Robinhood Q1 2025: Revenue Beats Estimates Despite Crypto Trading Dip

Robinhood, the popular trading platform, has reported its Q1 2025 earnings, exceeding Wall Street expectations despite a decrease in both overall revenue and crypto trading volume compared to the previous quarter. The company’s strategic initiatives and growth in key areas have contributed to its positive performance.

Key Takeaways from Robinhood’s Q1 2025 Earnings:

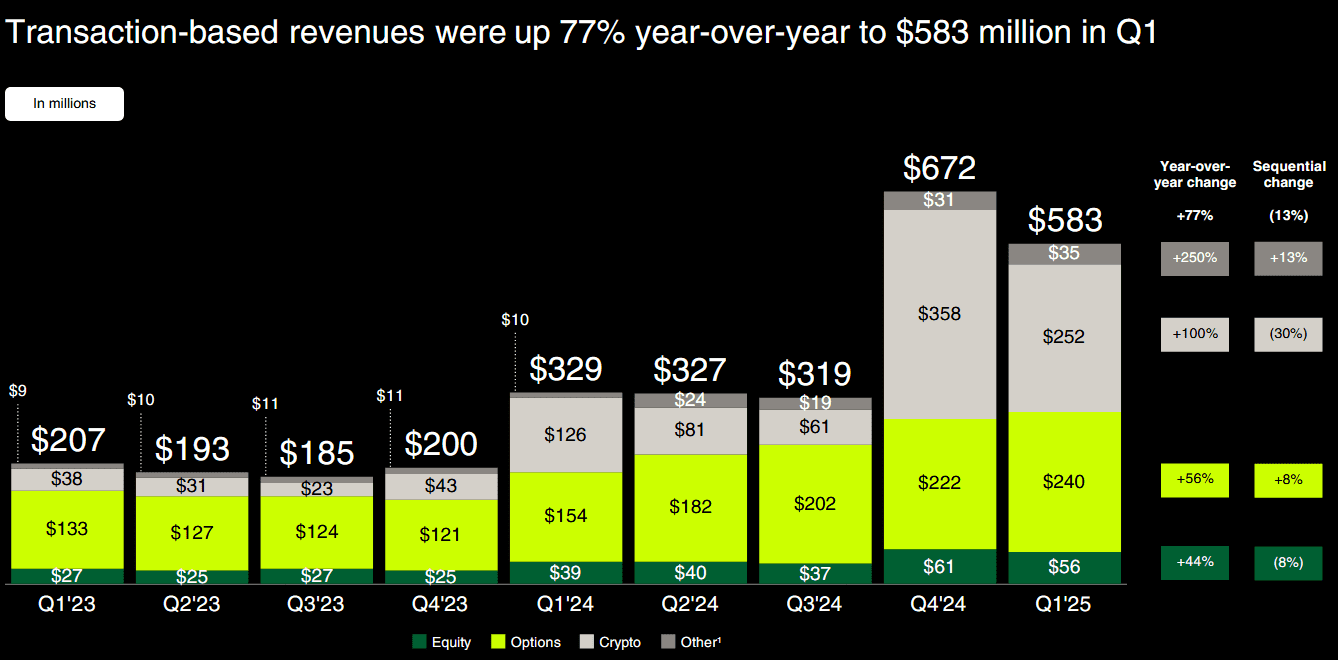

- Revenue: Reached $927 million, surpassing analyst estimates by 3.16%.

- Crypto Revenue: Experienced a nearly 30% quarter-over-quarter decrease, totaling $252 million.

- Crypto Trading Volume: Declined by 35% compared to Q4 2024.

- Share Buyback Program: Increased by $500 million, bringing the total authorization to $1.5 billion.

- Bitstamp Acquisition: Remains on track for regulatory approval, expected in mid-2025.

Detailed Analysis:

Robinhood’s Q1 2025 results demonstrated resilience despite headwinds in the crypto market. While crypto revenue experienced a decline from the record-setting Q4 2024, it still marked a 100% increase compared to the same quarter a year ago. This suggests sustained long-term growth in the crypto sector for Robinhood.

The decrease in crypto trading volume was attributed to a 10% drop in customer trades and a 27% fall in average notional volume per trade. This decline may be linked to broader market trends, including the impact of potential tariffs on the crypto market, which led to an 18% fall in the overall crypto market capitalization during the quarter.

Robinhood’s CEO, Vladimir Tenev, acknowledged the fluctuating nature of crypto trading volumes but emphasized the company’s focus on capturing market share. Despite the dip, Robinhood’s overall performance was bolstered by growth in other areas, showcasing the platform’s diversified revenue streams.

Strategic Initiatives and Future Outlook:

Robinhood is actively pursuing several strategic initiatives to drive future growth:

- Share Buyback Program: The increased share buyback program demonstrates Robinhood’s confidence in its financial health and commitment to boosting shareholder value.

- Bitstamp Acquisition: The anticipated acquisition of Bitstamp is a significant move that will allow Robinhood to serve institutional investors in the US and expand its crypto offerings.

- Crypto Tokenization: Robinhood is exploring the integration of crypto tokenization into its services, potentially unlocking significant economic value for the crypto industry and providing investors with access to tokenized shares in private companies.

Regulatory Landscape:

Robinhood received positive news on the regulatory front as the Securities and Exchange Commission (SEC) closed its investigation into the firm’s crypto business. This development alleviates potential regulatory hurdles and provides greater certainty for Robinhood’s crypto operations.

Robinhood’s Focus on Crypto Tokenization

According to Tenev, the integration of crypto tokenization into Robinhood’s services remains a high priority. By tokenizing private equities, the company plans to solve problems that plague secondary market transactions.

Tenev has stated that crypto tokenization could unlock huge economic value for the crypto industry in the United States. Investors, for example, could buy tokenized shares in firms like OpenAI and SpaceX in just a few minutes.