A recent report by Standard Chartered raises concerns about Solana’s reliance on memecoin trading, suggesting it may be evolving into a ‘one-trick pony.’ This analysis highlights potential challenges for Solana’s long-term growth and sustainability.

Key Takeaways from the Standard Chartered Report:

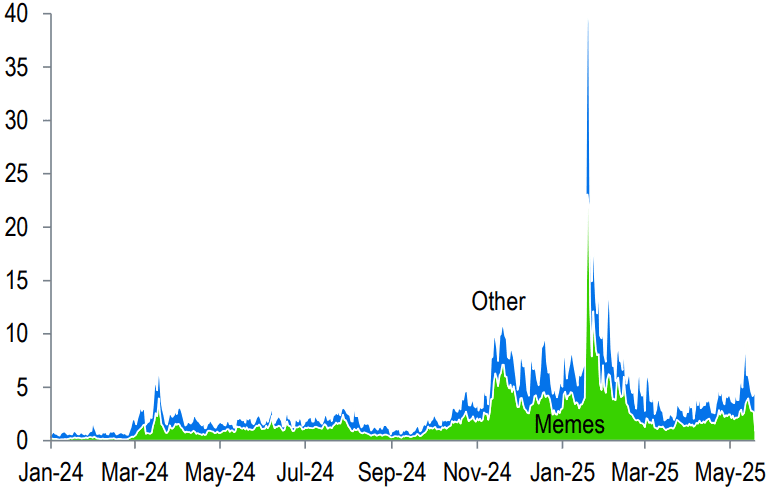

- Memecoin Dominance: Solana currently excels in high-volume, low-transaction-cost solutions, largely driven by memecoin trading.

- Scalability Stress Test: The memecoin frenzy served as a scalability test for Solana but carries risks due to the volatility of these assets.

- Declining Volumes: As memecoin trading decreases, Solana may struggle to maintain its current momentum.

- Expansion Needed: To ensure future success, Solana must expand into other sectors that require high-throughput and low-cost transactions.

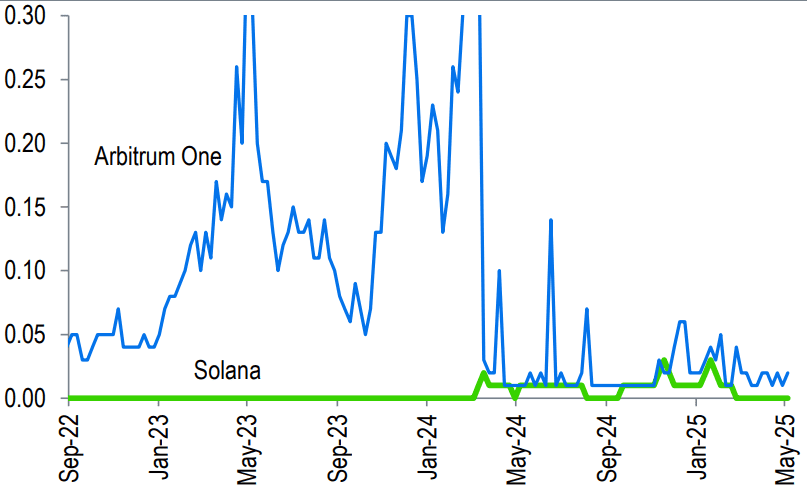

- Ethereum Competition: Ethereum layer-2 solutions are catching up in terms of transaction costs, challenging Solana’s value proposition.

Standard Chartered’s report indicates that Solana’s advantage in processing high volumes of transactions cheaply has primarily been exploited by memecoin traders. While this has showcased the blockchain’s scalability, it also exposes it to the inherent risks associated with speculative and volatile assets.

“So far, this has been mostly in memecoin trading, which accounts for the majority of activity on Solana (as measured by ‘GDP,’ which is application revenue),” the report states, emphasizing the current dependence.

The Problem with Memecoin Dependency

The speculative nature of memecoins means that trading volumes can fluctuate wildly. As the initial hype fades, Solana may face difficulties in maintaining its transaction volume and revenue. This reliance on a single, volatile use case raises concerns about the platform’s ability to sustain long-term growth.

Standard Chartered warns that declining memecoin trading volumes, combined with low transaction costs, is not a favorable situation for Solana’s future.

Potential Solutions for Solana

To overcome this potential ‘one-trick pony’ status, Standard Chartered suggests that Solana should diversify its applications and expand into other sectors. These could include:

- High-Throughput Financial Apps: Applications requiring fast and cheap transaction processing, such as decentralized exchanges (DEXs) and payment systems.

- Traditional Consumer Apps: Social media platforms and other consumer-facing applications that benefit from high scalability and low fees.

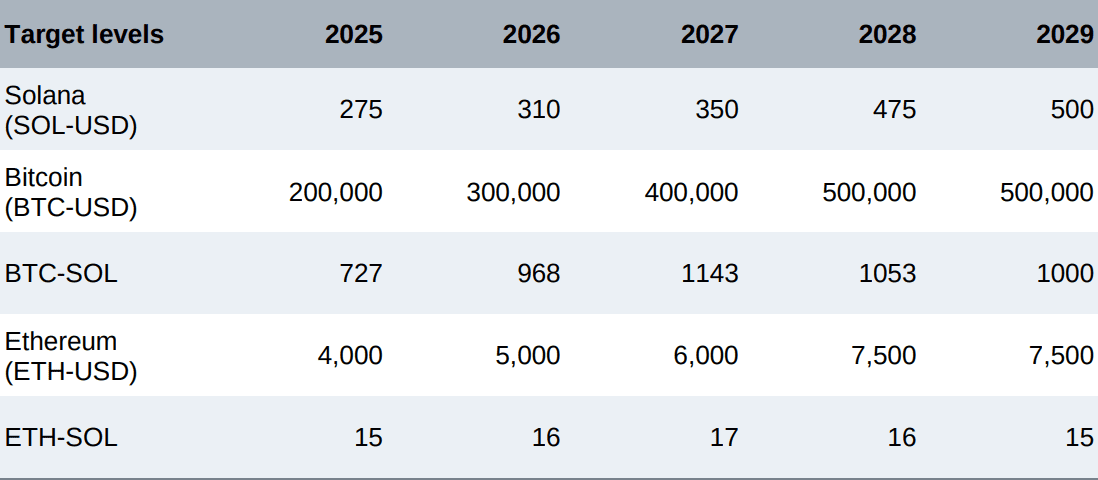

However, scaling such applications may take considerable time, potentially leading to a period of underperformance compared to Ethereum. The report anticipates that Solana may lag behind Ethereum for the next two to three years before potentially catching up.

Ethereum’s Rising Competition

Solana has long positioned itself as a competitor to Ethereum, offering faster and cheaper transactions. However, Ethereum’s layer-2 scaling solutions, particularly after the Dencun upgrade, have significantly reduced transaction costs, closing the gap with Solana.

The Dencun upgrade allows Ethereum to scale transactions at a lower cost while maintaining the security of its decentralized mainnet. This poses a direct challenge to Solana’s primary value proposition.

Conclusion: The Future of Solana

Standard Chartered’s analysis paints a cautious picture for Solana. While its focus on high-throughput, low-cost transactions has led to success in the memecoin market, this reliance could become a liability as the hype fades. To secure its future, Solana needs to diversify its applications, expand into new sectors, and address the growing competition from Ethereum’s layer-2 solutions. The coming years will be critical in determining whether Solana can evolve beyond its current ‘one-trick pony’ status and establish itself as a major player in the blockchain landscape.