While Solana has garnered attention for its high transaction speeds and low fees, a recent analysis by crypto bank Sygnum suggests that it lacks “convincing signs” of overtaking Ethereum as the preferred blockchain for institutional use. This assessment hinges on factors beyond mere transaction volume, delving into revenue stability, tokenomics, and the crucial role of traditional financial institutions.

Key Takeaways

- Revenue Stability: Sygnum argues Solana’s revenue is heavily reliant on memecoins, making it less stable compared to Ethereum’s broader ecosystem.

- Institutional Adoption: Ethereum’s security, stability, and longevity are highly prized by institutions, giving it an edge.

- Tokenomics: Solana’s tokenomics, while easier to modify, haven’t prioritized driving value to the SOL token.

- Ethereum’s Strengths: Ethereum leads in use cases like tokenization, stablecoins, and DeFi, backed by governments, regulators, and traditional finance.

- Solana’s Potential: Solana could gain ground by focusing on more stable revenue sources like tokenization and stablecoins.

Solana’s Rise and Ethereum’s Response

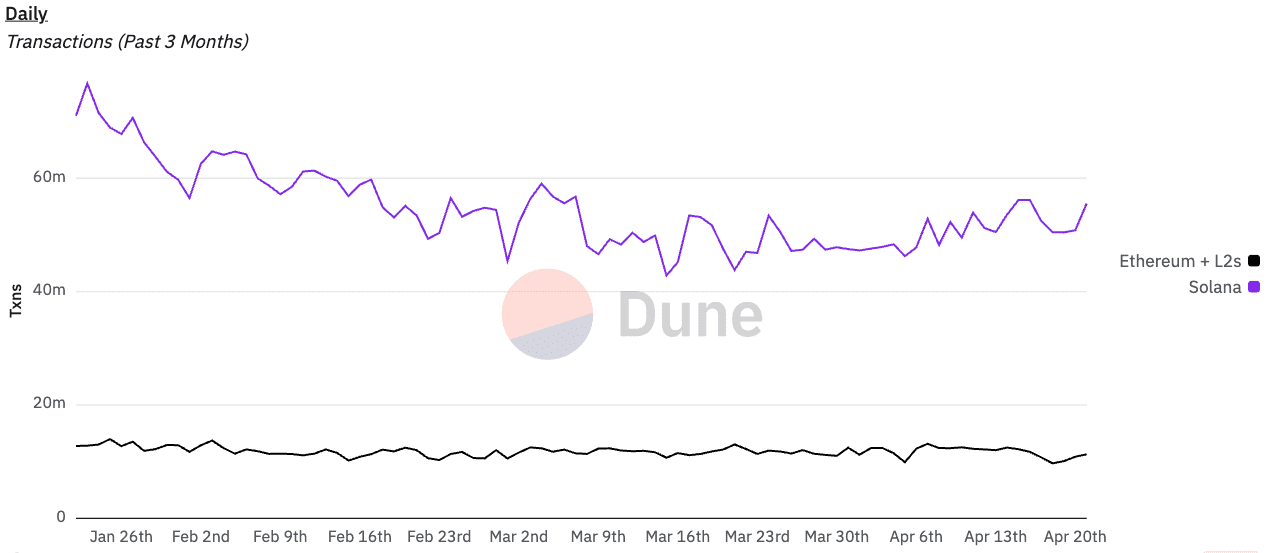

Solana emerged as a strong contender in the blockchain space, boasting significantly higher transaction throughput and lower fees compared to Ethereum. This made it attractive for applications requiring speed and scalability, particularly in the DeFi and NFT sectors. The rise of memecoins on Solana further fueled its transaction volume and fee generation.

However, Ethereum has not remained stagnant. The ongoing development and deployment of Layer 2 scaling solutions (like Optimism and Arbitrum) address Ethereum’s scalability issues and lower transaction costs. The Ethereum Foundation has also been actively working on enhancing the user experience and Layer 1 scaling, signaling a renewed focus on its core strengths.

Institutional Perspective: Stability and Security Matter

Sygnum emphasizes that the long-term success of a blockchain platform depends heavily on its adoption by traditional financial institutions. These institutions prioritize security, stability, and regulatory compliance. While Solana has made strides in these areas, Ethereum’s established track record and robust ecosystem give it a significant advantage.

Institutions are particularly interested in blockchain applications like tokenization of real-world assets, stablecoins, and decentralized finance (DeFi). Ethereum currently dominates these use cases, benefiting from strong support from governments, regulators, and traditional financial players.

Revenue Sources: Memecoins vs. Diverse Ecosystem

One of Sygnum’s primary concerns is Solana’s reliance on memecoins for revenue generation. While memecoins can drive transaction volume and fees, they are inherently volatile and unsustainable in the long run. Ethereum, on the other hand, benefits from a more diverse ecosystem of applications and revenue sources, including DeFi protocols, NFT marketplaces, and enterprise solutions.

To challenge Ethereum, Solana needs to diversify its revenue streams and attract more stable and sustainable applications. Focusing on tokenization of real-world assets and developing a robust stablecoin ecosystem could be key strategies for Solana to gain ground.

Tokenomics and Value Accrual

Tokenomics plays a crucial role in the long-term health and value of a blockchain network. Sygnum notes that Solana’s tokenomics haven’t prioritized driving value to the SOL token. While Solana has a mechanism for burning transaction fees, a larger proportion of fees are paid to validators, which may not directly translate to increased value for SOL holders. The community recently rejected a proposal to cut SOL’s inflation rate, signaling a potential lack of commitment to increasing token value.

Ethereum, with its transition to Proof-of-Stake (PoS) and the implementation of EIP-1559, has a more compelling tokenomic model. EIP-1559 burns a portion of each transaction fee, reducing the supply of ETH and potentially increasing its value over time. The PoS mechanism also reduces energy consumption and enhances network security.

Looking Ahead: The Future of Blockchain Dominance

The competition between Solana and Ethereum is far from over. Both platforms continue to evolve and adapt to the changing landscape of the blockchain industry. Solana has the potential to gain ground by diversifying its revenue sources, attracting institutional adoption, and refining its tokenomics.

However, Ethereum’s established ecosystem, strong security, and commitment to scalability give it a significant advantage. The success of Layer 2 scaling solutions and the ongoing development of Ethereum 2.0 will be crucial in maintaining Ethereum’s dominance in the long run.

Ultimately, the future of blockchain dominance will depend on which platform can best meet the needs of both institutional and retail users, providing a secure, scalable, and sustainable foundation for the next generation of decentralized applications.