The United States Securities and Exchange Commission (SEC) has postponed its decision regarding a proposed spot Solana (SOL) exchange-traded fund (ETF). This delay shifts the focus to upcoming deadlines for Polkadot (DOT) and XRP-based ETFs in June.

Specifically, the SEC’s decision on listing Grayscale’s spot Solana Trust ETF on the New York Stock Exchange (NYSE) has been pushed to October 2025, as indicated in a May 13 filing. This delay follows a similar postponement for Canary Capital’s Litecoin (LTC) ETF.

Why are Spot ETFs Important? Spot ETFs are considered crucial for boosting liquidity and encouraging institutional investment in digital assets. For example, U.S. spot Bitcoin ETFs accounted for approximately 75% of new investment following their launch, contributing to Bitcoin’s price recovery above $50,000 in February 2024.

While a Solana ETF might not attract the same level of inflows as Bitcoin ETFs, it’s anticipated to enhance Solana’s institutional acceptance. It would offer investors a regulated investment option, potentially drawing billions in capital. Ryan Lee, chief analyst at Bitget Research, highlighted this potential.

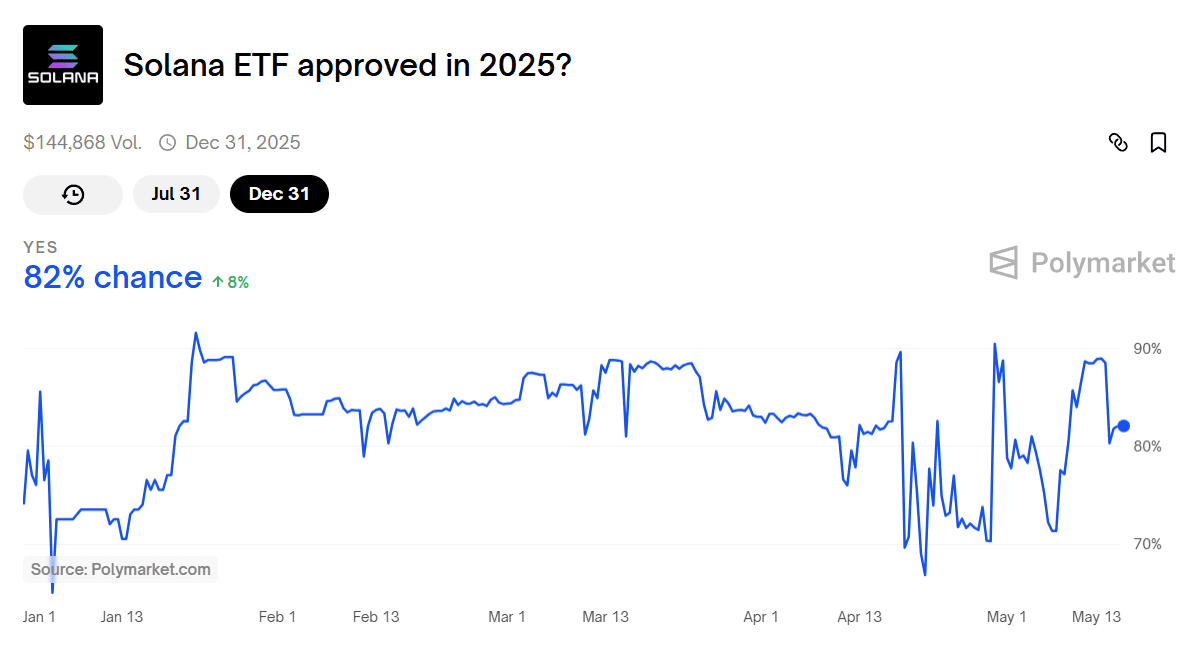

Despite the SEC’s recent delay, many investors are optimistic about the approval of a Solana ETF before the end of 2025.

Data from Polymarket, a decentralized betting platform, shows investors predicting an 82% chance of a Solana ETF approval and an 80% chance of a Litecoin ETF approval by the end of the year.

Upcoming SEC Decisions: Polkadot, XRP, and Dogecoin

Several other cryptocurrency ETF applications are nearing their SEC decision deadlines in June. Here’s a look at what to expect:

- Polkadot (DOT) ETFs: The SEC will decide on Grayscale’s Polkadot ETF by June 11, and 21Shares’ Polkadot ETF on June 24.

- XRP (XRP) ETF: A decision on Franklin Templeton’s spot XRP ETF is expected by June 17.

- Dogecoin (DOGE) ETF: Bitwise’s spot Dogecoin ETF also has a decision deadline of June 17.

It’s important to note that the SEC may extend these deadlines. The agency frequently uses the full 240-day review period when evaluating crypto-related financial products, a practice observed during the review of Bitcoin and Ether ETF applications in 2023 and 2024.

Factors Influencing SEC Decisions

The SEC’s decisions regarding cryptocurrency ETFs are influenced by several key factors:

- Market Maturity: The perceived maturity and stability of the underlying cryptocurrency market.

- Regulatory Clarity: The level of regulatory clarity surrounding the cryptocurrency and its ecosystem.

- Investor Protection: Concerns about investor protection and the potential for fraud or manipulation.

- Custody Solutions: The availability of secure and regulated custody solutions for the underlying cryptocurrency.

Potential Impact of ETF Approvals

The approval of a Solana, Polkadot, XRP, or Dogecoin ETF could have significant positive effects on their respective markets:

- Increased Liquidity: ETFs provide an easier way for investors to gain exposure, which can increase trading volume.

- Wider Adoption: Makes cryptocurrencies more accessible to traditional investors who may be hesitant to directly purchase and store them.

- Price Appreciation: Increased demand from ETF inflows could drive up the price of the underlying cryptocurrency.

- Institutional Investment: Attracts more investment from institutions that are restricted from investing directly in crypto assets.

Conclusion

The delay of the Solana ETF decision by the SEC highlights the ongoing regulatory scrutiny surrounding cryptocurrency-based investment products. However, the continued optimism for Solana and Litecoin ETF approvals, coupled with upcoming decisions for Polkadot, XRP, and Dogecoin ETFs, indicates a dynamic landscape for crypto ETFs. Investors are eagerly awaiting the SEC’s decisions, which could significantly impact the adoption and market performance of these digital assets.