Strive Aims for 75,000 Bitcoin from Mt. Gox Claims to Bolster Bitcoin Treasury

Strive, led by Vivek Ramaswamy, is strategically positioning itself to become a major player in the Bitcoin space. The company plans to acquire discounted Bitcoin claims, starting with a significant portion tied to the infamous Mt. Gox bankruptcy. This initiative aims to amass a substantial Bitcoin treasury.

In a May 20 regulatory filing, Strive disclosed its partnership with 117 Castell Advisory Group LLC. Their objective is to secure claims to Bitcoin (BTC) that have already received legal validation but are awaiting distribution from the Mt. Gox proceedings.

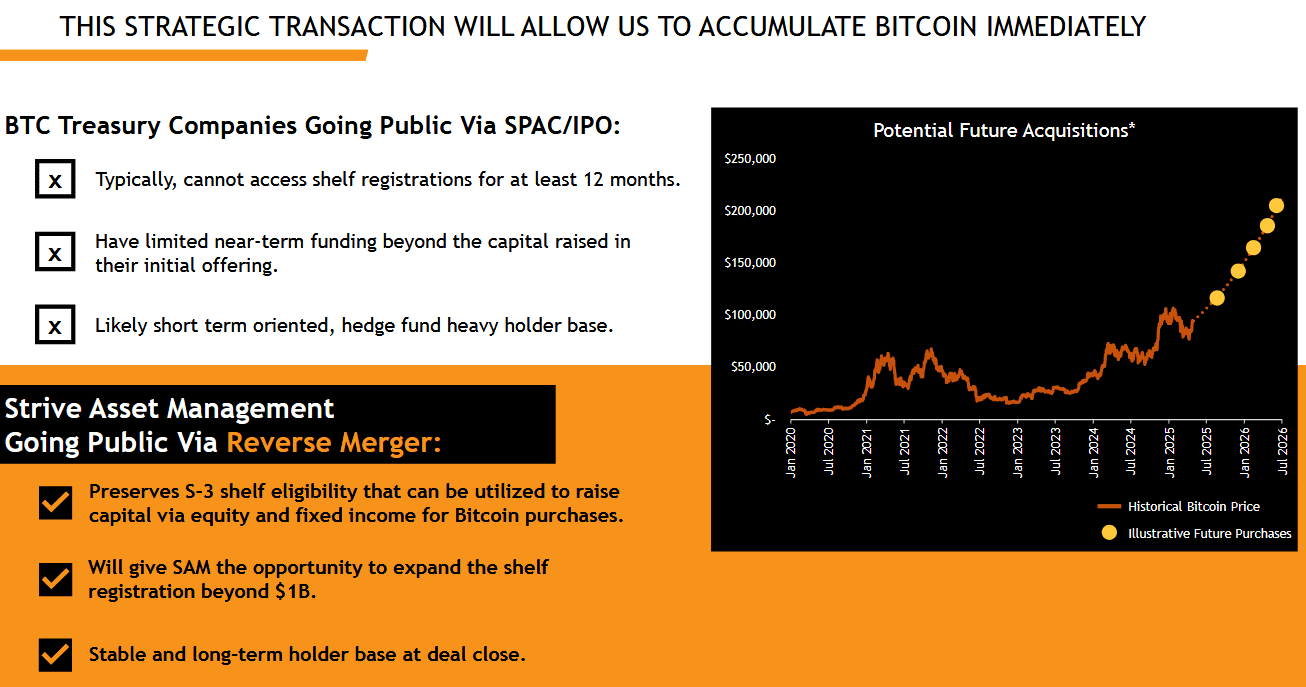

The rationale behind this move is to procure Bitcoin at a reduced cost, thereby enhancing Strive’s Bitcoin per share ratio. This is particularly important as Strive prepares for its planned reverse merger with Asset Entities, a deal anticipated to finalize mid-year. The resulting entity is poised to become a formidable Bitcoin investment firm.

While Strive has not yet revealed its existing Bitcoin holdings, the company asserts that it will encounter fewer regulatory hurdles in purchasing Bitcoin compared to firms pursuing public listing through Special Purpose Acquisition Company (SPAC) mergers.

The Mt. Gox Opportunity

Strive’s pursuit of Mt. Gox claims necessitates shareholder approval. The company intends to file with the Securities and Exchange Commission (SEC), providing a comprehensive overview of the proposed transaction. Subsequently, a proxy statement will be disseminated to shareholders, seeking their endorsement.

Timeliness is crucial in this endeavor, as Mt. Gox is slated to fully compensate its creditors by October 31. The Japan-based exchange was once the dominant force in the Bitcoin market before its collapse in 2014, triggered by a devastating security breach that resulted in the theft of approximately 750,000 Bitcoin.

A Growing Trend: Bitcoin as a Treasury Asset

Strive’s strategic shift towards becoming a Bitcoin treasury company mirrors a broader industry trend. Increasingly, businesses are recognizing the potential of holding Bitcoin on their balance sheets as a long-term strategic asset. This trend is fueled by Bitcoin’s potential as a store of value, a hedge against inflation, and a diversifying asset.

Other Players in the Bitcoin Treasury Space

Strive is not alone in its pursuit of building a Bitcoin treasury. Other companies are also entering this space, including:

- Twenty One Capital: A newly established Bitcoin treasury firm backed by notable entities such as Tether, SoftBank, and Cantor Fitzgerald.

Asset Entities’ Stock Surge

Asset Entities (ASST), the social media marketing firm slated to merge with Strive, has witnessed a significant surge in its stock price. On May 20, shares closed up by 18.2% at $7.74. This surge brings the company’s market capitalization to $122.1 million, representing a staggering 1,170% increase since the announcement of the merger plan.

Upon completion of the reverse merger, Strive is projected to own 94.2% of the combined entity, with Asset Entities retaining the remaining 5.8%. The merged entity will operate under the name Strive and Asset Entities, continuing to trade under the ASST ticker symbol.

Key Takeaways:

- Strategic Acquisition: Strive is aiming to acquire 75,000 Bitcoin from Mt. Gox claims at a discounted rate.

- Reverse Merger: This acquisition is part of a larger strategy leading to a reverse merger with Asset Entities.

- Bitcoin Treasury: Strive aims to establish a significant Bitcoin treasury, reflecting a growing trend among corporations.

- Shareholder Approval: The Mt. Gox claims acquisition requires shareholder approval and SEC filings.

- Market Impact: The merger announcement has already significantly impacted Asset Entities’ stock price.

Factors Driving the Bitcoin Treasury Trend:

- Diversification: Bitcoin provides diversification beyond traditional assets.

- Inflation Hedge: Bitcoin is seen by some as a hedge against inflation due to its limited supply.

- Potential Upside: The long-term potential of Bitcoin adoption drives interest in holding it as a treasury asset.

- Decentralization: The decentralized nature of Bitcoin offers advantages over centralized financial systems.

Risks and Considerations:

- Volatility: Bitcoin’s price volatility presents a risk to treasury holdings.

- Regulatory Uncertainty: Evolving regulations surrounding Bitcoin could impact its viability as a treasury asset.

- Security: Secure storage of Bitcoin is crucial to prevent loss or theft.

- Market Sentiment: Negative market sentiment can significantly impact the value of Bitcoin holdings.

In conclusion, Strive’s strategic move to acquire Mt. Gox Bitcoin claims underscores the increasing importance of Bitcoin as a treasury asset and signals a potential shift in corporate finance strategies. However, companies must carefully weigh the risks and benefits before committing to holding Bitcoin on their balance sheets.