Silk Road Founder’s Auction Nets $1.8M in Bitcoin: A Look at the Market Impact

An auction of personal belongings from Silk Road founder Ross Ulbricht has brought in more than $1.8 million worth of Bitcoin as collectors vied for pieces of crypto history.

Ulbricht, who was pardoned by former President Donald Trump earlier this year, offered a range of items through Bitcoin-only marketplace Scarce City.

The collection included personal effects from before his 2013 arrest — such as a sleeping bag, backpack, and drum — as well as prison memorabilia like a lock, notebook, clothing, and several paintings created while incarcerated.

“I’ve left Arizona, the state where I was in prison. It’s time to travel. That means downsizing and turning the page,” Ulbricht wrote on the auction page. “I don’t need the reminders and I’m sure some of you will love to have them.”

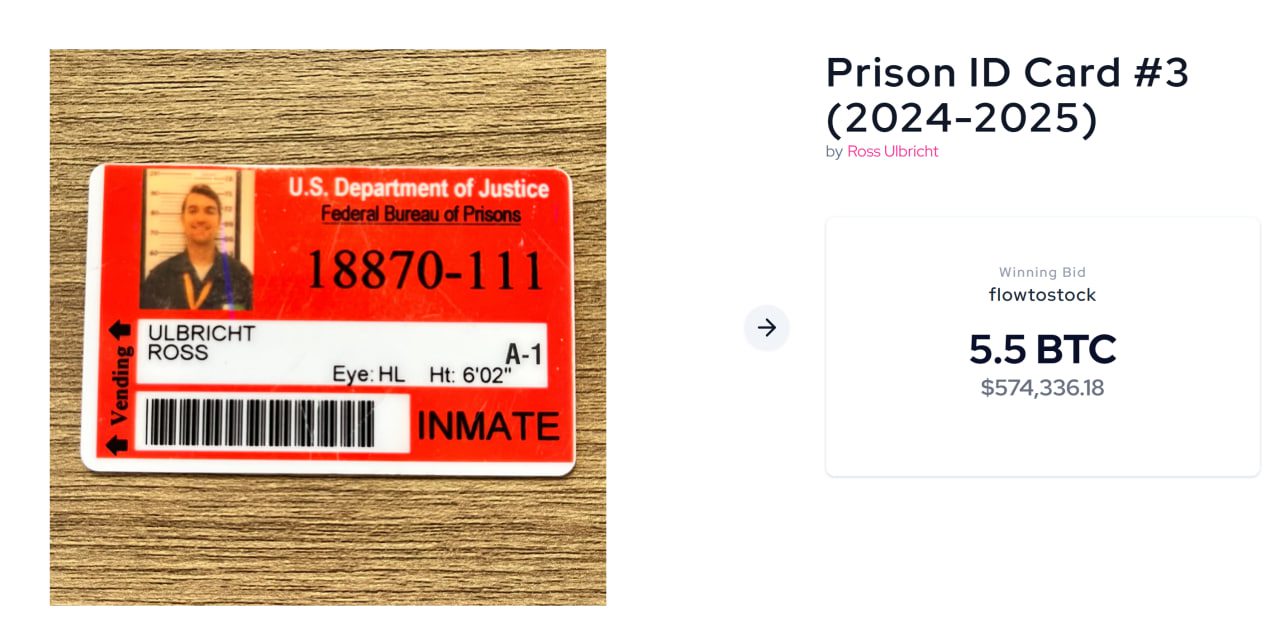

Ulbricht’s final prison ID card fetches 11 BTC

One of the standout pieces, Ulbricht’s final prison ID card, fetched 11 BTC — over $1.1 million at current prices. “The guard tried to get me to stop smiling for the photo, but my joy comes from within,” Ulbricht commented. “So I smiled that day, even though I was in prison.”

A collaborative painting by Ulbricht and a fellow prisoner known as “Omega” also drew attention, securing a winning bid of 1.01 BTC. “It gave me the feeling that, if I could pass through it, something better would be on the other side,” Ulbricht said of the artwork.

In order to participate in the auction, Bidders had to deposit 1% of their bid as collateral. Last-minute bids also reset the countdown timer to ensure fair competition.

Final payments must be completed by June 2, with Bitcoin (BTC) preferred, though smaller PayPal payments were also accepted.

Millions in Dormant Bitcoin

In addition to raising $1.8 million from the auction and receiving significant community donations, Ulbricht may have access to millions in Bitcoin.

Coinbase director Conor Grogan recently highlighted that approximately 430 BTC, currently valued at around $47 million, remain in wallets likely tied to Ulbricht. These wallets have been inactive for over 13 years and were never seized by authorities.

“I found ~430 BTC across dozens of wallets associated with Ross Ulbricht that were not confiscated by the [US government] and have been untouched for 13+ years,” Grogan shared on X.

Blockchain analytics firm Arkham Intelligence confirmed Grogan’s assessment, tracing 14 Bitcoin addresses connected to Silk Road. One of these wallets alone holds more than $9 million in BTC.

Quick Summary of the News:

- Ross Ulbricht’s personal items auction on Scarce City raised over $1.8 million in Bitcoin.

- The auction included items from before his arrest and prison memorabilia.

- His final prison ID card fetched 11 BTC (over $1.1 million).

- Wallets potentially linked to Ulbricht hold approximately 430 BTC, worth around $47 million.

Why It Matters:

The auction’s success underscores the enduring notoriety of Silk Road and Ulbricht’s place in crypto history. More importantly, the significant sums involved, and the potential for Ulbricht to access even larger dormant Bitcoin holdings, could introduce considerable volatility into the market.

Market Impact:

While $1.8 million is unlikely to cause a major market shift, the potential access to $47 million in dormant BTC is a different story. The sudden movement of such a large sum could trigger a sell-off, impacting Bitcoin’s price. Here’s a hypothetical scenario:

| Event | Potential Impact on BTC Price |

|---|---|

| Ulbricht accesses and moves 430 BTC | Potential short-term price drop (2-5%) due to increased selling pressure. |

| News of the dormant wallets spreads widely | Increased market volatility and uncertainty. |

Expert Take or Personal Insight:

The Ulbricht saga continues to be a fascinating intersection of cryptocurrency, law, and human interest. While some may see Ulbricht as a criminal, others view him as a symbol of early crypto ideals. Regardless, the potential for these dormant BTC holdings to enter the market is a factor that traders and investors should be aware of. I believe that the market has largely priced in this risk at this point. However, any confirmed movement of these funds will lead to a flash crash for BTC.

Actionable Insight:

Traders should monitor blockchain activity related to the 14 Bitcoin addresses identified by Arkham Intelligence. Look for any movement of funds. Investors should be prepared for potential short-term volatility if the dormant BTC is accessed and sold. Diversification remains a key strategy to mitigate risks associated with such events.

Conclusion:

The Ross Ulbricht auction and the potential reactivation of dormant Bitcoin wallets serve as a reminder of the unpredictable nature of the cryptocurrency market. While the long-term impact remains uncertain, staying informed and prepared is crucial for navigating the evolving landscape.