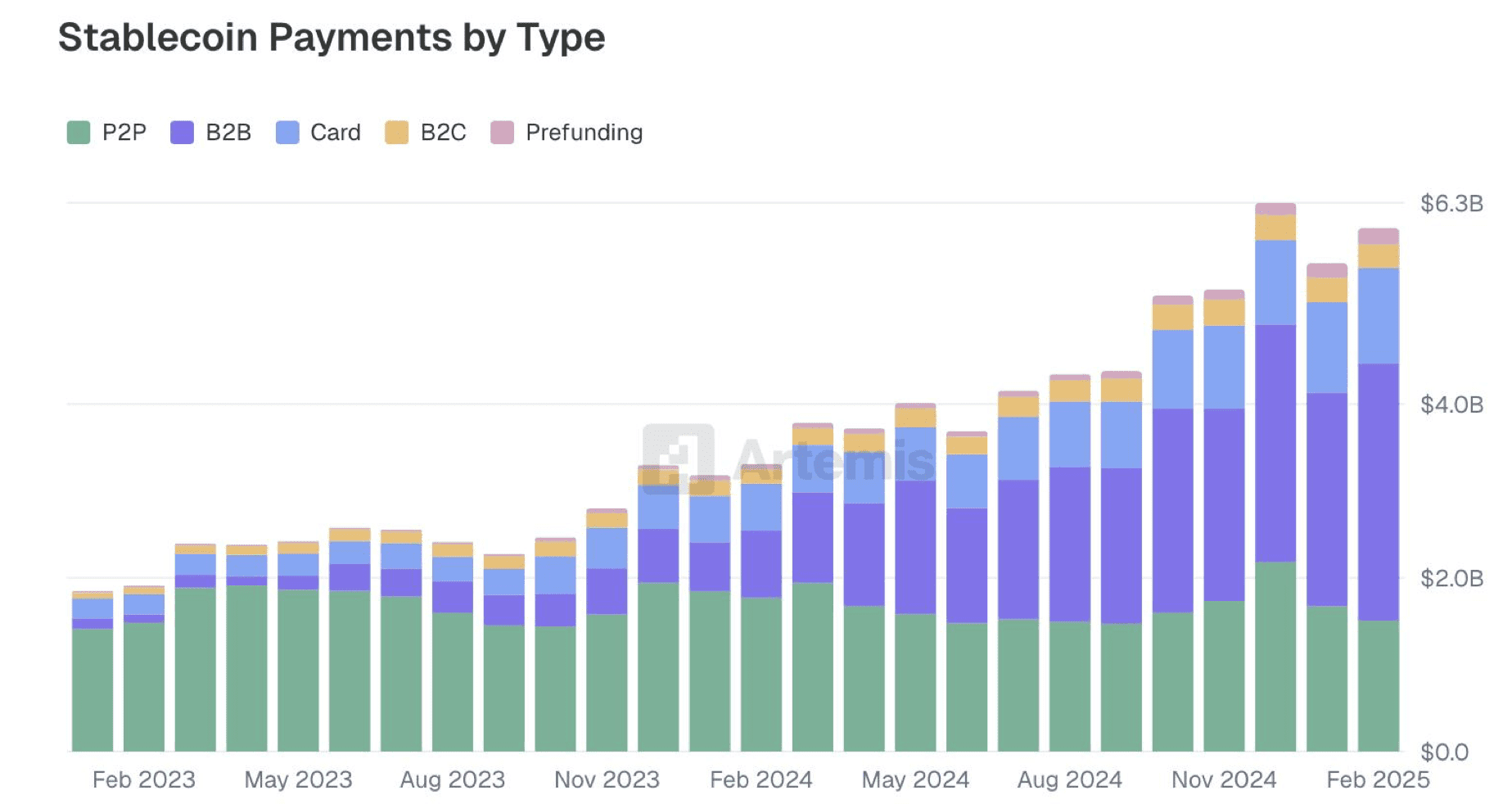

Stablecoins are gaining ground as a reliable tool for digital payments. New data from Artemis shows that $94.2 billion in stablecoin transactions were settled between January 2023 and February 2025.

The report shed light on a few specific rising areas for stablecoin payments. Business-to-business transactions made up the largest block, accounting for an annual run rate of $36 billion. Card-linked stablecoin payments have also grown, jumping above $13.2 billion in annual volume.

“Overall, stablecoins have established themselves as growing and significant components of the global payment infrastructure,” the report notes.

Crypto users preferred Tether’s USDt (USDT) for payments over any other stablecoin, with Circle’s USDC (USDC) coming in a distant, but established second position.

Of the blockchains used for stablecoin payments, Tron and Ethereum ranked first and second respectively, with Binance Smart Chain coming in third. Tron and Ethereum are also notable in that the average business-to-business (B2B) transaction sizes for both chains exceeded $219,000. B2B transaction sizes on other blockchains were much smaller.

Stablecoins attract attention of governments, banks

According to DefiLlama, the stablecoin market cap reached $247.3 billion on May 29, a growth of 54.5% in the past 12 months. The usefulness of stablecoins for cross-border payments, remittances and commerce has attracted more than just crypto enthusiasts; governments and banks have taken notice as well.

In the United States, lawmakers are trying to pass legislation that would regulate these assets, hoping to establish dollar dominance in the digital economy. The United Arab Emirates and European Union have already done so, permitting certain stablecoin issuers to operate in these areas.

According to a Wall Street Journal report, big banks in the US are in early talks about the possibility of launching a joint crypto stablecoin. Companies have gotten into the game as well. On May 7, payments platform Stripe introduced stablecoin accounts to users in over 100 countries.

Demand for a variety of this crypto asset could grow as well. At Token2049, Fireblocks policy chief Dea Markova told Cointelegraph that governments outside the US are growing increasingly interested in non-dollar-backed stablecoins.

Quick Summary of the News:

- $94.2 Billion Settled: Stablecoin transactions reached $94.2 billion between January 2023 and February 2025.

- B2B Dominance: Business-to-business transactions account for the largest share, with an annual run rate of $36 billion.

- Card-Linked Growth: Card-linked stablecoin payments have exceeded $13.2 billion annually.

- USDT Leads: Tether’s USDT is the preferred stablecoin for payments, followed by Circle’s USDC.

- Tron & Ethereum Top Chains: Tron and Ethereum lead in blockchain usage for stablecoin payments, with high average B2B transaction sizes.

Why It Matters:

The surge in stablecoin payment volume signifies a growing acceptance of cryptocurrencies in mainstream finance, especially for practical use cases like B2B transactions and everyday payments. This trend highlights stablecoins’ potential to disrupt traditional payment systems by offering faster, cheaper, and more efficient alternatives. The increasing interest from governments and banks further validates stablecoins as a legitimate asset class, paving the way for wider adoption and integration into the global economy.

Market Impact:

The increasing market cap of stablecoins and their rising transaction volumes suggest a potential shift in how businesses and individuals handle payments. The dominance of USDT and USDC indicates strong brand recognition and trust, but also highlights the need for regulatory clarity to foster fair competition and innovation.

Expert Take or Personal Insight:

The rise of stablecoin payments, especially in the B2B sector, is a strong indicator of the practical utility of cryptocurrencies beyond speculation. While USDT currently leads the pack, the growing interest in non-dollar-backed stablecoins suggests a diversification trend that could challenge the current dominance. Regulatory developments in the US, EU, and UAE will significantly shape the future landscape of stablecoin usage and adoption.

Actionable Insight:

For traders and investors, keeping a close watch on regulatory developments surrounding stablecoins is crucial. The introduction of new regulations could impact the market share and usability of different stablecoins. Additionally, monitoring the adoption rates of card-linked stablecoin payments and B2B transaction volumes can provide valuable insights into the long-term growth potential of this sector. Consider diversifying stablecoin holdings to include non-dollar-backed options, especially as governments explore alternatives to USD-dominated stablecoins.

Conclusion:

The future of stablecoins looks promising, with increasing adoption for payments and growing interest from both traditional financial institutions and governments. As the regulatory landscape evolves and new use cases emerge, stablecoins are poised to play a significant role in the global financial system, offering a bridge between traditional finance and the digital economy.