billion as of April 27, with private credit making up nearly 60%, while Treasury’s and commodities shared 27% and 8%, respectively.

Shemeliak also emphasizes the immense potential of tokenizing private companies. “Crucially, 99.9% of all companies in the world are private, and nearly all of them are untapped candidates for tokenization,” he stated. Tokenization can provide these companies with new avenues for fundraising, investor engagement, and capital table transparency.

Institutional Focus: Profit Over Efficiency

Yin believes that institutions are primarily motivated by profit when considering RWAs. “So the reason why tokenized assets are interesting to them is because they are looking for an angle to make more money, not to save money, not to do efficiency.” He points to BlackRock’s money market fund as an example, noting that its $2.5 billion in tokenized treasuries is relatively small compared to the company’s overall assets.

The Future of RWA Tokenization

While the RWA market may be small today, its future potential is undeniable. Deloitte predicts that tokenized real estate on the blockchain could reach $4 trillion by 2035. Yin suggests that the RWA industry should initially focus on the native crypto community, stating, “There are zero institutions putting money onchain. They are trying to actually suck money out of the ecosystem. Their products try to sell new things to crypto. Not putting money here.”

Shemeliak acknowledges that RWA tokenization is still in its early stages, similar to Bitcoin in 2013. However, he believes that tokenized assets are inherently institutional due to their nature as regulated securities and yield-bearing instruments that require legal compliance and governance.

Key Takeaways:

- Plume CEO Chris Yin questions the accuracy of the reported $21 billion RWA market size.

- Yin believes that institutional adoption of RWAs will be slow, similar to Bitcoin and stablecoins.

- Data fragmentation and inaccessible private market information make it challenging to accurately assess the RWA market size.

- Institutions are primarily motivated by profit when considering RWA investments.

- The RWA industry has significant future potential, with Deloitte predicting a $4 trillion tokenized real estate market by 2035.

- Early stages of RWA tokenization require institutional support, fund managers, underwriters, legal advisors, and regulated platforms.

In conclusion, while the RWA market faces challenges related to size, data accuracy, and institutional hesitancy, its long-term prospects remain promising. As the market matures and institutions recognize the potential benefits of tokenized assets, the RWA sector is poised for substantial growth.