SEC’s Caroline Crenshaw Slams Proposed Ripple Settlement

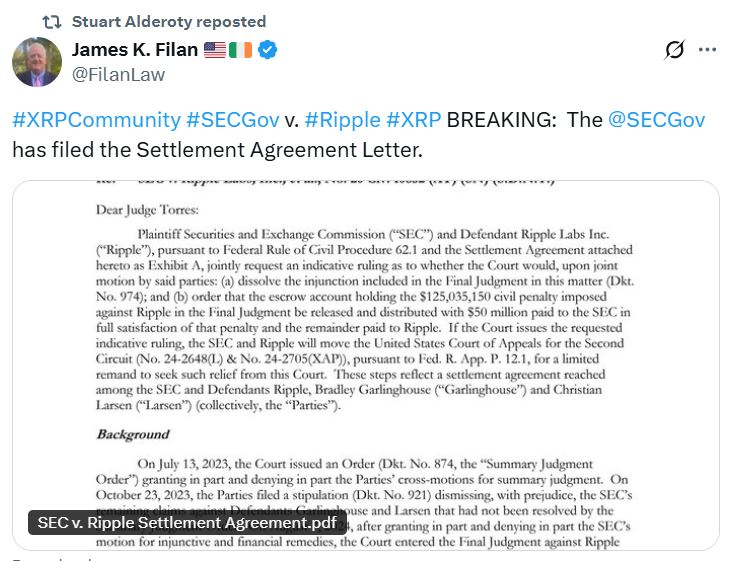

A commissioner at the U.S. Securities and Exchange Commission (SEC), Caroline Crenshaw, has publicly criticized her agency’s proposed settlement with Ripple Labs. Crenshaw’s concerns center around the potential for a “regulatory vacuum” and the weakening of investor protections. This comes as the SEC and Ripple jointly filed a settlement letter in a New York court, aiming to dissolve an existing injunction and return $75 million of escrowed funds to Ripple.

Key Concerns Raised by Commissioner Crenshaw:

- Regulatory Vacuum: Crenshaw argues that the settlement, if approved, would erase existing investor protections and leave a void in regulatory oversight until a comprehensive crypto framework is established.

- Damage to Investor Protection: She believes the settlement undermines the SEC’s ability to effectively regulate crypto firms and enforce securities laws.

- Credibility of SEC Lawyers: Crenshaw suggests the settlement contradicts previous legal positions taken by the SEC, potentially eroding the credibility of the agency’s legal team.

Crenshaw stated the settlement does a disservice to investors and undermines the court’s role in interpreting securities laws. She added that the settlement erodes the credibility of SEC lawyers in court who are taking legal positions that contrast ones taken just months ago.

Background of the SEC vs. Ripple Lawsuit

The SEC’s initial lawsuit against Ripple Labs was filed in December 2020, alleging that the company illegally sold its XRP token as an unregistered security. A judge previously ordered Ripple to pay $125 million in penalties after ruling that XRP was covered by securities laws when sold to institutional investors. The proposed settlement seeks to resolve the long-standing legal battle.

Potential Implications of the Settlement

If approved, the settlement would allow Ripple to regain control of $75 million in escrowed funds and potentially bring an end to the SEC’s oversight. However, critics like Crenshaw argue that it sets a concerning precedent, potentially weakening the SEC’s ability to regulate the crypto industry and protect investors from fraudulent schemes and unregistered securities offerings.

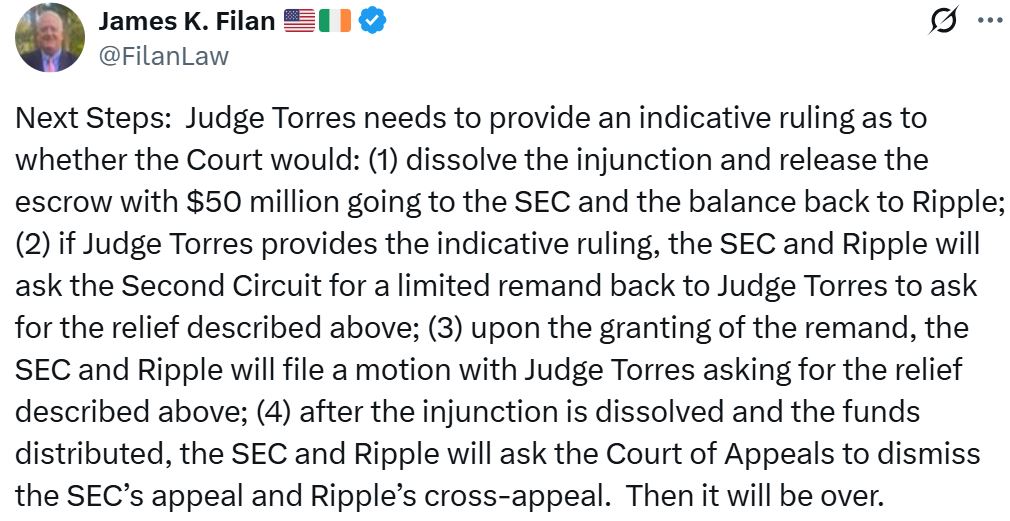

Next Steps in the Ripple Case

According to James Filan, a former federal prosecutor, several steps must occur before the settlement can be finalized:

- Judge Torres must provide an indicative ruling on the settlement letter.

- If approved, the SEC and Ripple will request a limited remand from the Second Circuit Court of Appeals back to Judge Torres.

- Upon granting the remand, another motion will be filed for the agreed settlement.

- After the injunction is dissolved and the funds distributed, the SEC and Ripple will request the Court of Appeals to dismiss the SEC’s appeal and Ripple’s cross-appeal.

Wider Context: SEC’s Evolving Stance on Crypto

The SEC’s approach to regulating the crypto industry has been evolving, particularly following the departure of former SEC Chair Gary Gensler. There have been indications of the SEC backtracking on some of its hardline stances against crypto firms, as seen in dismissing a number of enforcement actions. Commissioner Crenshaw’s dissent underscores the internal debates and varying perspectives within the SEC regarding the appropriate regulatory approach for the crypto market.

The Future of Crypto Regulation

The Ripple case is a significant example of the complexities involved in regulating the crypto industry. The proposed settlement highlights the challenges in defining and enforcing securities laws in the context of digital assets. The outcome of the Ripple settlement, along with ongoing legislative efforts to establish a clear regulatory framework, will likely shape the future of crypto regulation in the United States and beyond. A key question remains: will this settlement provide clarity, or further muddy the waters, for crypto businesses operating in the US? The lack of a clear regulatory framework continues to be a pain point, potentially stifling innovation and creating uncertainty for both businesses and investors. The SEC’s actions, therefore, are under intense scrutiny from all corners of the crypto space, with stakeholders eagerly awaiting more definitive guidance.