Polygon-based non-fungible tokens (NFTs) have recently taken the lead in digital collectible sales, experiencing a significant surge of 20% in the last seven days. This shift indicates a growing interest in the Polygon network and the unique NFT projects it hosts.

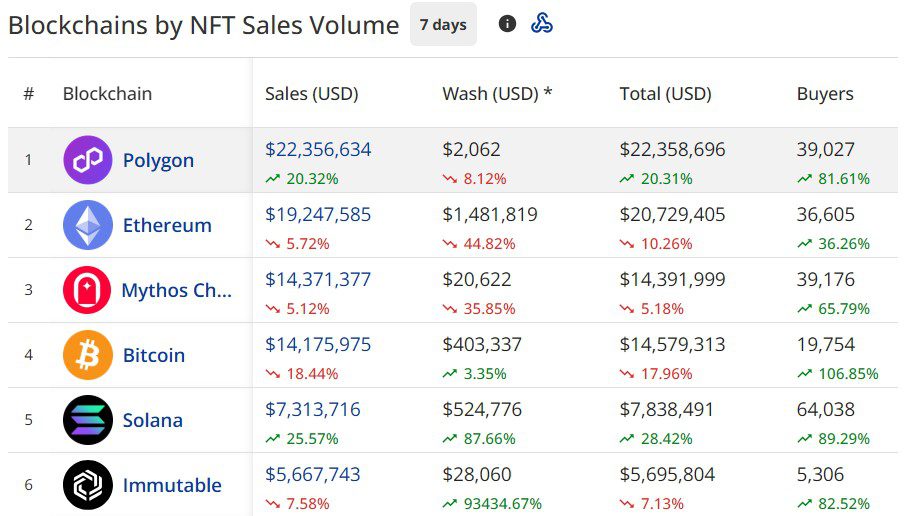

According to data from CryptoSlam, Polygon NFTs achieved a remarkable $22.3 million in sales volume over the past week, surpassing Ethereum’s $19.2 million. This represents a substantial 24% of the total NFT sales volume for the week, which reached $92.9 million. The Polygon network also saw a significant increase in NFT buyers, with over 39,000 users participating in transactions, marking an impressive 81% increase compared to the previous week.

While Ethereum remains a strong contender in the NFT space, Polygon’s recent success highlights the increasing adoption of its blockchain for NFT projects. Mythos Chain and Bitcoin-based collections followed closely behind in sales volume, ranking third and fourth, respectively.

The Rise of RWA NFTs on Polygon

The primary driver behind Polygon’s NFT surge is the growing popularity of real-world asset (RWA) NFTs. This trend signifies the expansion of RWA tokenization into the NFT realm.

RWA tokenization involves representing tangible assets on a blockchain, enhancing their accessibility and trading opportunities. By converting assets like art, property, or stocks into digital tokens, individuals can easily buy, sell, and trade these assets on blockchain platforms.

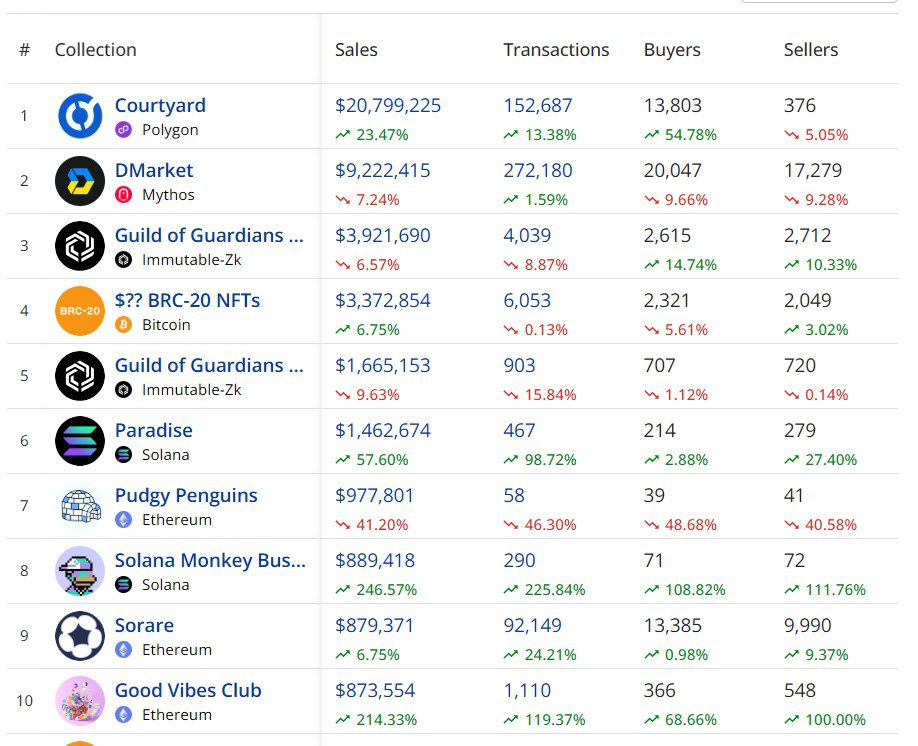

CryptoSlam data reveals that the increased sales of Courtyard NFTs played a significant role in Polygon’s NFT surge. The Courtyard collection achieved a sales volume of $20.7 million, outperforming other popular NFT projects during the week.

Courtyard: Tokenizing Physical Collectibles

Courtyard operates as an RWA marketplace specializing in graded physical card collections. These collections include popular trading cards such as Pokémon, basketball, and baseball cards, which are highly sought after by collectors.

The platform ensures the safety and security of tokenized cards by storing and insuring them in a vault managed by a security company. This physical backing adds value and credibility to the NFTs. Users who purchase Courtyard NFTs have the option to redeem the physical card. Upon redemption, the corresponding NFT is burned, removing it from circulation in the marketplace.

RWA Tokenization: A Growing Trend

Onchain RWAs have emerged as a significant trend in the first quarter of 2025. Data from RWA.xyz indicates that tokenized assets have reached a value of $21.2 billion, with a total of over 97,000 asset holders. This figure excludes the value of stablecoins, which is already at $227 billion.

Why Polygon is Gaining Traction in the NFT Space:

- Lower Transaction Fees: Polygon offers significantly lower transaction fees compared to Ethereum, making it more accessible for both creators and collectors.

- Faster Transaction Speeds: Polygon boasts faster transaction speeds, ensuring quicker and more efficient NFT trading.

- Growing Ecosystem: The Polygon ecosystem is rapidly expanding, attracting new NFT projects and users.

- Focus on RWAs: Polygon’s focus on supporting RWA tokenization has positioned it as a leading platform for this emerging trend.

Key Takeaways:

- Polygon NFTs have surpassed Ethereum in 7-day sales volume.

- Real-world asset (RWA) NFTs are driving Polygon’s growth.

- Courtyard is a leading RWA marketplace for graded physical card collections.

- RWA tokenization is a growing trend in the blockchain space.

In conclusion, Polygon’s recent surge in NFT sales highlights the platform’s growing prominence in the digital collectible space. The rise of RWA NFTs, combined with Polygon’s lower fees and faster transaction speeds, has attracted a significant number of users and projects. As the RWA tokenization trend continues to gain momentum, Polygon is well-positioned to remain a leading platform for NFT innovation.