Solana (SOL) is showing signs of renewed strength, holding the $140 support level for the first time in over two months. This stability, coupled with a surge in futures open interest, suggests growing confidence among traders and institutions. But can SOL sustain this momentum and reach the coveted $200 mark?

Key Takeaways:

- Solana’s resilience: Successfully held the $140 support level for a week, indicating stronger buyer support.

- Soaring futures open interest: Reached $5.75 billion, reflecting substantial institutional interest in SOL derivatives.

- Strong on-chain activity: Boasts a $9.5 billion total value locked (TVL) and dominance in decentralized exchange (DEX) volumes.

- Potential ETF catalyst: Analysts predict a 90% chance of spot Solana ETF approval by Oct. 10, potentially driving further price gains.

Understanding the Solana Futures Market

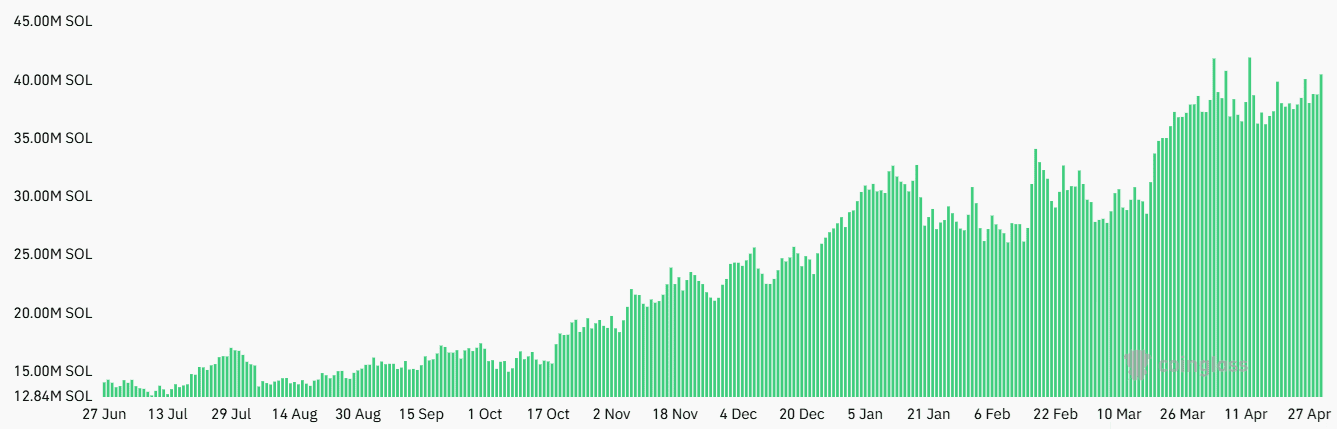

The Solana futures market provides valuable insights into trader sentiment and institutional activity. On April 30, SOL futures open interest reached 40.5 million SOL, nearing its all-time high. In dollar terms, this translates to $5.75 billion, placing it third among cryptocurrencies, surpassing even XRP derivatives by over 50%. This robust demand for SOL derivatives underscores growing institutional interest in the Solana ecosystem.

Decoding Leverage: Bullish or Bearish?

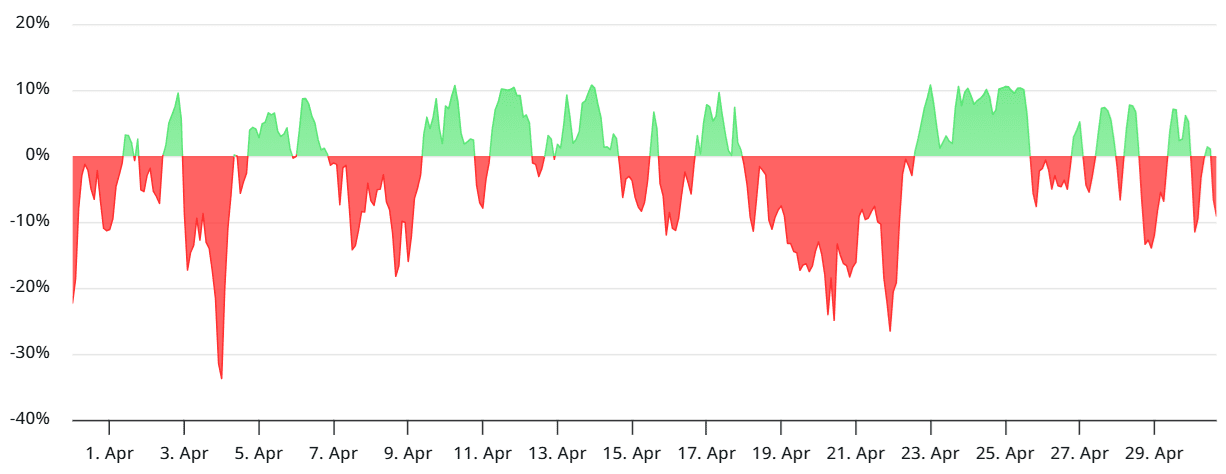

While increasing SOL futures open interest might initially suggest rising optimism, it’s crucial to analyze the funding rate for perpetual contracts to gauge the prevailing sentiment. A negative funding rate indicates a higher demand for bearish positions (shorts), while a positive rate suggests bullish sentiment (longs).

Currently, the funding rate for SOL perpetual futures is negative, indicating a slight bearish bias. This could be attributed to the significant 43% price surge SOL experienced between April 8 and April 29, leading some traders to take profits or hedge their positions.

Solana’s Fundamentals: More Than Just Memecoins

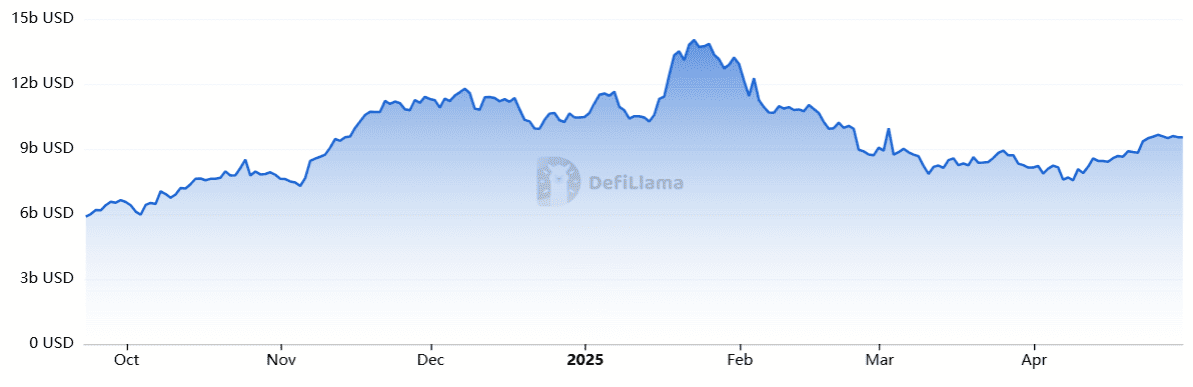

Despite facing criticism for its association with memecoins, Solana boasts a strong underlying infrastructure and vibrant decentralized finance (DeFi) ecosystem. With a $9.5 billion total value locked (TVL), Solana ranks second only to Ethereum. This TVL encompasses various DeFi activities, including liquid staking, collateralized loans, automated yield platforms, and synthetic derivatives.

Several Solana-based decentralized applications (dApps) are among the top fee earners, showcasing the platform’s growing adoption. Meteora, Pump-fun, and Juto have generated substantial fees in recent weeks, demonstrating the network’s economic activity.

Solana’s DEX Dominance

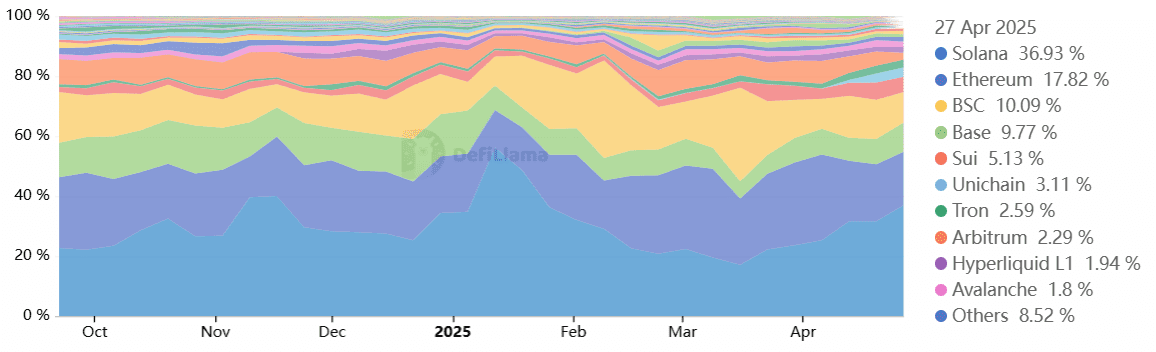

Solana’s decentralized exchanges (DEXs) are experiencing remarkable growth, outpacing even Ethereum in trading volumes. Despite Ethereum’s lower transaction fees, Solana’s DEXs have consistently recorded higher trading volumes, highlighting the platform’s efficiency and user appeal. In the past week, Solana led with $21.6 billion in DEX activity, even when including the entire Ethereum layer-2 ecosystem.

Raydium and Meteora, two prominent Solana DEXs, have witnessed significant increases in trading volumes, further solidifying Solana’s position as a leading DeFi hub.

The Potential for a Spot Solana ETF

The potential approval of a spot Solana ETF in the United States could serve as a major catalyst for SOL’s price. Analysts estimate a 90% probability of approval by the US Securities and Exchange Commission (SEC) by October 10. Such an ETF would provide institutional and retail investors with easier access to SOL, potentially driving increased demand and price appreciation.

Will SOL Reach $200?

Considering the factors discussed above – Solana’s resilient price action, strong futures market, thriving DeFi ecosystem, DEX dominance, and the potential for a spot ETF – a rally to $200 appears increasingly plausible. While bearish sentiment may persist in the short term, the underlying fundamentals and potential catalysts suggest a positive outlook for SOL’s long-term price trajectory.