Real-world asset (RWA) tokenization is experiencing a breakout moment, transforming abstract concepts into practical financial applications. Several factors are converging to drive this evolution, including increased institutional involvement, clearer regulatory frameworks, and advancements in blockchain technology. This article explores the latest developments in RWA tokenization and its potential to reshape the financial landscape.

Key Drivers of RWA Tokenization

Several key factors are contributing to the rise of RWA tokenization:

- Institutional Adoption: Major financial institutions are actively exploring and implementing RWA tokenization solutions.

- Regulatory Clarity: Increased regulatory clarity in key markets is providing institutions with the confidence to invest in and deploy tokenization technologies.

- Technological Advancements: Improvements in blockchain infrastructure, particularly in scalability, security, and interoperability, are making RWA tokenization more viable.

- Macroeconomic Pressures: Institutions are seeking efficiency and liquidity in traditionally illiquid markets.

Recent Developments in RWA Tokenization

Recent announcements highlight the growing momentum behind RWA tokenization:

- BlackRock’s Digital Ledger Technology Shares: BlackRock filed to create a digital ledger technology shares class for its $150 billion Treasury Trust fund, leveraging blockchain technology to track share ownership.

- Libre’s Telegram Bond Fund: Libre announced plans to tokenize $500 million in Telegram debt through its new Telegram Bond Fund (TBF), offering accredited investors collateral for onchain borrowing.

- MultiBank Group’s RWA Tokenization Deal: MultiBank Group signed a $3 billion RWA tokenization deal with United Arab Emirates-based real estate firm MAG and blockchain infrastructure provider Mavryk, marking the largest RWA tokenization initiative to date.

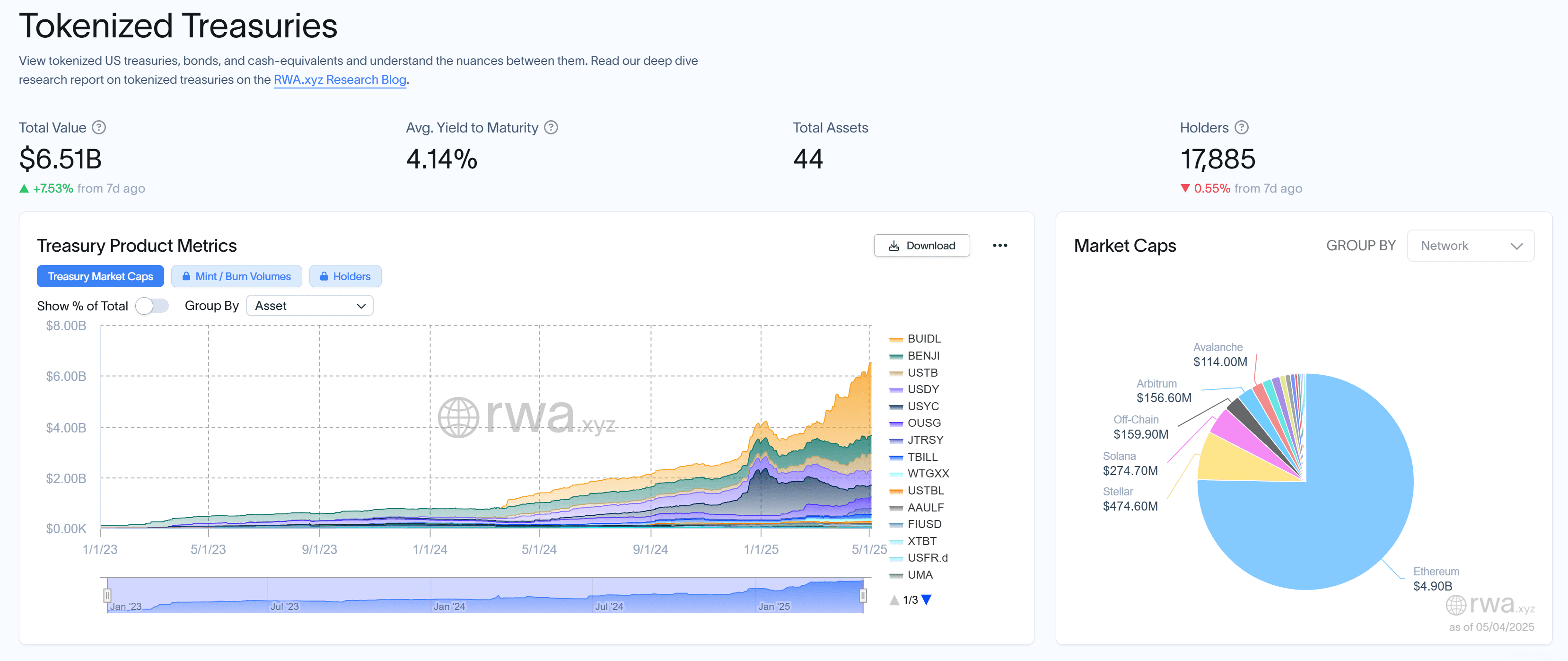

Ethereum’s Dominance in RWA Tokenization

Ethereum remains the leading platform for RWA tokenization due to its:

- Mature Ecosystem: Ethereum boasts a well-established ecosystem with a wide range of tools, services, and infrastructure for tokenizing assets.

- Broad Developer Support: A large and active developer community ensures ongoing innovation and support for Ethereum-based applications.

- Robust Infrastructure: Ethereum’s robust and secure infrastructure provides a reliable foundation for tokenizing and managing RWAs.

- Institutional Adoption: Ethereum’s prominence has attracted significant institutional interest, further solidifying its position as the leading RWA tokenization platform.

While Ethereum dominates, specialized RWA ecosystems like Canton Network, Plume, and Ondo Chain are emerging as compelling alternatives.

Currently, tokenized US Treasurys have a market value of $6.5 billion, with Ethereum hosting over $4.9 billion.

Challenges and Opportunities

Despite the growing momentum, RWA tokenization faces several challenges:

- Regulatory Uncertainty: Lack of clear and consistent regulations remains a significant barrier, particularly for risk-averse institutions.

- Technical Limitations: Interoperability between different blockchain platforms is limited, hindering the seamless transfer of tokenized assets.

However, the opportunities for RWA tokenization are vast:

- Increased Liquidity: Tokenization can unlock liquidity in traditionally illiquid assets, such as real estate and private equity.

- Improved Efficiency: Tokenization can streamline processes and reduce costs associated with managing and transferring assets.

- Greater Accessibility: Tokenization can democratize access to investment opportunities, allowing a broader range of investors to participate in previously exclusive markets.

Future Outlook

Experts predict significant growth in the RWA tokenization market in the coming years.

- Estimates suggest that 10% to 30% of global financial assets could be tokenized by the end of the decade.

- The RWA market could reach between $30 trillion and $50 trillion by 2030.

- Even conservative estimates predict substantial growth, with the market potentially exceeding $10 trillion by 2030.

The convergence of institutional adoption, regulatory clarity, and technological advancements positions RWA tokenization as a transformative force in the future of finance.