The financial data industry, valued at $50 billion, is undergoing a significant transformation driven by high-speed blockchain oracle networks like Pyth. Michael James, Head of Institutional Business Development at Douro Labs (the company behind Pyth Network), highlighted in a recent interview how Pyth’s unique approach is disrupting the established order, dominated by a few major providers.

The Problem: High Costs and Limited Access in Traditional Finance Data

Traditional financial data providers, according to James, operate in a near-monopoly, dictating prices with little competition. These high costs create barriers to entry, particularly for small and medium-sized businesses, stifling innovation and concentrating power in the hands of a few large players. Compliance requirements further exacerbate the issue, forcing financial institutions to purchase expensive data regardless of trading volume.

“These data vendors have no competition in traditional finance, and so they have all the pricing power in the world. There is no substitutability; whether you are a banker or hedge fund and you are trading more or less – you still have to buy that data for compliance reasons,” James stated.

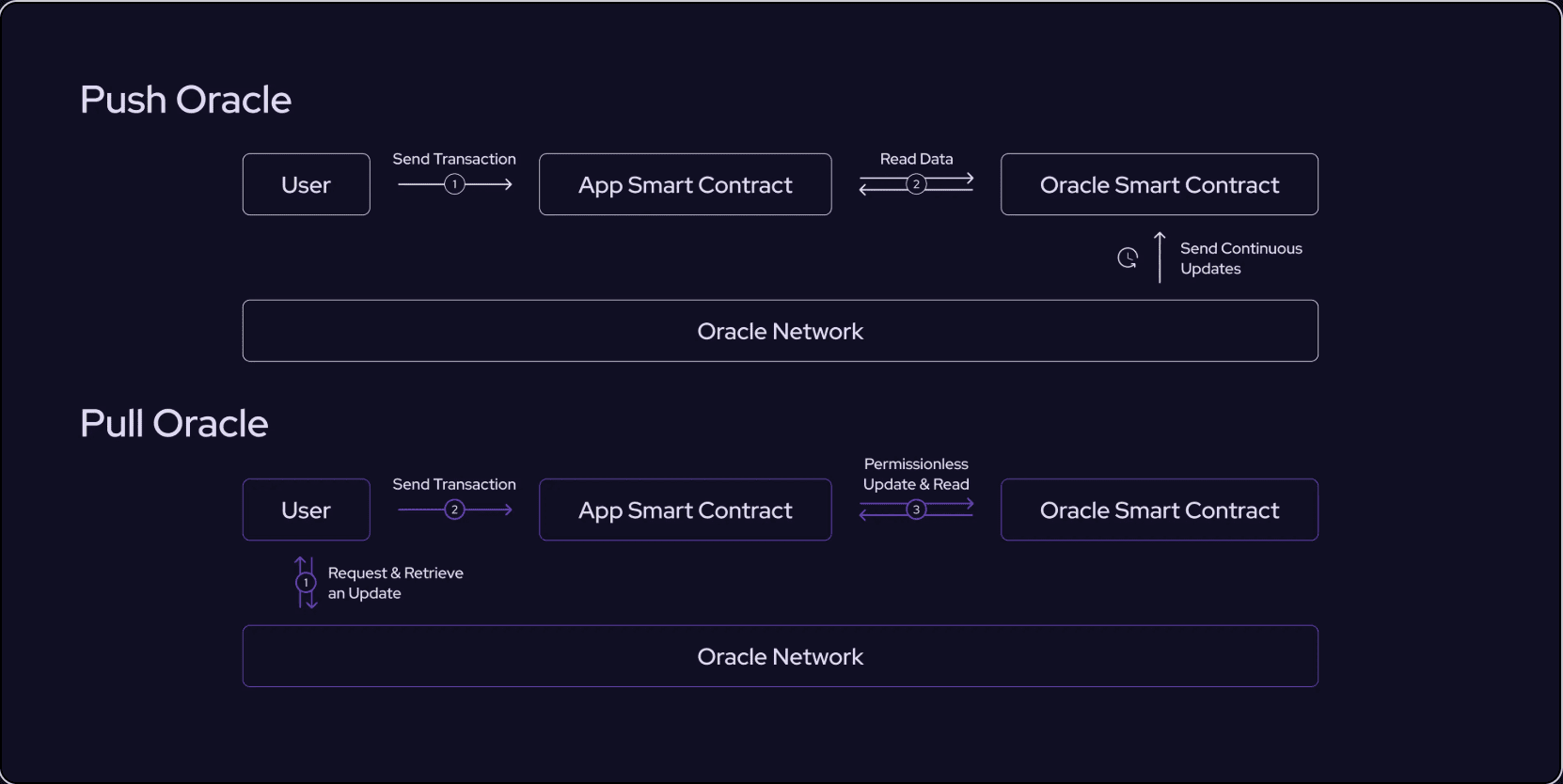

Pyth Network’s Solution: A Data Pull Model for Cost-Effective, Real-Time Data

Pyth Network distinguishes itself through its innovative data pull model. This approach allows customers to access and pay for data on demand, significantly reducing costs compared to traditional pricing oracles. This model is particularly beneficial for institutions requiring real-time market data but wanting to avoid exorbitant subscription fees.

Key benefits of the Pyth Network’s data pull model:

- Reduced Costs: Pay-as-you-go model eliminates unnecessary subscription fees.

- Real-Time Data: Provides up-to-the-second market information.

- Accessibility: Opens opportunities for smaller businesses to participate in the financial ecosystem.

Pyth Network’s Growth and Impact

Pyth Network provides real-time market data and price feeds for a wide range of assets, including cryptocurrencies, equities, FOREX, commodities, and rates. The network has experienced significant growth, expanding its reach and influence within the blockchain oracle market.

A notable achievement in December 2024 was the launch of real-time oil pricing data on over 80 blockchain networks. This provides crucial data for West Texas Intermediate (WTI) and Brent Crude Oil, facilitating energy derivatives trading and energy trading activities on blockchain platforms.

Pyth Network’s key offerings:

- Real-time pricing data for various asset classes.

- Support for over 80 blockchain networks.

- Enables energy derivatives and trading on blockchain rails.

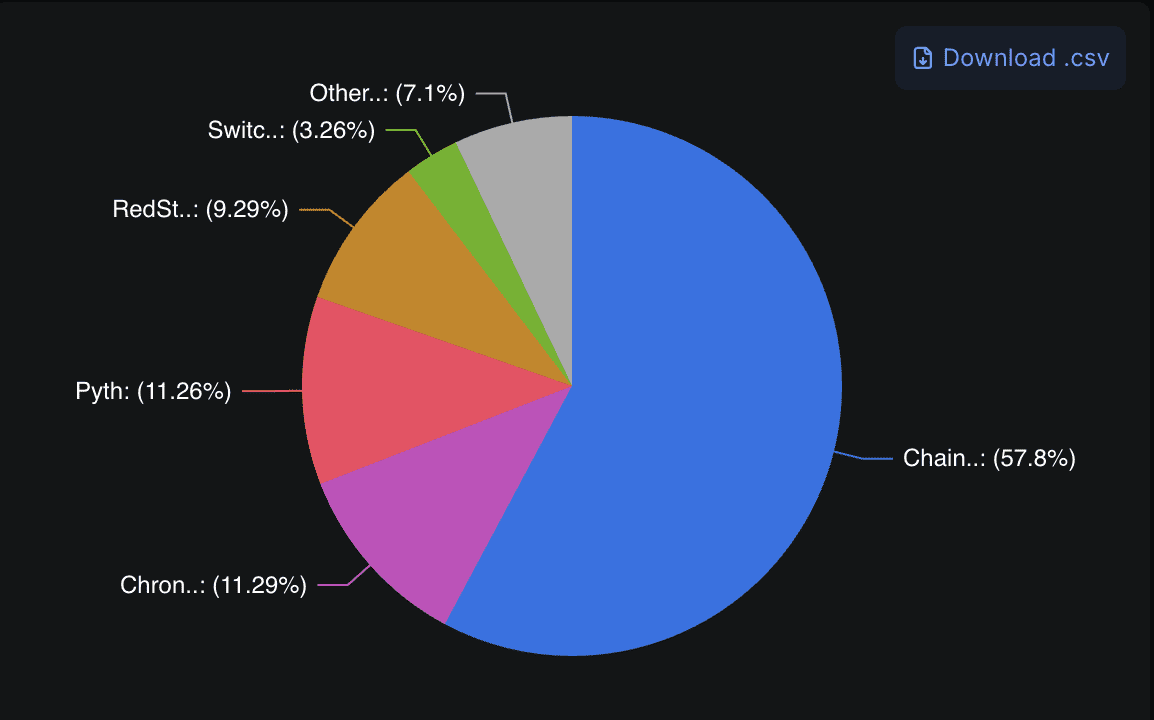

Throughout 2024, Pyth Network witnessed a substantial increase in its Total Value Secured (TVS), growing 46-fold. This reflects the increasing adoption and trust in Pyth’s oracle solutions. According to DeFiLlama data, Pyth currently holds approximately 11.3% of the blockchain oracle market, a notable increase from 10.8% in September 2024, showcasing its growing influence.

The Future of Financial Data with Blockchain Oracles

Pyth Network’s success underscores the potential of blockchain oracles to democratize access to financial data and foster innovation. By providing cost-effective, real-time market information, Pyth is leveling the playing field and empowering smaller businesses to participate in the global financial ecosystem. This disruption promises to unlock new opportunities and drive further growth in the decentralized finance (DeFi) space and beyond.

The rise of high-speed oracles like Pyth Network is not just about faster data; it’s about fundamentally changing the economics of financial information and creating a more inclusive and competitive financial landscape.