Update May 21, 4:32 am UTC: This article has been updated to incorporate additional details from the SEC’s complaint.

The U.S. Securities and Exchange Commission (SEC) has filed charges against Unicoin, a crypto investment platform, and three of its top executives, accusing them of making false and misleading statements regarding their crypto assets. These alleged misrepresentations reportedly led to the raising of over $100 million from investors.

The SEC’s complaint, announced on May 20, names Unicoin CEO Alex Konanykhin, board member Silvina Moschini, and former investment chief Alex Dominguez as defendants. The agency alleges that the trio misled more than 5,000 investors regarding certificates that purportedly granted rights to receive Unicoin tokens and stock.

Mark Cave, Associate Director of the SEC’s Division of Enforcement, stated that the accused parties, starting in 2022, “exploited thousands of investors with fictitious promises that its tokens, when issued, would be backed by real-world assets including an international portfolio of valuable real estate holdings.” He further added, “The real estate assets were worth a mere fraction of what the company claimed, and the majority of the company’s sales of rights certificates were illusory.”

The SEC’s complaint, filed in a Manhattan federal court, accuses Unicoin and the three executives of violating various securities laws. The SEC is seeking permanent injunctive relief, along with the repayment of allegedly ill-gotten gains.

Key Allegations Against Unicoin

The SEC’s charges against Unicoin revolve around several key misrepresentations:

- Misrepresenting Financial Status: The SEC alleges that Unicoin misrepresented its financial situation to investors, claiming decades of financial runway when, in reality, it had significantly less, sometimes as little as four months.

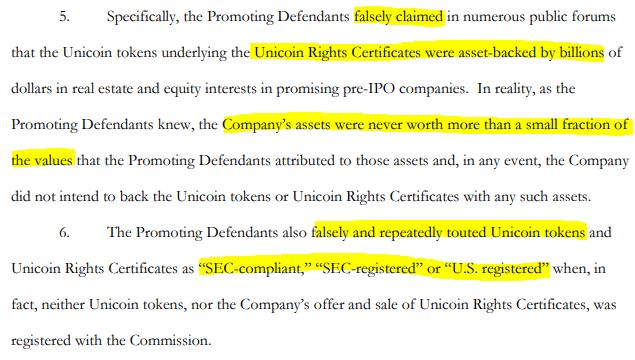

- Inflated Sales Figures: Unicoin allegedly claimed to have sold over $3 billion in rights certificates when actual sales amounted to only $110 million.

- False Claims of SEC Registration: The company falsely advertised its tokens and certificates as SEC-registered.

Additional Details and Involvement

The SEC also charged Unicoin’s general counsel, Richard Devlin, with violating federal securities laws. Devlin settled the charges by paying a $37,500 civil penalty without admitting or denying the agency’s claims.

Former FOX Business reporter Eleanor Terrett reported that Unicoin received an SEC Wells notice in December regarding a token airdrop and was asked to attend a settlement negotiation with the SEC on April 18. Konanykhin stated that the company declined the meeting due to unacceptable requests from the regulator and intends to fight the case in court.

Understanding the Implications of the SEC Charges

The SEC’s charges against Unicoin highlight the agency’s ongoing scrutiny of the crypto industry and its commitment to protecting investors from fraudulent schemes. This case serves as a reminder of the importance of conducting thorough due diligence before investing in crypto assets.

Key Takeaways for Investors

- Increased Regulatory Scrutiny: The SEC is actively monitoring the crypto space and taking action against companies that make misleading claims.

- Due Diligence is Crucial: Investors should carefully research crypto platforms and tokens before investing.

- Verify Claims: Don’t rely solely on marketing materials. Seek independent verification of claims regarding asset backing and financial stability.

What’s Next?

The lawsuit against Unicoin is ongoing. The SEC is seeking injunctive relief, disgorgement of ill-gotten gains, and civil penalties. The outcome of the case could have significant implications for Unicoin, its executives, and the broader crypto industry.

This situation underscores the potential risks associated with crypto investments and the necessity for greater regulatory oversight. Investors should remain vigilant and informed as the legal proceedings unfold.

In Summary:

The SEC’s lawsuit against Unicoin paints a concerning picture of alleged fraud and misrepresentation within the crypto platform. The charges highlight the need for increased transparency and accountability in the crypto industry. As the case progresses, it will be crucial to monitor the developments and their potential impact on the future of crypto regulation.