Despite recent price consolidation for Bitcoin (BTC), emerging digital asset legislation may provide the next significant catalyst for the world’s first cryptocurrency.

Upcoming stablecoin rules, such as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, may lay the foundation for a Bitcoin cycle top of over $150,000, according to Alice Li, investment partner and head of US at crypto venture capital firm Foresight Ventures.

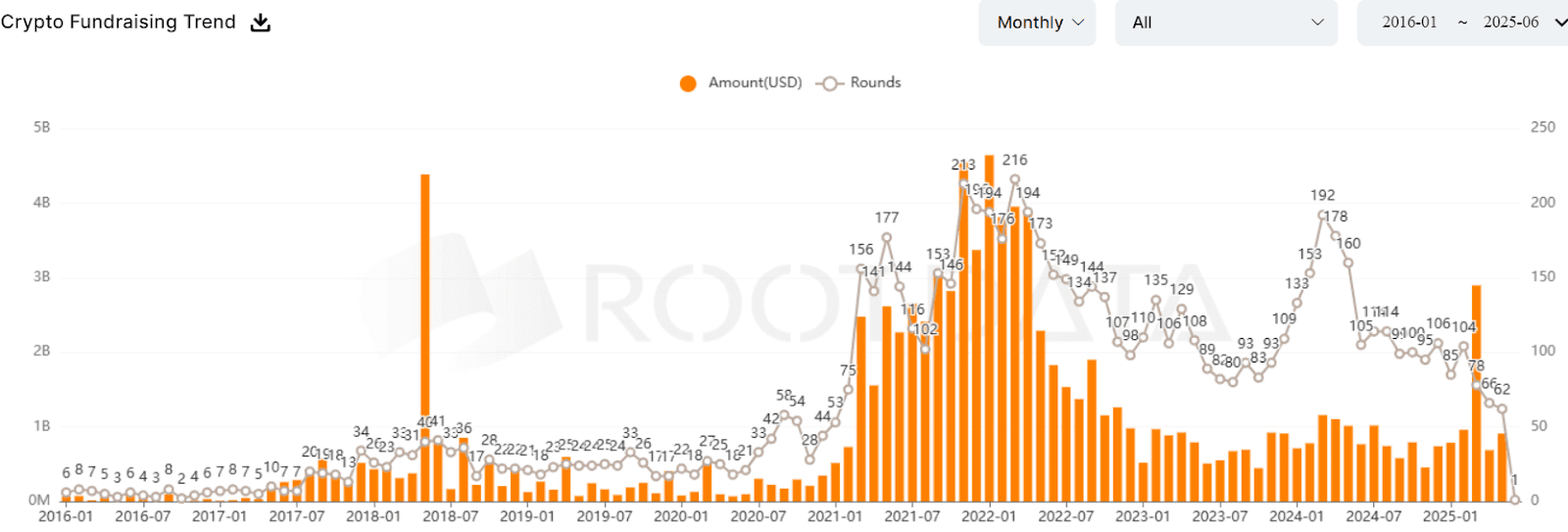

Meanwhile, venture capitalist (VC) interest has slumped. The number of VC deals closed recorded its lowest month of the year in May, with just 62 investment rounds resulting in $909 million raised.

A challenging “macro backdrop” paired with “higher-for-longer policy rates, jittery bond markets and fresh tariff headlines have made it harder for risk assets to get new M&A deals over the finish line,” Patrick Heusser, head of lending at Sentora and a former investment banker, told Cointelegraph.

Bitcoin reserve, stablecoin regulations big 2025 market catalysts, says VC

Improving regulatory clarity in the United States may push Bitcoin past $150,000 during the current market cycle, according to Alice Li, investment partner and head of US at crypto venture capital firm Foresight Ventures.

During Cointelegraph’s Chain Reaction X Spaces show on June 3, Li said the crypto market’s 2025 rally had been driven mainly by shifting US policy.

“One of the strongest drivers is definitely the policy change,” she said, referencing US President Donald Trump’s Bitcoin reserve approval and stablecoin policy developments as the main catalysts for Bitcoin price upside in 2025.

“Stablecoin will be one of the strongest places that I would invest long term,” she added, citing regulatory progress in the US.

Li’s comments came as the industry was awaiting a full Senate vote on the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to set clear rules for stablecoin collateralization and mandate compliance with Anti-Money Laundering laws.

Why It Matters

- Regulatory Clarity: The GENIUS Act aims to establish clear rules for stablecoin collateralization and compliance, reducing uncertainty in the market.

- Institutional Adoption: Clear regulations can encourage institutional investors to enter the crypto market, increasing capital inflow.

- Market Confidence: Defined rules can boost investor confidence, leading to increased trading activity and higher valuations for cryptocurrencies like Bitcoin.

Market Impact

The potential approval of the GENIUS Act could lead to a significant increase in stablecoin adoption and usage. This, in turn, could positively influence Bitcoin’s price due to increased on-ramps and overall market confidence.

| Factor | Current Status | Potential Impact with GENIUS Act |

|---|---|---|

| Stablecoin Market Cap | Relatively Stable | Significant Increase |

| Institutional Investment | Limited | Potential Surge |

| Bitcoin Price | Consolidating | Potential Breakout Above $150K |

Expert Take

Alice Li’s prediction of Bitcoin reaching $150,000+ hinges on the assumption that the GENIUS Act will pass and be effectively implemented. While regulatory progress is undoubtedly positive, it’s crucial to remember that the crypto market is also influenced by macroeconomic factors and unforeseen events. I believe this target is optimistic, but not unrealistic, provided the broader financial landscape remains supportive.

Actionable Insight

Traders and investors should closely monitor the progress of the GENIUS Act. Any positive developments, such as the bill passing through the Senate, could be a signal to increase Bitcoin holdings. Additionally, keep an eye on stablecoin market capitalization and institutional interest as indicators of the regulation’s impact.

Conclusion

The potential passage of the GENIUS Act represents a pivotal moment for the crypto industry. While its ultimate impact remains to be seen, the prospect of clearer stablecoin regulations could provide the catalyst needed to propel Bitcoin to new heights in 2025. This makes it a crucial development for all crypto enthusiasts to watch.