The U.S. Securities and Exchange Commission (SEC) has recently delayed decisions regarding several crypto-related Exchange Traded Funds (ETFs), specifically those involving Ether staking and XRP. This move, largely anticipated by market analysts, underscores the complexities and ongoing regulatory scrutiny surrounding cryptocurrency investments.

Key Takeaways:

- SEC Delays: Decisions on Bitwise’s Ether staking ETF and Grayscale’s XRP ETF are postponed.

- Reasoning: The SEC cites the need for more time to analyze the proposals and gather public comments to ensure regulatory compliance.

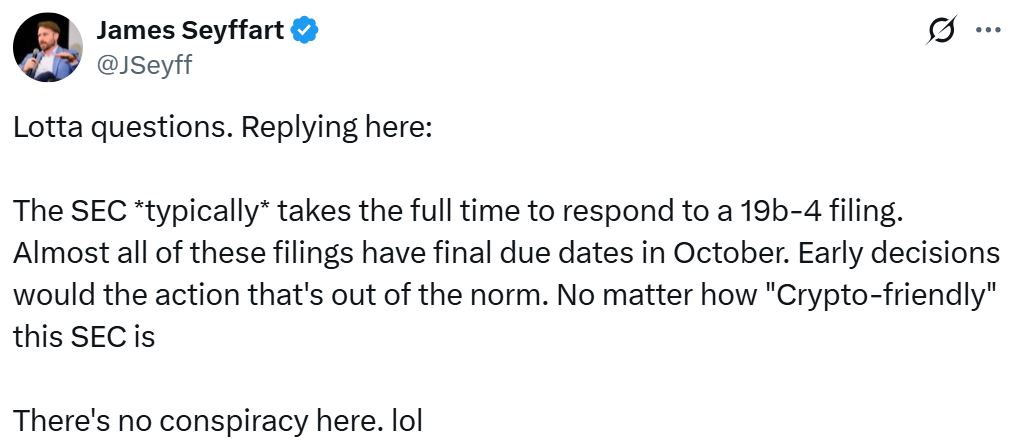

- Analyst Perspective: Bloomberg ETF analyst James Seyffart notes these delays are typical, with final decisions expected later in the year.

- Broader Implications: These delays are part of a larger trend as the SEC evaluates a flood of crypto ETF applications, including those tracking Solana, Polkadot and potentially Litecoin.

Detailed Explanation

The SEC’s delay impacts applications from Bitwise and Grayscale, two major players in the ETF market. Bitwise sought to add staking to its Ether ETF, while Grayscale aimed to launch an ETF tracking the price of XRP. The SEC stated it needs additional time to thoroughly review the proposed rule changes and address the issues raised.

According to an official statement released on May 20th, the SEC extended the decision deadline for Bitwise’s application by 45 days, explaining the extension was to allow the SEC to consider the proposed rule change and the issues raised therein. A similar delay was applied to Grayscale’s XRP ETF, and Bitwise’s Solana (SOL) tracking fund.

Bloomberg ETF analyst James Seyffart commented on the delays, stating that they are within the normal course of SEC procedures. He highlighted that the SEC typically utilizes the full allotted time to respond to 19b-4 filings, the regulatory form required for ETFs. He further elaborated that the final decision deadlines for most of these filings fall in October, making any earlier decision unusual.

The Broader ETF Landscape

Seyffart also indicated that delays are expected for other spot crypto ETF bids, including those for Litecoin (LTC). However, he noted that a Litecoin ETF has a relatively higher likelihood of approval compared to other altcoin ETFs. Several XRP ETPs also have upcoming deadlines, but Seyffart does not anticipate early approvals before late June or early July, with Q4 being a more realistic timeframe.

SEC’s Regulatory Environment

The SEC is currently processing a significant number of crypto ETF applications. Deadlines for other crypto ETFs are approaching, including Grayscale’s Polkadot (DOT) tracking ETF by June 11 and 21Shares’ Polkadot ETF on June 24.

The recent surge in altcoin ETF filings followed Donald Trump’s election and the resignation of former SEC Chair Gary Gensler. Gensler’s tenure was characterized by a more aggressive regulatory approach towards the crypto industry, marked by numerous enforcement actions. With his departure, the SEC is now perceived as potentially more open to crypto-related financial products.

Several firms previously facing legal action from the SEC have seen their cases dismissed, including crypto exchange Gemini and crypto trading firm Cumberland DRW, indicating a possible shift in the regulatory climate. This makes approval times more unpredictable and requires careful attention from the cryptocurrency community.

What’s Next?

Investors and industry participants should closely monitor the SEC’s upcoming decisions on these ETF applications. These decisions will provide significant insights into the regulatory future of cryptocurrencies. As the SEC evaluates the rapidly evolving crypto landscape, its decisions regarding these ETFs will serve as benchmarks for future crypto related financial products.

The delay in Ether staking and XRP ETF decisions signals continued caution and the need for comprehensive evaluation, particularly regarding investor protection and compliance. Stay tuned for further developments as the SEC navigates the growing wave of cryptocurrency investment products.