Medical tech company Semler Scientific has deepened its Bitcoin strategy, revealing a new $20 million investment for 185 BTC between May 23 and June 3. The latest acquisition brings its total holdings to 4,449 Bitcoin (BTC), purchased at an average price of $107,974 per coin.

According to a June 4 filing with the US Securities and Exchange Commission (SEC), Semler’s total investment in the cryptocurrency now stands at $410 million, valued at approximately $472.9 million as of June 3. Its Bitcoin yield is up by 26.7% since it began accumulating BTC in May 2024.

Semler has made regular Bitcoin purchases over the past year. The company also revealed the addition of $50 million to its Bitcoin reserve in May, after it acquired another $10 million BTC between February and April.

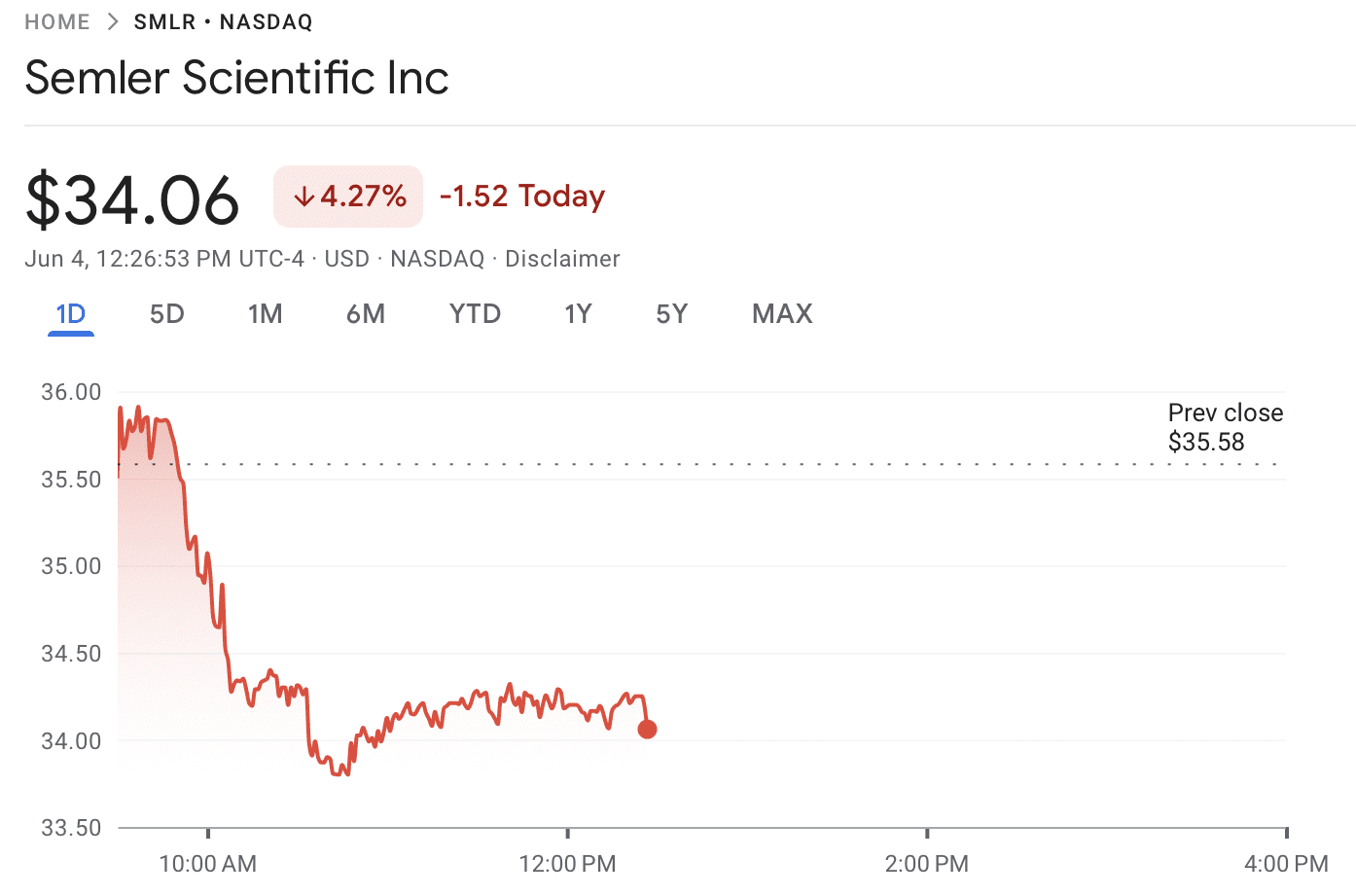

The BTC strategy does not appear to be attracting investors’ interest. As of June 4, the company’s shares are down 37% in 2025, according to Google Finance. Since May 29, 2024, when it announced its pivot to add a Bitcoin reserve, the share price is up 16% at this writing.

Companies that are betting on Bitcoin reserves are experiencing mixed results in their share prices in 2025. Strategy’s shares are up 33% year-to-date, while Japanese firm Metaplanet has seen a 265% spike in its share price.

Bitcoin has had a volatile ride in 2025. Despite climbing 11.8% year-to-date and reaching an all-time high of $112,000, the asset has also dropped below $77,000. Ongoing trade wars and broader macroeconomic uncertainty have weighed on its performance.

According to BitcoinTreasuries.NET, approximately 3.4 million BTC are currently being held in treasuries. Exchange-traded funds and public companies make up the largest groups holding Bitcoin, while governments come in third.