Strategy Boosts Bitcoin Holdings with 4,020 BTC Purchase as Price Briefly Exceeds $110K

Strategy, led by Michael Saylor, has further solidified its position as a major corporate Bitcoin investor by acquiring 4,020 Bitcoin (BTC) for $427.1 million between May 19 and 23. This purchase occurred as Bitcoin’s price briefly surged above $110,000, showcasing the company’s continued bullish stance on the cryptocurrency.

The average purchase price was $106,237 per coin. This acquisition brings Strategy’s total Bitcoin holdings to an impressive 580,250 BTC, acquired for approximately $40.61 billion at an average price of $69,979 per coin.

Key Takeaways:

- Significant Investment: Strategy invested $427.1 million in 4,020 BTC.

- Rising Prices: The purchase occurred when Bitcoin briefly exceeded $110,000.

- Total Holdings: Strategy now holds 580,250 BTC.

- Average Cost: The average cost per Bitcoin is $69,979.

Strategy Director Sells Shares

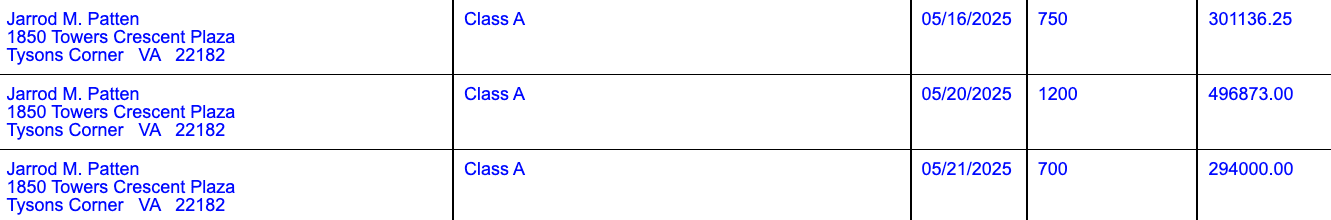

Interestingly, amidst these large Bitcoin purchases, Strategy director Jarrod Patten sold 2,650 MSTR shares between May 16 and 21, worth nearly $1.1 million. Since April 22, Patten has sold a total of 17,050 Class A shares, totaling $6.7 million. This activity has raised some eyebrows in the investment community.

CFO Share Sales

Adding to the mix, Strategy’s chief financial officer, Andrew Kang, sold 2,185 Class A shares on May 23, netting $719,447.

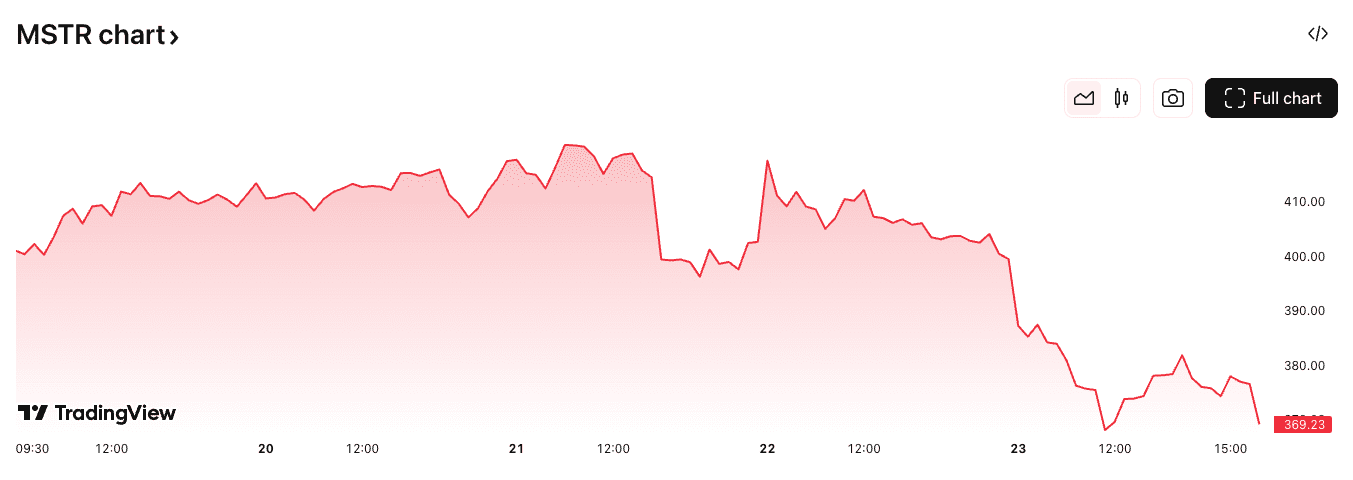

Stock Performance and Lawsuit

Despite the continued Bitcoin accumulation, Strategy’s shares (MSTR) have faced some turbulence. The stock experienced a decline of around 12% recently, falling from approximately $420 to $369. This downturn coincides with a class-action lawsuit filed against the company on May 19. The lawsuit alleges that Strategy misrepresented its Bitcoin investments and seeks to recover losses for shareholders affected by alleged securities fraud in April 2025.

Despite the recent volatility and legal challenges, Michael Saylor has publicly stated his commitment to continuing Bitcoin purchases, regardless of price fluctuations. This unwavering conviction underscores Strategy’s long-term investment strategy in the cryptocurrency.

Broader Context: Strategy’s Bitcoin Strategy

Strategy’s approach to Bitcoin investment has been a topic of considerable debate and analysis. The company’s strategy has been viewed by some as visionary, as they are leading the charge into Bitcoin adoption, while others have concerns about the risk associated with such a concentrated bet on a volatile asset.

Factors driving Strategy’s Bitcoin strategy:

- Inflation Hedge: Bitcoin is seen as a hedge against inflation, preserving value over time.

- Store of Value: Bitcoin is viewed as a digital store of value, similar to gold.

- Potential for Growth: Strategy believes in Bitcoin’s long-term growth potential.

Potential risks of Strategy’s Bitcoin strategy:

- Volatility: Bitcoin’s price is highly volatile, leading to potential losses.

- Regulation: Changes in regulations could negatively impact Bitcoin.

- Competition: Other cryptocurrencies could emerge as competitors to Bitcoin.

Ultimately, Strategy’s Bitcoin strategy reflects a high-conviction bet on the future of cryptocurrency and its potential to reshape the global financial landscape. As Strategy continues to accumulate Bitcoin, the company’s actions will be closely watched by investors and analysts alike.

The highest historic closing price on record for MSTR stock was around $474, recorded on Nov. 19, 2024.

The recent drop in Strategy shares came after the company was hit with a class-action lawsuit alleging that the company had misrepresented Bitcoin investments. Filed on May 19, the suit seeks to recover losses of shareholders who were adversely affected by alleged securities fraud in April 2025.