Stripe, a leading global payments platform, has launched stablecoin-based accounts for its clients in over 100 countries. This initiative aims to provide access to dollar-pegged stablecoins like USDC and USDB, mirroring the functionality of traditional fiat bank accounts.

This new feature enables users to send, receive, and hold balances in US dollar stablecoins, offering a streamlined approach to managing digital assets. The move addresses the growing demand for stablecoins in regions facing high inflation, capital controls, and limited financial infrastructure.

Key Features and Benefits

- Global Accessibility: Available in over 100 countries, including Argentina, Chile, Turkey, Colombia, and Peru.

- Supported Stablecoins: Initially supports Circle’s USDC and Bridge’s USDB stablecoins.

- Functionality: Allows users to send, receive, and hold stablecoin balances, similar to traditional bank accounts.

- Addressing Financial Needs: Targets regions with high inflation and limited financial infrastructure, providing a stable store of value.

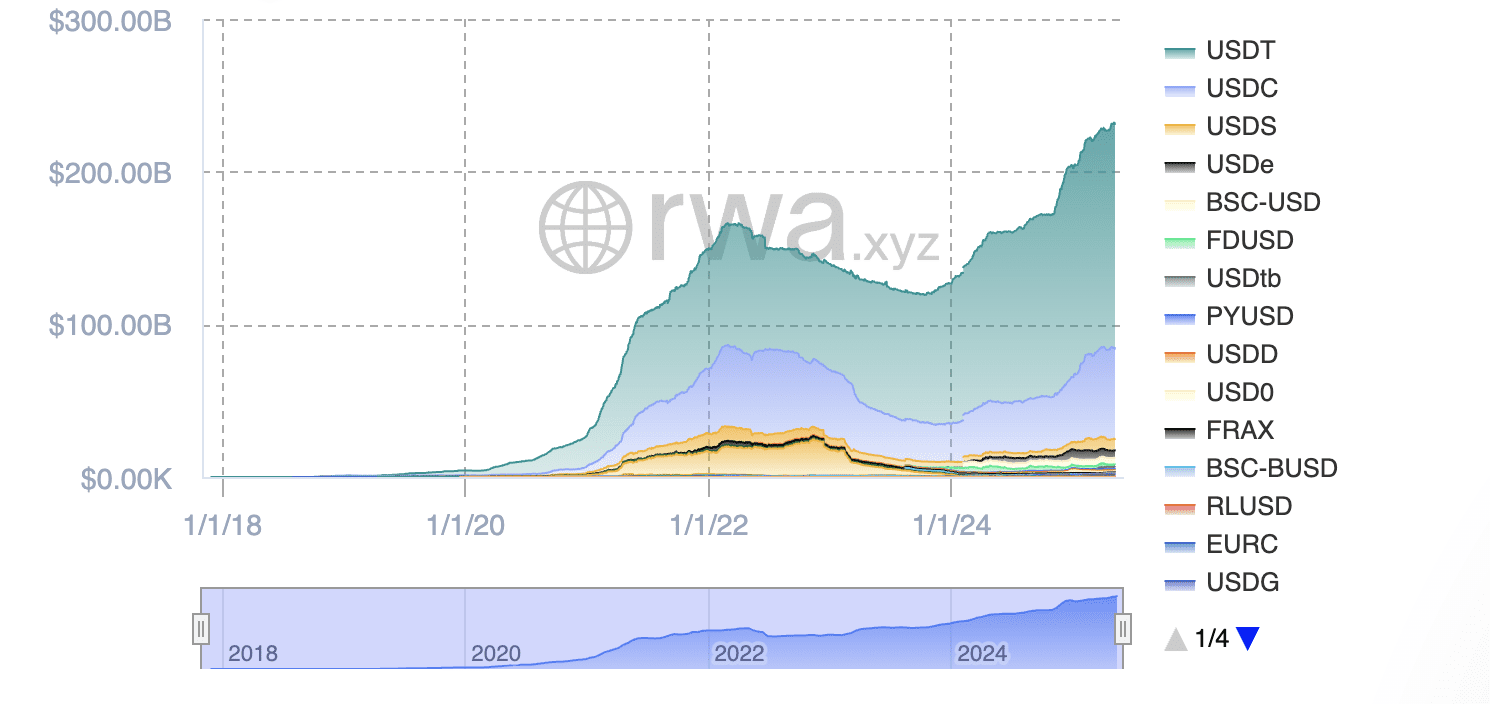

The stablecoin market cap has crossed $231 billion and continues to grow due to international demand for US dollar tokens.

Why Stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value relative to a reference asset, such as the US dollar. This stability makes them ideal for:

- Cross-border transactions: Facilitating faster and cheaper international payments.

- Store of value: Providing a hedge against inflation in countries with volatile currencies.

- Access to financial services: Enabling individuals without traditional banking access to participate in the global economy.

Stripe’s Strategic Move

Stripe’s expansion into stablecoins is a strategic move to cater to the evolving needs of its global clientele. By offering stablecoin-based accounts, Stripe aims to:

- Enhance payment solutions: Provide more versatile and efficient payment options.

- Tap into emerging markets: Address the growing demand for stablecoins in developing economies.

- Promote financial inclusion: Enable broader access to financial services for individuals and businesses.

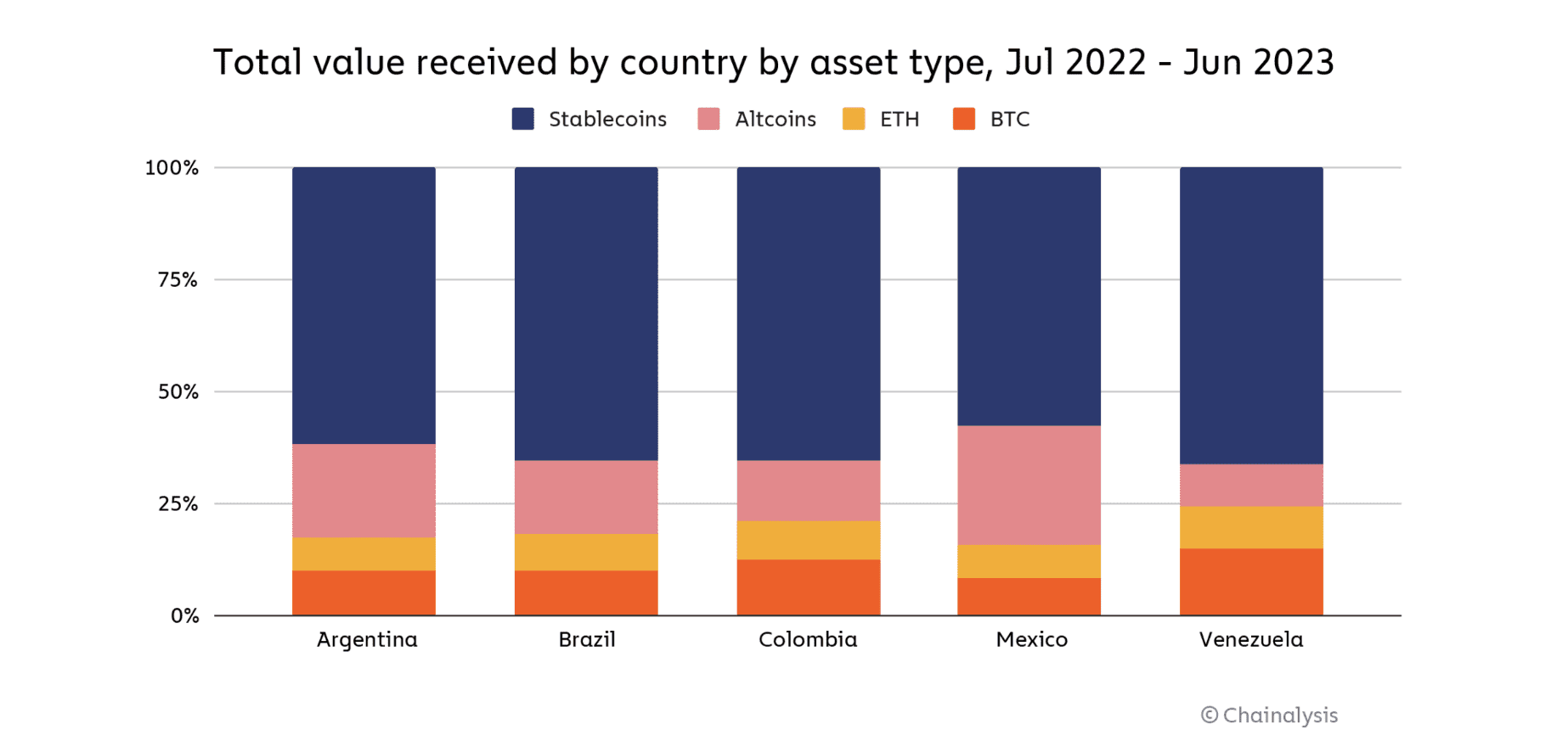

Stablecoins dominate crypto transactions in South America.

Stablecoins as a Solution for the Unbanked

In many developing regions, traditional banking infrastructure is limited, leaving a significant portion of the population unbanked. Stablecoins offer a viable alternative by providing:

- Access to digital wallets: Enabling users to store and manage their funds using smartphones.

- Lower transaction fees: Reducing the costs associated with cross-border payments.

- Financial autonomy: Empowering individuals to control their finances without relying on traditional institutions.

By integrating stablecoins, Stripe is playing a crucial role in promoting financial inclusion and empowering individuals in underserved regions.

The Future of Stablecoins and Global Payments

As the adoption of stablecoins continues to grow, they are poised to transform the landscape of global payments. Stripe’s initiative reflects a broader trend towards leveraging digital assets to create a more inclusive and efficient financial system.

With increased regulatory clarity and technological advancements, stablecoins have the potential to:

- Revolutionize cross-border payments: Making international transactions faster, cheaper, and more accessible.

- Drive financial innovation: Enabling new business models and financial products.

- Empower individuals: Providing greater control over their financial lives.

Stripe’s commitment to stablecoins positions it as a key player in shaping the future of global payments and fostering financial inclusion worldwide.