Solana (SOL) is currently navigating a critical juncture, with analysts pointing to a potential rally towards $260. This optimism stems from both technical indicators and historical price fractals. However, low trading volumes warrant careful consideration.

Key Takeaways:

- Bull Flag Pattern: A bull flag pattern suggests a potential rally to $260, but low spot buy volumes are raising concerns.

- Resistance at $180: SOL is attempting to establish a position above $180 for the second consecutive week.

- Capital Rotation: Market speculation suggests capital rotation from Bitcoin could benefit altcoins like Solana.

After a brief dip from $184 to $160, Solana is striving to maintain its position above the key resistance level of $180. With Bitcoin recently achieving an all-time high, many investors are anticipating a subsequent flow of capital into major altcoins, potentially propelling SOL to new heights.

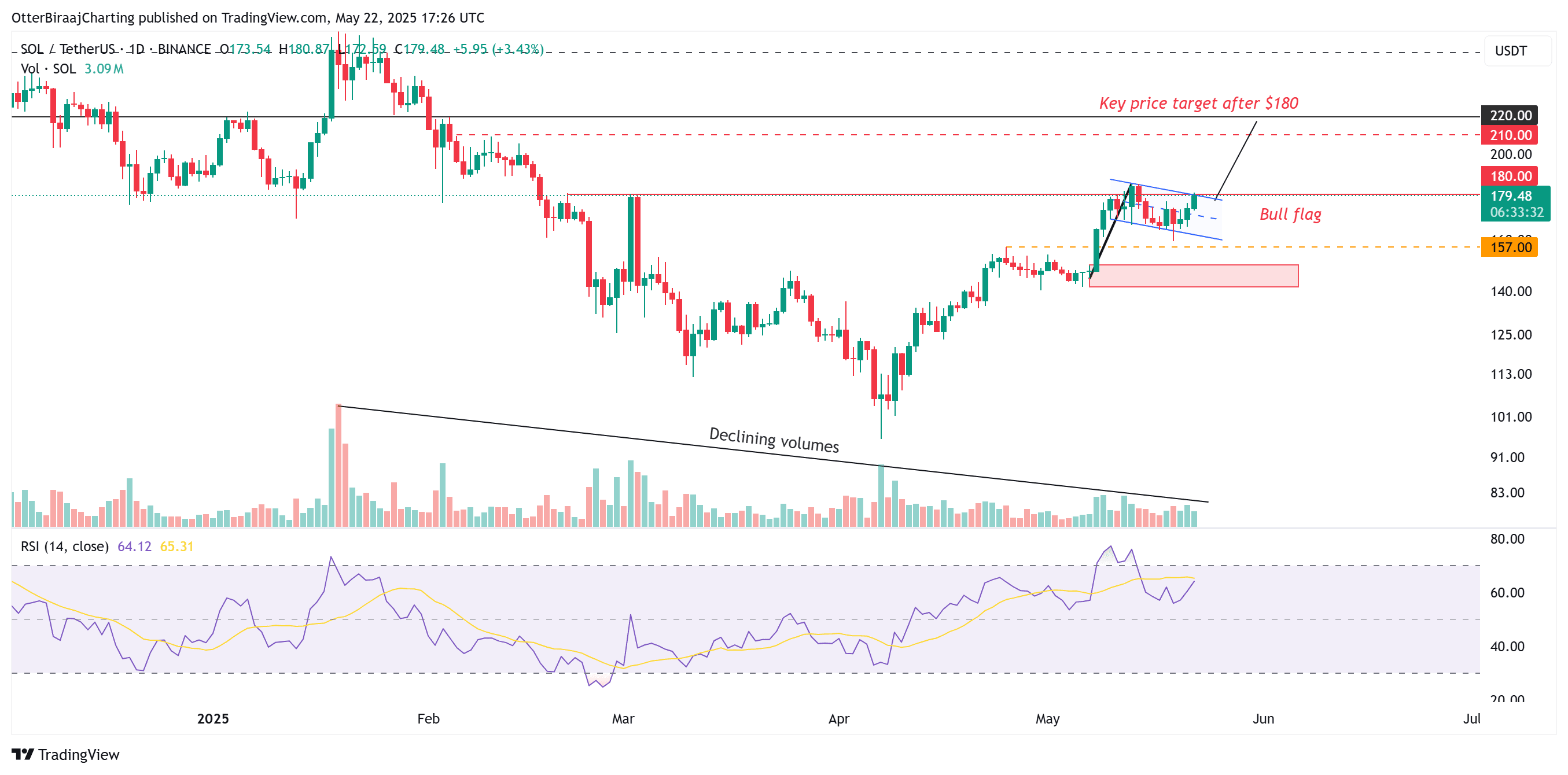

The daily chart for Solana reveals a promising bull flag pattern, a formation typically observed after a strong upward trend. While SOL is currently trading below $180, a successful breakout above this level could drive it towards an initial target of $200, with the possibility of reaching $220 if the bullish momentum persists.

The relative strength index (RSI) stands at 64.30, which supports the bullish trend. It signifies healthy momentum without indicating overbought conditions. However, a clear market structure break (MSB) or a decisive bullish breakout above $180 is necessary to initiate the next phase of the rally.

One factor that suggests caution is the declining trading volume during the consolidation phase. Insufficient buying pressure could impede the breakout.

A failure to surpass $180 would bring the $140-$150 range into focus as an immediate area of interest. In such a scenario, the bull flag pattern would be invalidated. This support range is characterized as a daily order block that is expected to provide higher time frame (HTF) support in the event of a price correction.

Fractal Analysis Suggests $260 Target

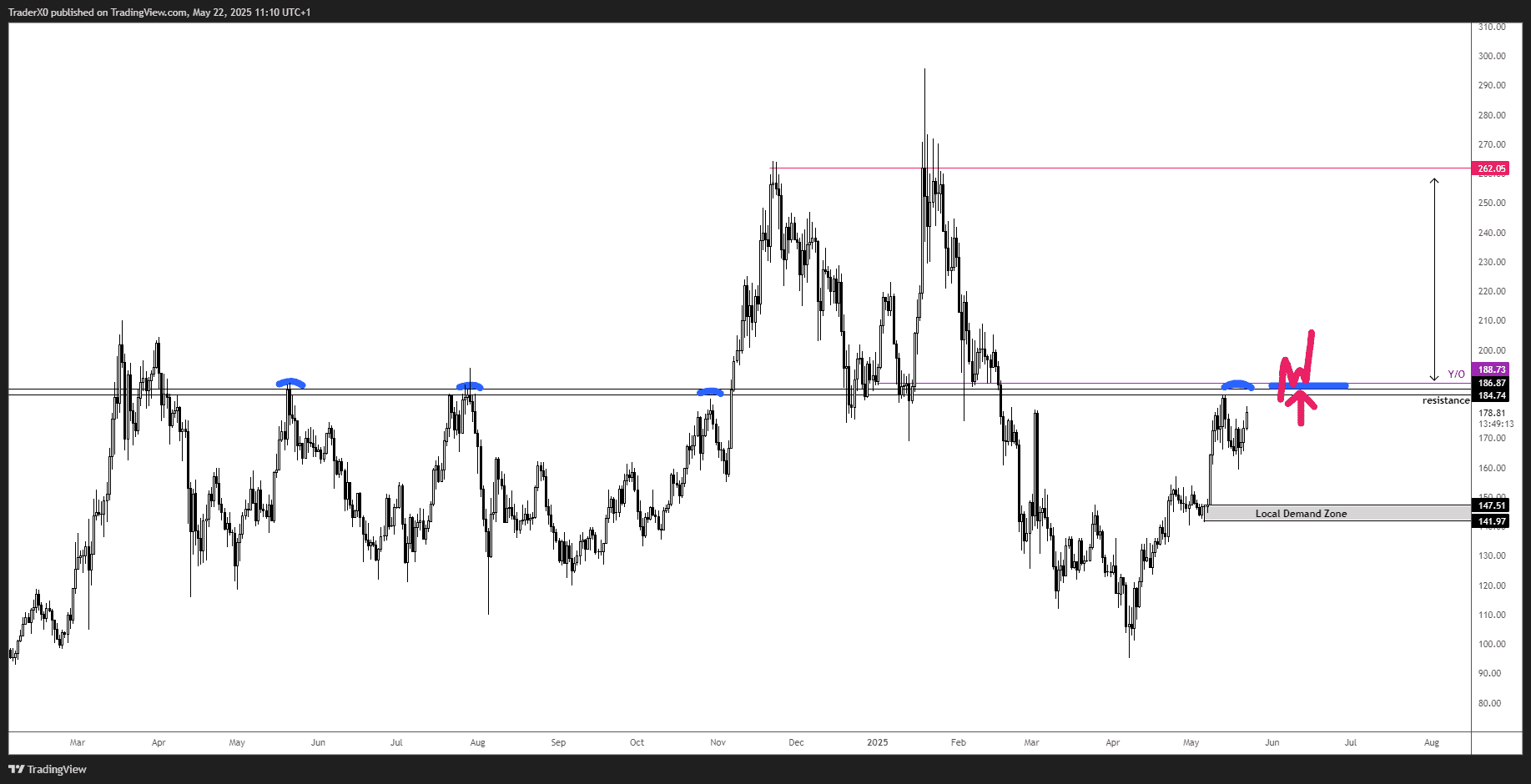

Crypto trader Robert Mercer has identified a price fractal pattern reminiscent of October 2024. Mercer highlights two crucial zones: the late 2024 period, where SOL broke through $180 after a period of consolidation, and the current zone, which mirrors that setup. He anticipates that a breakout above $180 could spark a significant upward movement, mirroring the late 2024 rally that propelled SOL to nearly $260.

Technical analyst Javon Marks has also noted a hidden bullish divergence on Solana’s 3-day chart. This pattern previously triggered an impressive 1,332% surge in 2024. Marks suggests that if this pattern reemerges in 2025, Solana has the potential to reach a price target of $450.

Popular crypto trader XO is also closely monitoring the situation, seeking a long opportunity. However, XO advises waiting to confirm whether Solana can successfully flip the $180 level into a reliable support.

Factors Influencing Solana’s Price

- Bitcoin’s Performance: The overall health and momentum of Bitcoin often influence the altcoin market, including Solana.

- Market Sentiment: General investor sentiment towards cryptocurrencies plays a crucial role in price movements. Positive news and adoption trends can drive prices higher.

- Network Activity: Increased usage of the Solana network, driven by DeFi, NFTs, or other applications, can positively impact SOL’s price.

- Technical Developments: Updates, upgrades, and improvements to the Solana blockchain can boost investor confidence and drive demand.

- Trading Volumes: Consistent and high trading volumes are essential for sustaining price rallies.

Potential Risks to Consider

- Market Corrections: The cryptocurrency market is inherently volatile, and sudden corrections can significantly impact Solana’s price.

- Regulatory Changes: Regulatory developments in the cryptocurrency space could introduce uncertainty and affect investor sentiment.

- Competition: Solana faces competition from other blockchain platforms. The success of competing platforms could impact Solana’s market share and price.

- Network Issues: While Solana has made strides in network stability, potential future outages or congestion could negatively impact its reputation and price.

Conclusion

Solana’s potential rally to $260 hinges on several factors, including a successful breakout above $180, sustained buying pressure, and overall market conditions. While technical indicators and fractal analysis present a bullish outlook, traders should remain cautious and closely monitor trading volumes and potential risks. Keeping a close eye on these elements will enable you to make well-informed decisions in the dynamic cryptocurrency market.