Tokenization platform Securitize and DeFi protocol Mantle have joined forces to introduce the Mantle Index Four (MI4) Fund, an institutional-grade investment vehicle designed to generate yield from a diverse portfolio of cryptocurrencies.

The MI4 Fund aims to replicate the structure of a traditional index fund, but within the digital asset space. It provides investors with exposure to leading cryptocurrencies like Bitcoin (BTC), Ether (ETH), and Solana (SOL), along with stablecoins pegged to the US dollar. This diversified approach seeks to provide a balanced risk profile within the often-volatile cryptocurrency market. The fund was officially announced on April 24.

A key feature of the MI4 Fund is its integration of liquid staking tokens, including Mantle’s mETH, Bybit’s bbSOL, and Ethena’s USDe. Liquid staking allows investors to earn rewards on their staked assets while maintaining the flexibility to trade or use them in other DeFi applications. This integration is intended to boost the fund’s overall returns through on-chain yield generation.

The launch of the MI4 Fund reflects the increasing interest in cryptocurrencies from both retail and institutional investors. Bitcoin, in particular, has gained traction as a potential hedge against macroeconomic uncertainty, prompting investors to seek exposure to digital assets.

MI4 Fund: The ‘S&P 500’ of Crypto?

Mantle envisions the market capitalization-weighted MI4 Fund becoming the benchmark index for the cryptocurrency market, akin to the S&P 500 in the traditional stock market. According to Timothy Chen, Mantle’s global head of strategy, the fund aims to be the “de facto SPX or S&P 500 of crypto.”

Mantle focuses on providing institutional investors with opportunities to earn yield on digital assets. Their Mantle Staked Ether (mETH) product, for example, offers an APR of approximately 3.78% as of April 24, according to DefiLlama data. The Mantle protocol boasts a total value locked (TVL) exceeding $680 million.

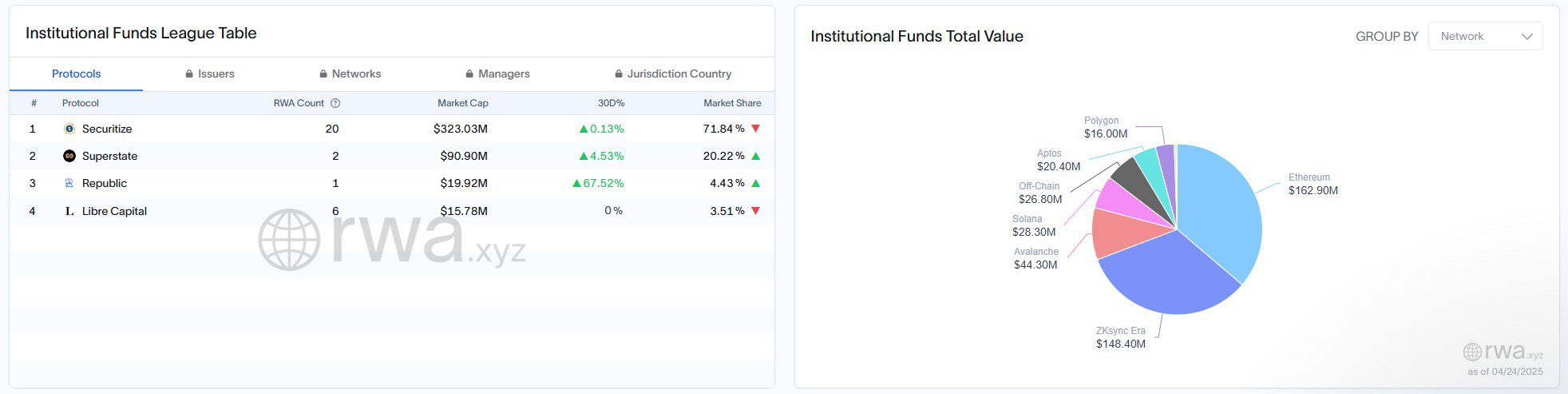

Securitize stands out as a leading platform for tokenizing real-world assets (RWAs) for institutional clients. As of April 24, it held an estimated 71% market share, according to data from RWA.xyz. The BlackRock Institutional Digital Liquidity Fund (BUILD), Securitize’s largest affiliated fund, holds over $2.5 billion in net assets.

Carlos Domingo, co-founder and CEO of Securitize, stated in March that demand for tokenized funds is growing as institutional investors, private equity firms, and credit managers increasingly use tokenization to improve efficiency, reduce operational friction, and enhance liquidity.

Key Takeaways for Investors

The launch of the Securitize and Mantle MI4 Fund presents several key points for potential investors:

- Diversified Exposure: The fund offers a diversified portfolio of leading cryptocurrencies and stablecoins.

- Yield Enhancement: Integration of liquid staking tokens aims to boost returns through on-chain yield generation.

- Institutional Grade: Designed to meet the needs and expectations of institutional investors.

- Tokenization Leader: Securitize’s experience in tokenizing RWAs provides a solid foundation for the fund.

What is Tokenization?

Tokenization is the process of converting rights to an asset into a digital token that can be traded on a blockchain. This can include real-world assets like real estate, stocks, or commodities. It offers several advantages, including increased liquidity, fractional ownership, and reduced administrative costs.

Understanding Liquid Staking

Liquid staking allows investors to stake their cryptocurrencies and earn rewards while also retaining the ability to trade or use those staked assets. This is achieved by receiving a liquid staking token in exchange for the staked asset. This token represents the staked position and can be freely traded or used in other DeFi protocols. Examples include Mantle’s mETH, Bybit’s bbSOL, and Ethena’s USDe.

Potential Risks

As with any investment, the MI4 Fund carries potential risks, including:

- Market Volatility: The cryptocurrency market is known for its volatility, which can impact the fund’s performance.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, which could create uncertainty for investors.

- Smart Contract Risks: DeFi protocols are vulnerable to smart contract bugs and exploits, which could result in losses.

Investors should carefully consider these risks before investing in the MI4 Fund.