The US Securities and Exchange Commission has been handed a $1.1 million court victory after a man it accused of running a crypto scam failed to answer the agency’s lawsuit.

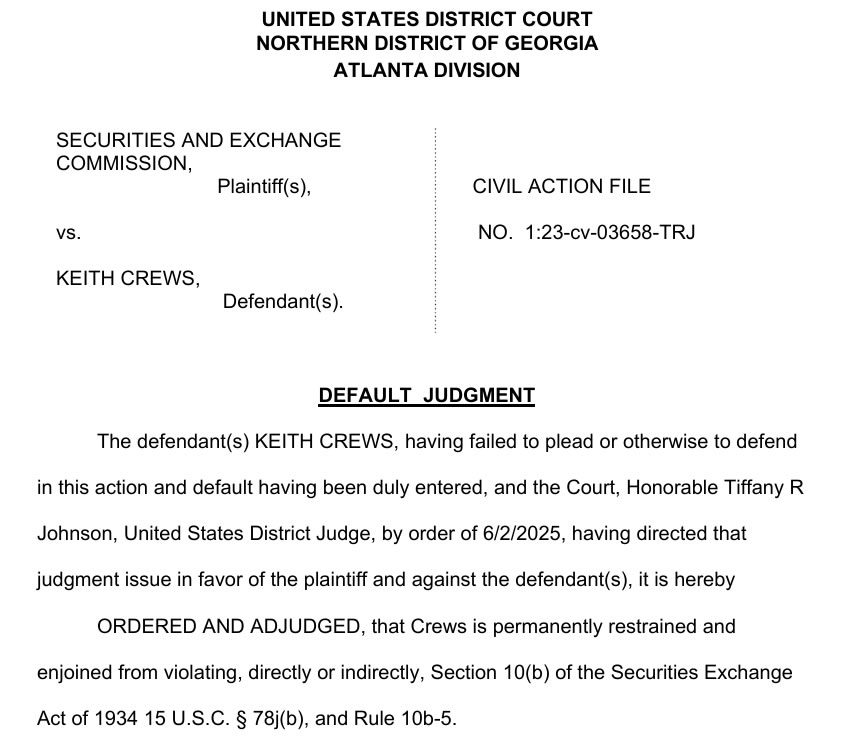

A Georgia federal court judge submitted a default judgment in the SEC’s favor on June 3 in its case against Keith Crews, who failed to respond or defend himself against the SEC’s lawsuit that it filed in August 2023.

Judge Tiffany Johnson ordered Crews to pay financial penalties of over $1.1 million, finding him liable for disgorgement of $530,000 in net profits from his alleged misconduct and ordered him to pay prejudgment interest of almost $51,000 and a civil penalty of $530,000.

The judge ruled that Crews is also permanently banned from future violations of securities laws.

The SEC alleged Crews carried out a crypto fraud scheme through his companies, Four Square Biz and Stem Biotech, between October 2019 and May 2021.

The SEC claimed he raised at least $800,000 from approximately 200 investors through the sale of a “purported crypto asset security” named “Stemy Coin,” and that many of the investors were “solicited through relationships in African-American and church communities.”

The regulator accused Crews of making false claims to investors, such as the token being backed by stem cell technology and hard assets like gold, and that his company had existing labs, products, and a track record of delivering stem cell treatments.

Fake labs and partnerships

The SEC claimed Crews touted partnerships with doctors and research teams, whereas in reality, the firm had no labs, products, research, partners or stem cell technology.

“Crews and his entities had no existing stem cell technology, products, or operations, there was no partnership with the claimed entities,” the agency said in its complaint.

The complaint alleged violations of multiple federal securities laws, including Securities Act fraud provisions, Exchange Act fraud provisions and registration violations.

The judgment represents a rare crypto-related victory for the SEC, which has wound down its crypto enforcement actions under the Trump administration this year.

Quick Summary of the News:

- The SEC won a default judgment of $1.1 million against Keith Crews.

- Crews was accused of running a crypto scam involving a token called “Stemy Coin.”

- The SEC alleged Crews misled investors, falsely claiming the token was backed by stem cell technology and other assets.

- Crews failed to respond to the SEC’s lawsuit, leading to the default judgment.

- The judgment includes financial penalties and a permanent ban from future securities law violations.

Why It Matters

This case highlights the SEC’s ongoing efforts to regulate the crypto space and protect investors from fraudulent schemes. While a default judgment isn’t the same as a contested victory, it sends a clear message that the SEC is actively pursuing those who allegedly violate securities laws within the crypto industry. It also underscores the risks associated with investing in unregistered and unregulated crypto assets, particularly those promising unrealistic returns or lacking transparency.

The targeting of specific communities (in this case, African-American and church communities) is a concerning aspect, emphasizing the need for increased awareness and education to prevent vulnerable populations from falling victim to scams.

Market Impact

While this specific case is unlikely to have a significant direct impact on the overall crypto market, it contributes to the broader narrative surrounding regulation and investor protection. Increased regulatory scrutiny can, in the short term, lead to market uncertainty and potentially dampen investor sentiment. However, in the long term, clear and effective regulations can foster greater trust and stability, attracting more institutional investment and wider adoption.

Expert Take or Personal Insight

The fact that Crews didn’t even bother to defend himself suggests a strong case against him. It’s a stark reminder that many of these alleged “opportunities” in the crypto space are simply scams preying on people’s desire for financial gain. While the SEC’s victory is positive, it’s also a reactive measure. The industry needs to do more to proactively educate investors and develop self-regulatory mechanisms to prevent these scams from happening in the first place. The lack of response from the defendant suggests a blatant disregard for the law, which is unfortunately not uncommon in the less regulated corners of the crypto world.

Actionable Insight

Traders and investors should view this case as a reminder to exercise extreme caution and due diligence when considering investments in lesser-known crypto assets. Key things to watch include:

- Regulatory Actions: Stay informed about SEC enforcement actions and other regulatory developments in the crypto space.

- Token Transparency: Investigate the underlying technology, team, and business model of any crypto project before investing. Be wary of projects that make unrealistic promises or lack transparency.

- Community Sentiment: Monitor online forums and social media for red flags and potential warnings from other investors.

Conclusion

The SEC’s default judgment against Keith Crews is a small victory in the ongoing battle against crypto fraud. While it doesn’t solve the problem entirely, it sends a signal that regulators are paying attention. Looking ahead, greater collaboration between regulators, industry participants, and the crypto community is crucial to create a safer and more sustainable environment for crypto innovation and investment. The focus should be on preventative measures and investor education to minimize the occurrence of such scams in the future.