Key Takeaways:

- Saifedean Ammous argues that even a single entity holding a significant amount of Bitcoin wouldn’t jeopardize the protocol.

- Ammous clarifies that major companies like BlackRock and MicroStrategy hold Bitcoin on behalf of investors, not for their own direct control.

- He suggests that any abuse of position by these entities would trigger investors to withdraw funds and seek other Bitcoin investment options.

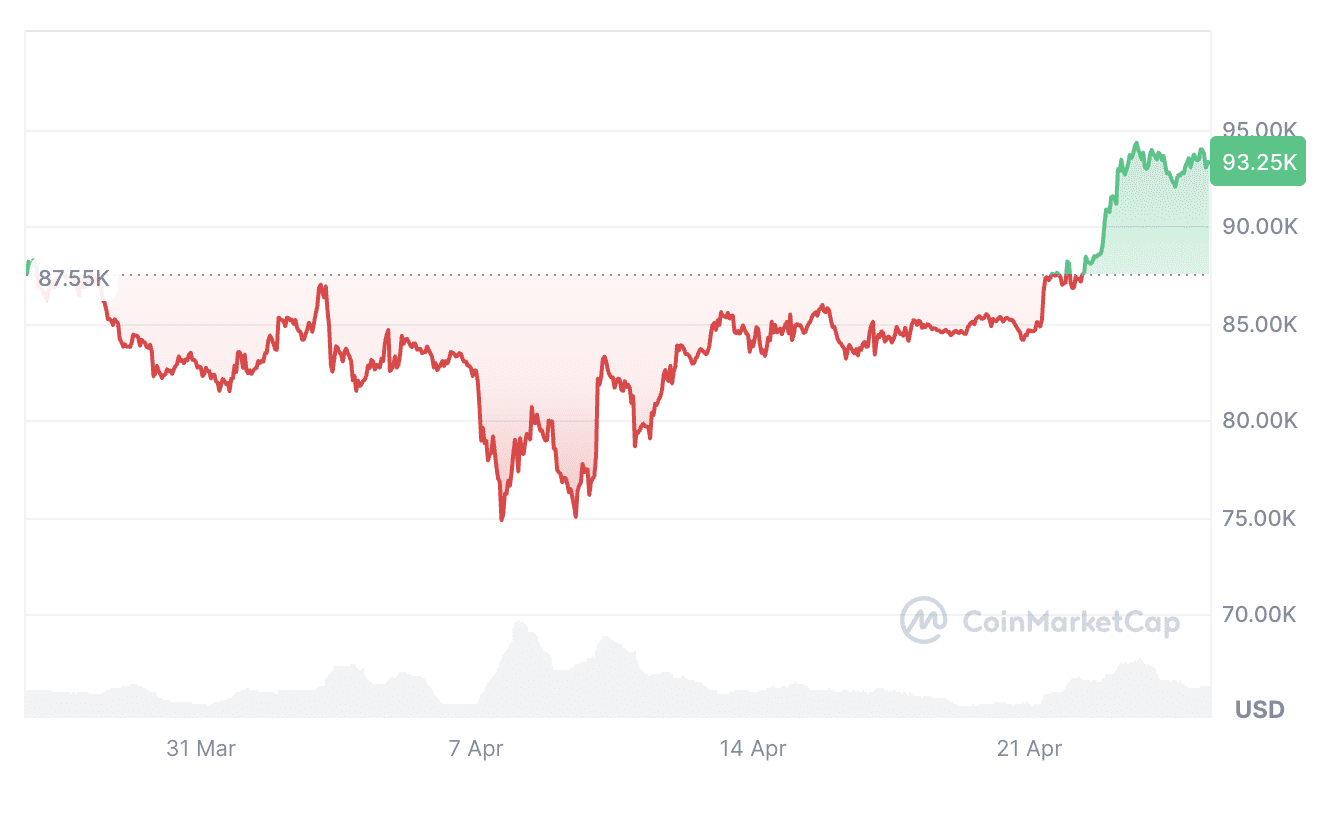

The notion that Michael Saylor’s MicroStrategy could potentially control close to half of Bitcoin’s total supply isn’t a cause for alarm, according to Saifedean Ammous, author of the Bitcoin Standard. In an April 25th interview with Anthony Pompliano, Ammous addressed concerns about centralized Bitcoin ownership.

“If Michael Saylor ends up with 10 million Bitcoin, what is he going to do? He’s likely just going to leverage them to buy more Bitcoin,” Ammous stated. He argues that Saylor’s incentive is to maximize the value of his holdings, which aligns with the health of the Bitcoin network.

Ammous Downplays Risks of Bitcoin Hoarding

“Ultimately, I don’t see how it would threaten the protocol in the serious sense,” Ammous reiterated. He believes the incentive structure of Bitcoin prevents large holders from acting against the network’s interests.

Ammous used the hypothetical scenario that even if Saylor controlled 10 million Bitcoin, he is unlikely to suddenly trigger a hard fork to generate more Bitcoin for himself. Doing so would significantly devalue his existing holdings.

Concerns have arisen in the past regarding the potential for Bitcoin whales to manipulate the market, centralize control, or create liquidity challenges. However, Ammous refutes these arguments, emphasizing the decentralized nature of Bitcoin and the market forces at play.

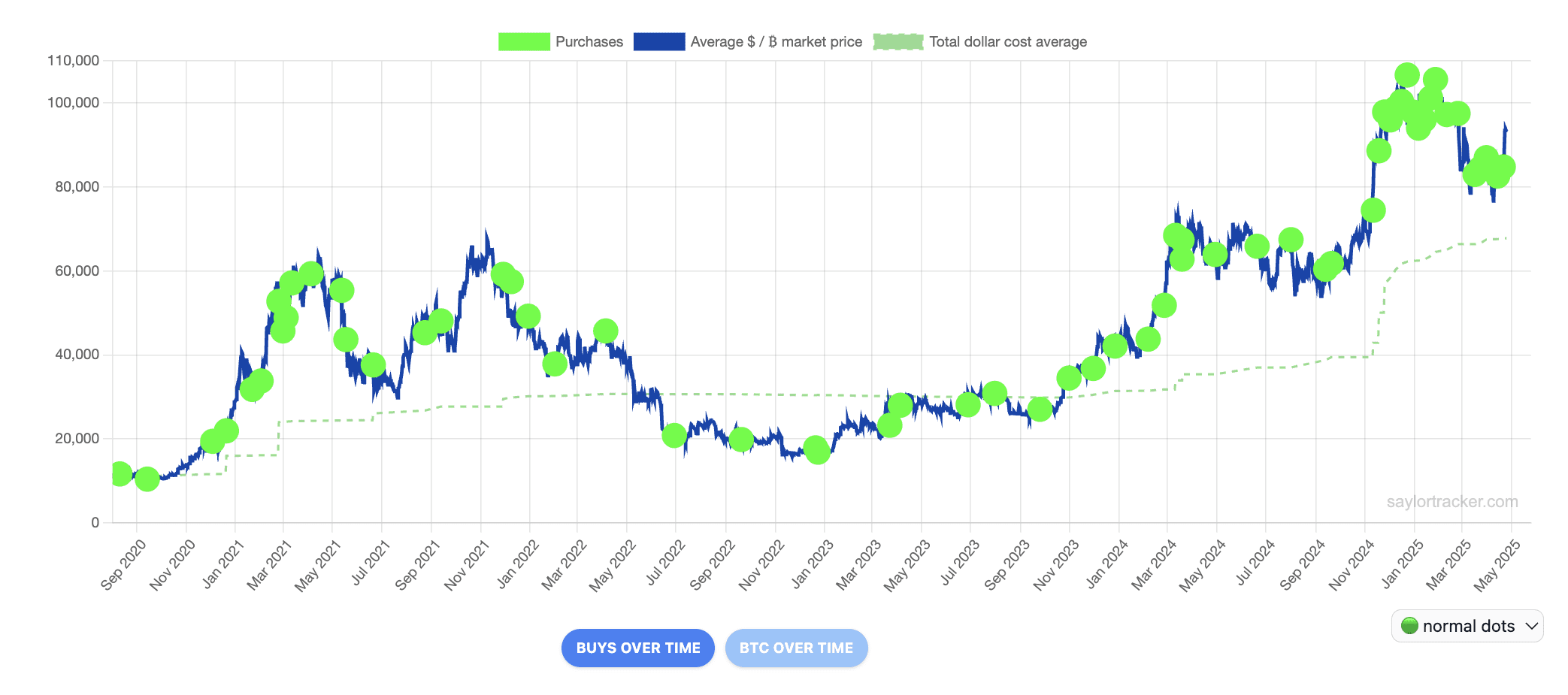

Currently, MicroStrategy holds 538,200 Bitcoin, valued at roughly $50.18 billion, as tracked by Saylor Tracker. The BlackRock iShares spot Bitcoin ETF manages approximately $54.48 billion in net assets, representing around 585,000 Bitcoin, according to BlackRock data.

Together, these two entities control about 5.3% of the total Bitcoin supply. Ammous maintains that this concentration doesn’t present a significant threat due to the nature of their holdings.

“It’s not like Michael Saylor or Larry Fink owns all those Bitcoins. They have shareholders who own all those Bitcoins, or ETF holders that own those Bitcoins.”

He argues that these companies are obligated to act in the best interests of their investors and ETF holders. “To the extent that BlackRock and Strategy hold those, they hold those because they are doing their fiduciary share of duties to their shareholders and the ETF holders in a satisfactory way,” Ammous explained.

Why Centralization Fears Might Be Overblown:

- Decentralized Ownership: While entities like MicroStrategy hold large amounts of Bitcoin, the ownership is often distributed among numerous shareholders or ETF holders.

- Fiduciary Duty: These companies are legally bound to act in the best interests of their investors, limiting their ability to manipulate the market or act against the Bitcoin protocol.

- Market Forces: If these companies were to abuse their positions, investors would likely sell their holdings and seek alternative investment vehicles, diminishing the company’s influence.

Potential Risks of Centralization (and Why They Are Unlikely):

- Market Manipulation: Large holders could theoretically manipulate the market through coordinated buying or selling. However, this is difficult to achieve in practice due to market dynamics and regulatory scrutiny.

- Censorship Resistance: While large entities could potentially attempt to influence Bitcoin transactions, the decentralized nature of the network makes censorship highly improbable.

- Protocol Changes: It’s unlikely a single entity, even with substantial Bitcoin holdings, could unilaterally force protocol changes without broad community consensus.

Ammous suggests that if BlackRock or MicroStrategy ever acted detrimentally to their shareholders or ETF holders, or abused their positions, investors would simply divest and find alternative ways to access Bitcoin.

Another player, Twenty One Capital, a Bitcoin treasury firm founded by Strike’s Jack Mallers with support from Tether, SoftBank, and Cantor Fitzgerald, is positioning itself as a competitor to MicroStrategy, aiming to be a superior avenue for capital-efficient Bitcoin exposure.

Ultimately, the discussion surrounding large Bitcoin holders highlights the ongoing debate between centralization and decentralization within the cryptocurrency space. While concerns about concentrated ownership are valid, the structure of Bitcoin and the incentives of market participants suggest that the risks of protocol-level disruption are minimal.