Solana (SOL) has experienced a notable price increase, prompting investors and enthusiasts to examine the underlying factors. This article delves into the key drivers behind Solana’s recent positive performance, analyzing on-chain metrics, futures market activity, and technical indicators to provide a comprehensive overview of the current market dynamics.

Key Takeaways:

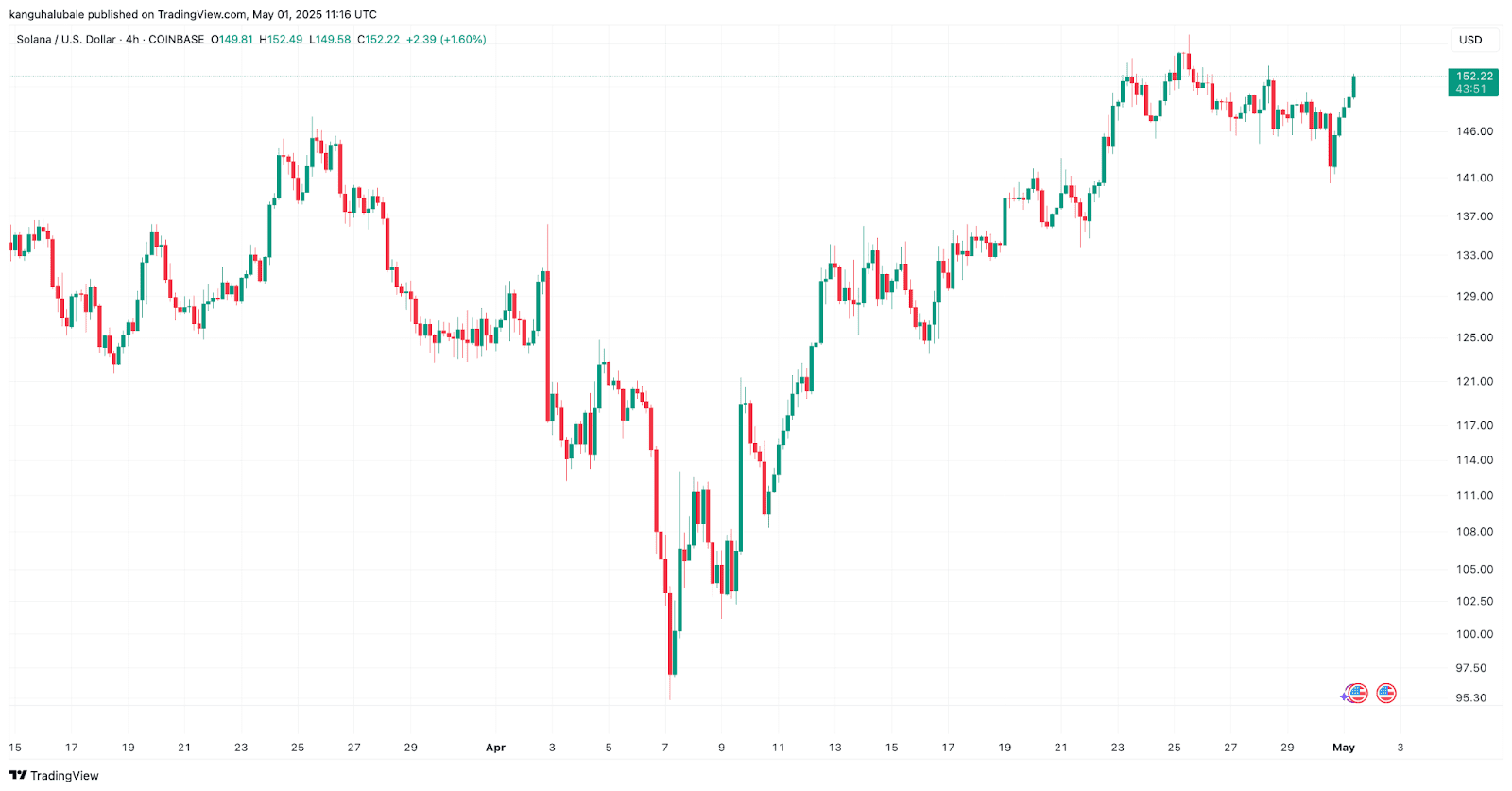

- Price Surge: Solana (SOL) gained 8% to reach $152, indicating renewed bullish momentum.

- Increased Trading Volume: A 35% surge in daily trading volume suggests heightened investor interest.

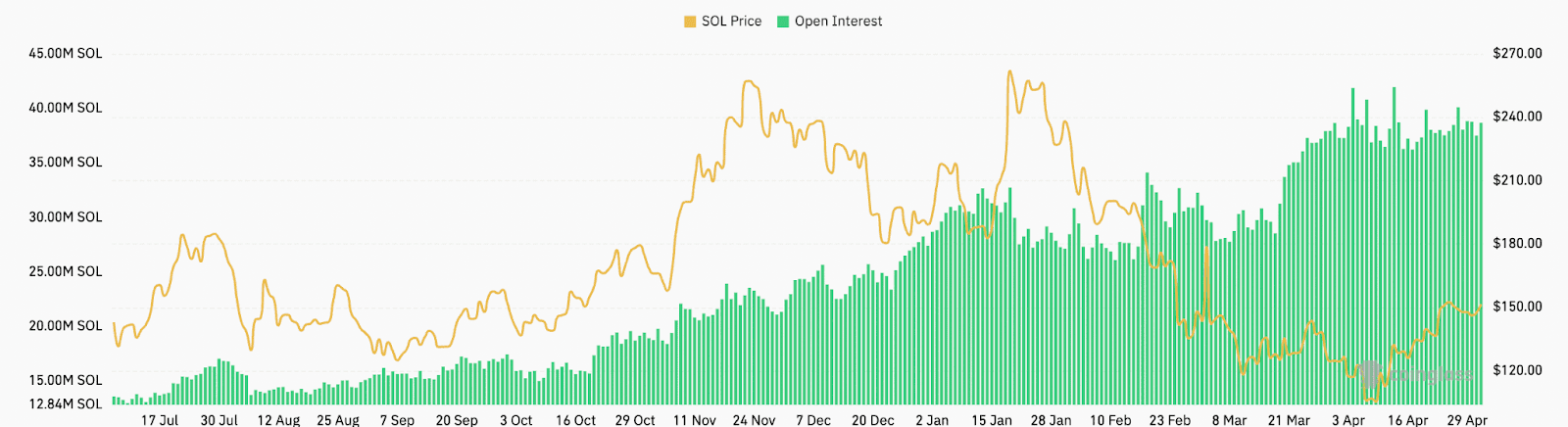

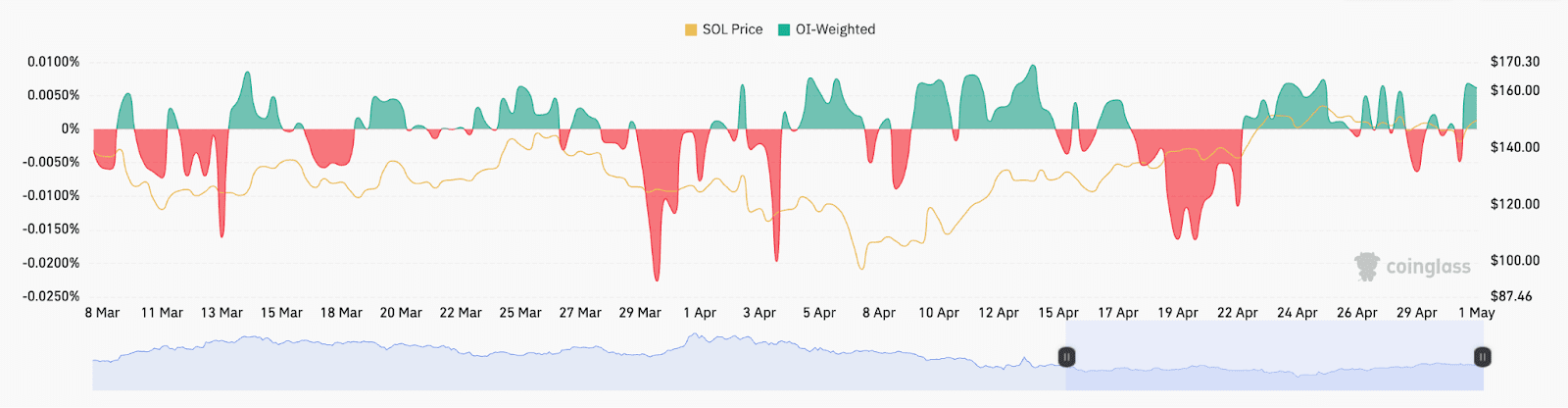

- Futures Market Strength: A 5% increase in futures open interest reflects growing confidence in Solana’s future price.

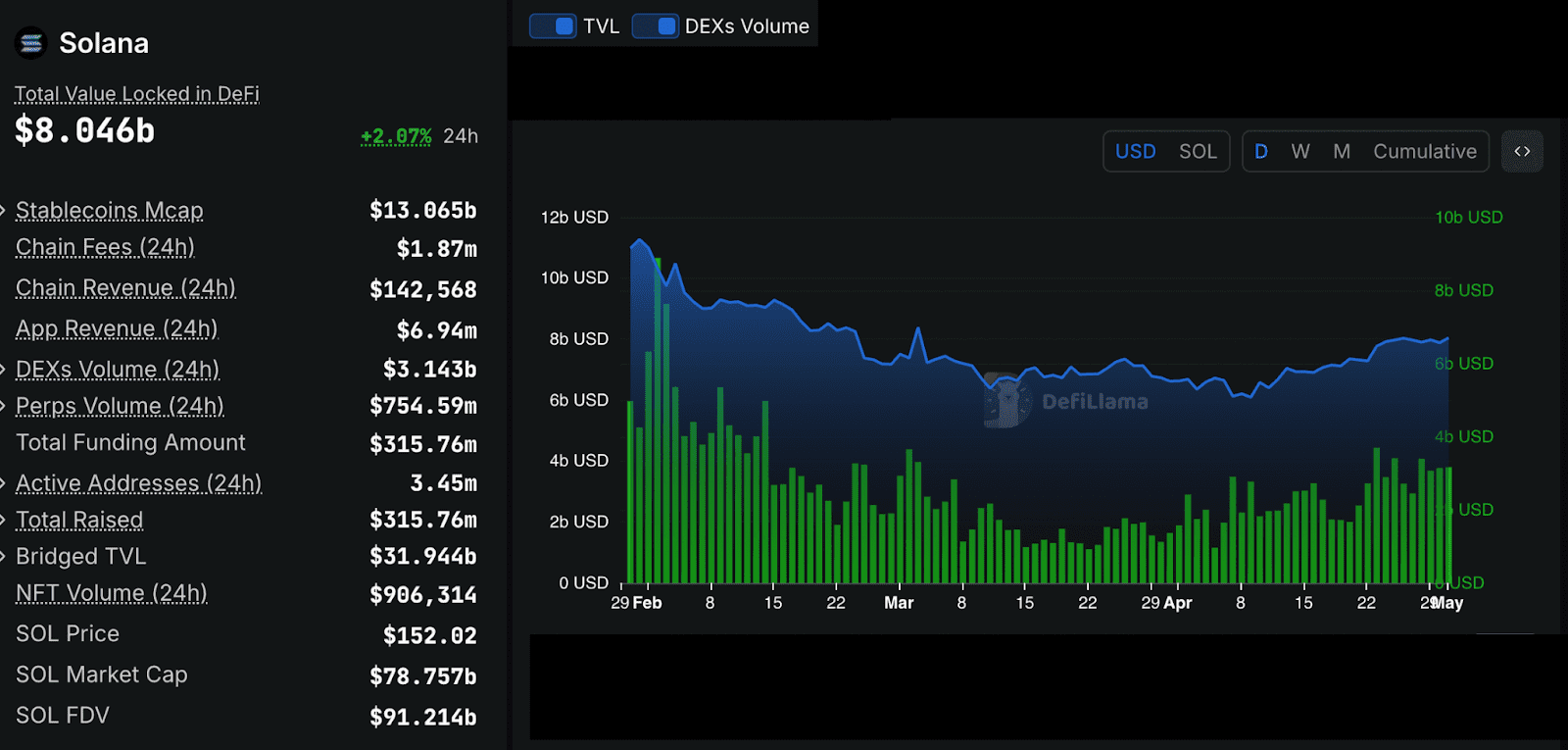

- TVL Growth: Solana’s Total Value Locked (TVL) has risen by 25% in the past 30 days, signifying increased network activity.

- DEX Volume Surge: Decentralized exchange (DEX) volumes on Solana have soared by 90%, highlighting the platform’s growing prominence in decentralized finance.

- Potential Price Target: A V-shaped recovery pattern suggests a potential price target of $250 if SOL breaks through resistance levels between $160 and $200.

Analyzing the Price Increase

Solana’s recent price increase can be attributed to a confluence of factors, each contributing to the overall positive sentiment surrounding the cryptocurrency.

Futures Market Activity

The futures market plays a significant role in Solana’s price discovery. An increase in open interest (OI) indicates that more contracts are being opened, suggesting a growing interest in Solana’s future price. The rise in SOL futures open interest, coupled with positive funding rates, signifies increased capital inflow and buying pressure.

On-Chain Activity

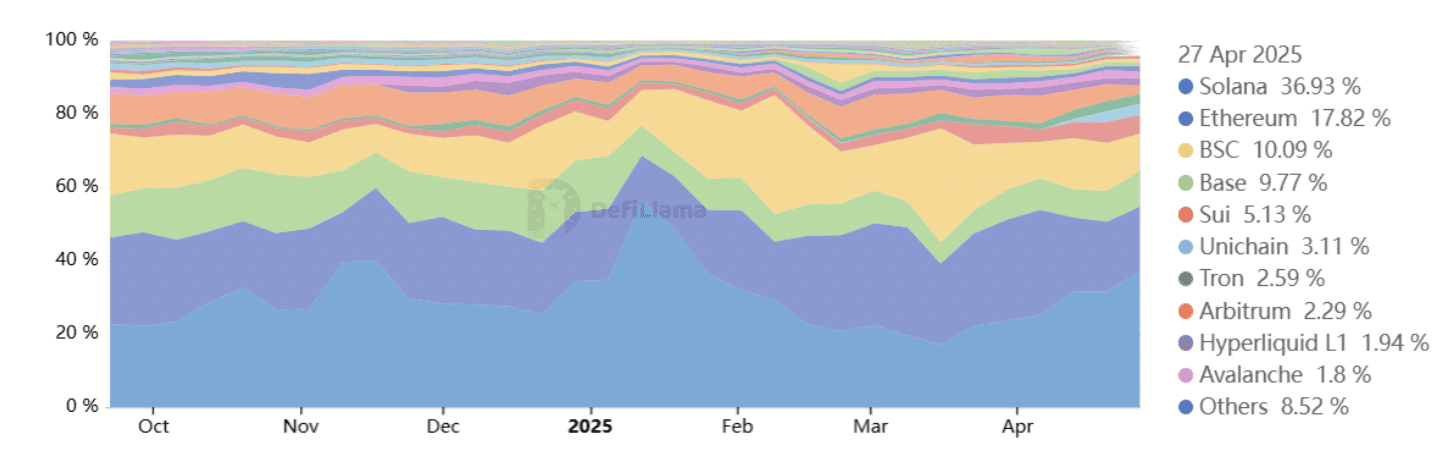

On-chain metrics provide valuable insights into the health and activity of the Solana network. A rising TVL indicates that more assets are being locked into Solana’s DeFi protocols, signaling increased user engagement and confidence in the platform. The surge in DEX volumes further reinforces this trend, demonstrating Solana’s growing dominance in the decentralized finance space.

TVL and DEX Volume Growth

Solana’s TVL has experienced significant growth, driven by strong performance from platforms like Sanctum, Kamino, Jito, and Jupiter. This increase in TVL underscores Solana’s growing adoption and utility within the DeFi ecosystem.

The surge in DEX volumes on Solana further solidifies its position as a leading blockchain for decentralized trading. Solana’s DEX volumes have surpassed those of the entire Ethereum layer-2 ecosystem, highlighting its scalability and efficiency.

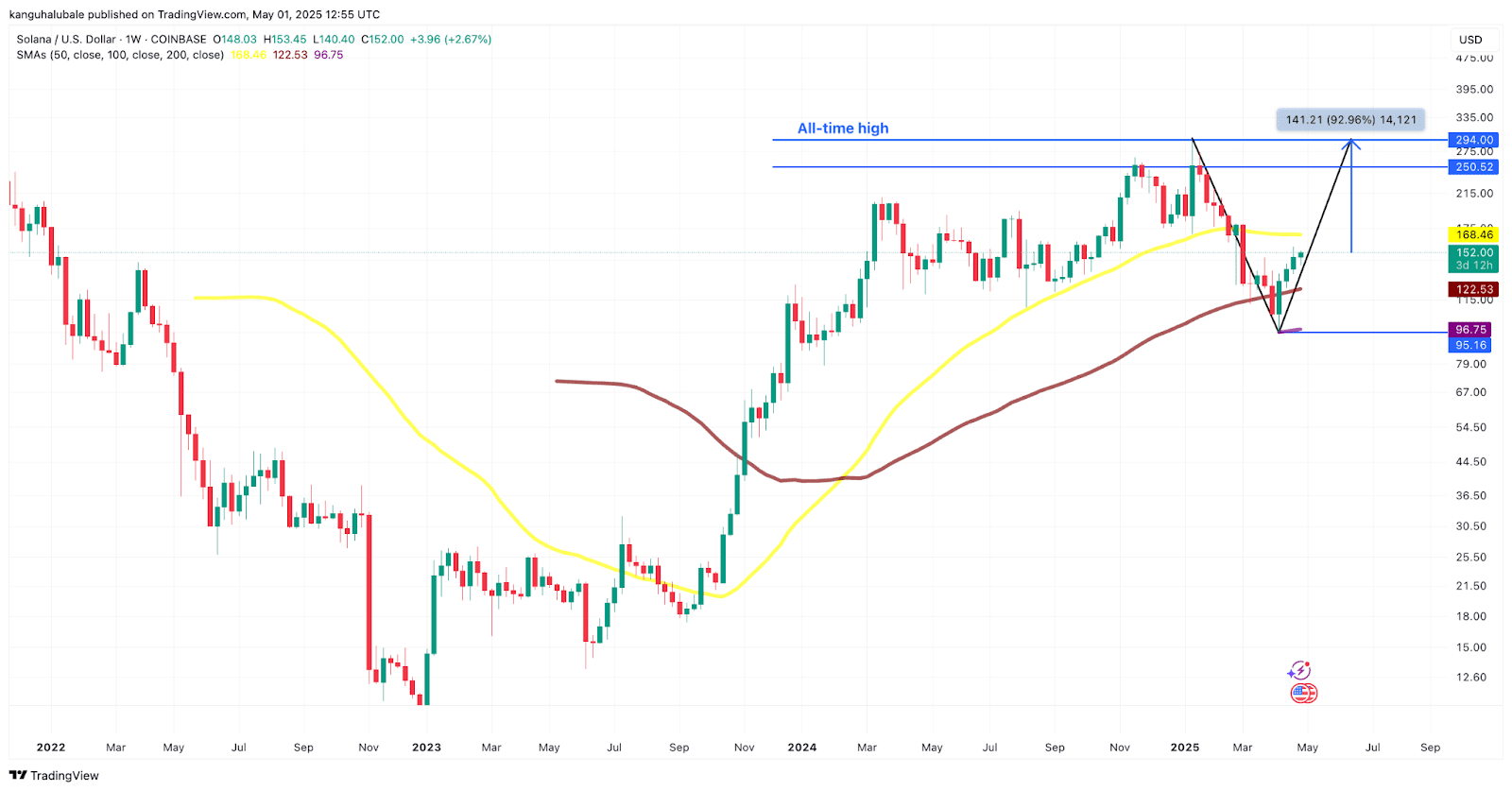

Technical Analysis: V-Shaped Recovery

From a technical analysis perspective, Solana’s price action is exhibiting a V-shaped recovery pattern on the weekly chart. This bullish pattern suggests a potential for further price appreciation if SOL can break through key resistance levels.

The neckline of the V-shaped pattern sits around $250, representing a significant target for Solana bulls. However, SOL must first overcome resistance between $160 and $200, where the 50-day simple moving average (SMA) is located.

Additional Factors

Beyond the factors discussed above, the overall market sentiment and broader macroeconomic conditions can also influence Solana’s price. Positive news and developments within the Solana ecosystem, such as new partnerships, protocol upgrades, and increased adoption, can further boost investor confidence and drive price appreciation.

Conclusion

Solana’s recent price increase is supported by a combination of strong on-chain activity, growing futures market interest, and positive technical indicators. While market conditions can change rapidly, the current trends suggest that Solana has the potential for further growth. Investors and enthusiasts should continue to monitor these factors and conduct their own research before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are inherently risky, and investors should be prepared to lose their entire investment.