The U.S. Securities and Exchange Commission (SEC) has extended its review period for the proposed Grayscale Polkadot Trust ETF, pushing the final decision deadline to June 11. This means the potential listing of a Polkadot (DOT) ETF on U.S. exchanges remains uncertain.

Key Takeaways:

- SEC Delay: The SEC postponed its decision on the Polkadot ETF application filed by Nasdaq on behalf of Grayscale.

- New Deadline: The final ruling is now expected by June 11.

- Altcoin ETF Trend: This delay comes amid a surge in applications for ETFs holding various altcoins.

What is a Polkadot ETF?

An ETF (Exchange-Traded Fund) is a type of investment fund that holds a collection of assets, such as stocks, bonds, or, in this case, cryptocurrencies. A Polkadot ETF would hold DOT tokens, the native cryptocurrency of the Polkadot network. This would allow investors to gain exposure to Polkadot’s price movements without directly buying and managing DOT themselves.

Why is a Polkadot ETF Significant?

The approval of a Polkadot ETF would be a significant step for the cryptocurrency market for several reasons:

- Increased Accessibility: ETFs make it easier for traditional investors to access cryptocurrencies through regulated exchanges.

- Mainstream Adoption: Approval signals growing acceptance of Polkadot and the broader cryptocurrency market by regulatory bodies.

- Potential Price Impact: Increased demand from ETF investors could potentially drive up the price of DOT.

The SEC’s Stance on Crypto ETFs

The SEC has been cautious in approving cryptocurrency ETFs, particularly those holding altcoins (cryptocurrencies other than Bitcoin and Ethereum). While spot Bitcoin ETFs were approved in early 2024, the SEC remains hesitant about altcoin ETFs due to concerns about market manipulation, volatility, and investor protection. The delay in the Polkadot ETF decision reflects this cautious approach.

The Growing Altcoin ETF Pipeline

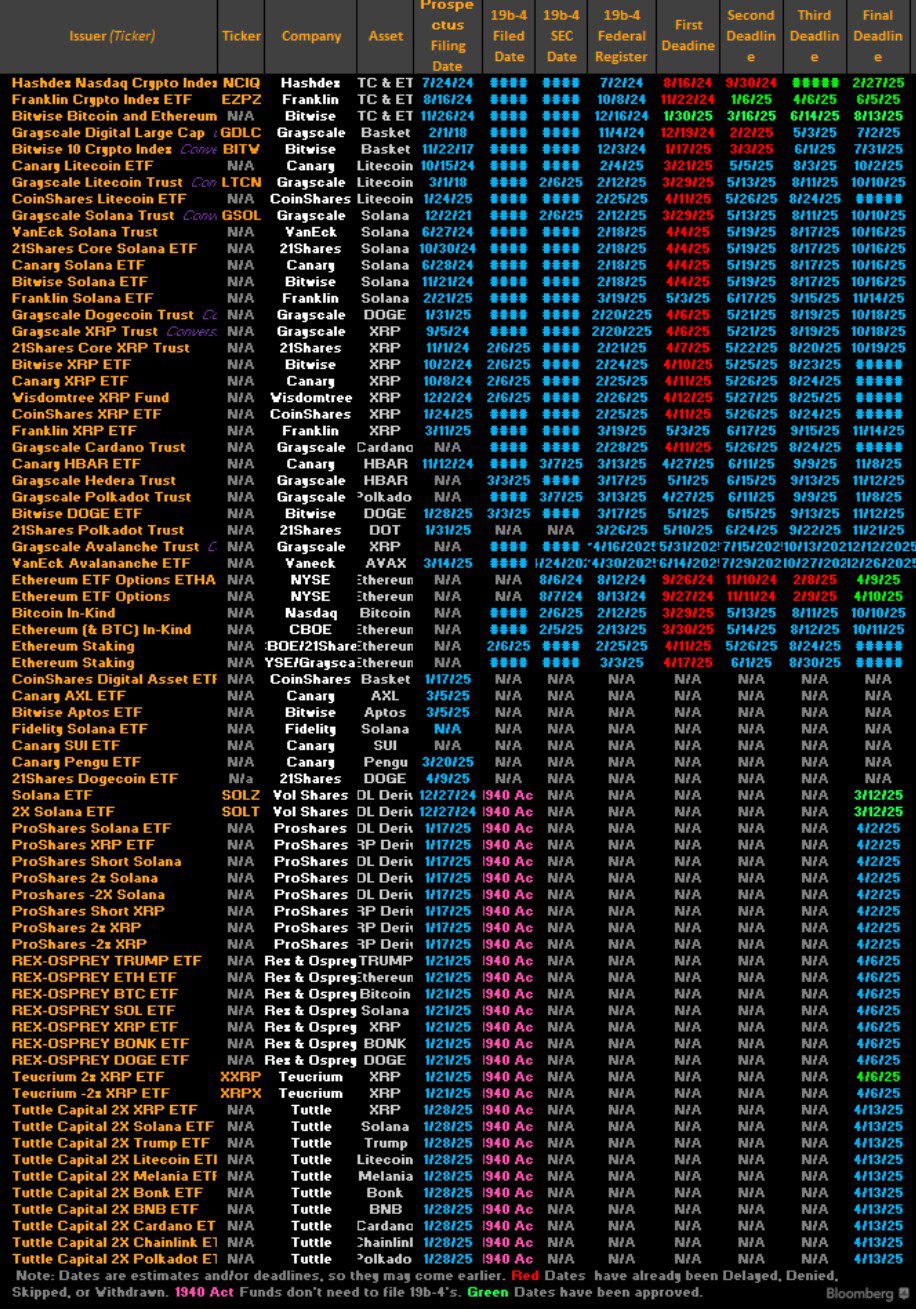

Grayscale’s Polkadot ETF is just one of many altcoin ETFs currently under consideration by the SEC. Other asset managers have filed applications for ETFs holding tokens like Solana (SOL), Litecoin (LTC), XRP (XRP), Dogecoin (DOGE), and Cardano (ADA). Bloomberg Intelligence estimates roughly 70 proposed ETFs are awaiting SEC approval. The high number of applications indicates a strong interest in offering investors diversified exposure to the cryptocurrency market beyond Bitcoin and Ethereum.

What is Polkadot?

Polkadot is a layer-1 blockchain network launched in 2020. It’s designed to enable interoperability between different blockchains, allowing them to communicate and share data. Polkadot’s architecture consists of a central “relay chain” and multiple parallel blockchains called “parachains.” This design aims to improve scalability and efficiency compared to traditional blockchains.

The DOT token is used for governance, staking, and bonding within the Polkadot network. As of April 24, DOT had a market capitalization of approximately $6.6 billion, according to CoinMarketCap.

Expert Opinions

Bloomberg analyst Eric Balchunas commented on the potential impact of altcoin ETFs, comparing it to a band getting its songs added to streaming services. He noted that while it doesn’t guarantee success, it puts the asset in front of a wider audience.

The Future of Altcoin ETFs

The SEC’s decision on the Grayscale Polkadot Trust ETF, along with other pending altcoin ETF applications, will have a significant impact on the future of cryptocurrency investing. A positive outcome could pave the way for broader adoption of altcoins by institutional and retail investors. However, continued regulatory scrutiny and potential rejections could hinder the growth of the altcoin market.