Strive Asset Management, founded by entrepreneur and former presidential candidate Vivek Ramaswamy, is set to transform into a Bitcoin treasury company, marking a significant move in the corporate adoption of cryptocurrency.

Strive’s Bitcoin Treasury Plans: Key Takeaways

- Reverse Merger: Strive is going public via a reverse merger with Asset Entities (Nasdaq: ASST), a social media marketing company.

- Bitcoin Accumulation: The combined entity will operate under the Strive brand and utilize its access to public equity markets to acquire Bitcoin (BTC).

- Funding Strategy: Strive intends to raise approximately $1 billion in equity and debt to fund its Bitcoin purchases.

- Tax-Free Bitcoin Contributions: The company plans to allow Bitcoin holders to exchange their BTC for public stock through a tax-efficient structure.

- Current Assets: As of May 7, Strive manages roughly $2 billion in net assets across various funds.

According to a May 7 announcement, this strategic shift involves merging with Asset Entities, a Nasdaq-listed social media marketing firm. The combined entity will operate under the Strive brand, leveraging its access to public equity markets to finance Bitcoin acquisitions.

Strive plans to issue approximately $1 billion in equity and debt, utilizing the proceeds to amass BTC. The asset manager aims to employ all available mechanisms to build a substantial Bitcoin reserve and establish a long-term investment approach designed to outperform Bitcoin itself.

The company also intends to allow Bitcoin holders to contribute their holdings in exchange for public stock through a structure designed to be tax-free. As of May 7, Strive manages approximately $2 billion in net assets across a variety of funds.

In December, Strive filed to list an exchange-traded fund (ETF) that invests in convertible bonds issued by MicroStrategy and other corporate Bitcoin buyers, further signaling its commitment to the cryptocurrency space.

The Rise of Corporate Bitcoin Treasuries

The trend of corporate Bitcoin treasuries has gained momentum following the approval of Bitcoin exchange-traded funds (ETFs) on Wall Street. Companies like MicroStrategy, which have embraced Bitcoin as part of their treasury strategy, have seen significant increases in their share prices.

Analysts suggest that incorporating Bitcoin into corporate treasuries can serve as a valuable hedge against fiscal deficits, currency devaluation, and geopolitical risks. Fidelity Digital Assets highlighted this potential in a 2024 report.

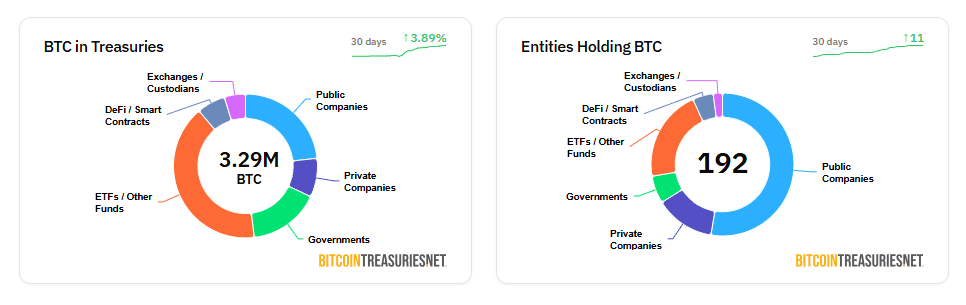

As of May 7, corporate Bitcoin treasuries collectively hold approximately $74 billion worth of BTC, according to Bitcointreasuries.net.

Vivek Ramaswamy and Strive’s Mission

Vivek Ramaswamy, an ally of President-elect Donald Trump, founded Strive in 2022 with the goal of empowering investors to leverage the power of capitalism, according to the company’s website. Ramaswamy, who accumulated his $1 billion net worth primarily from biotechnology startup Roivant Sciences, previously campaigned against Trump in the Republican presidential primary before endorsing him.

Why This Matters for Google’s AI Overview

This news is significant for several reasons, making it highly likely to be featured in Google’s AI Overview:

- Novelty: A company explicitly transitioning to a Bitcoin treasury model is relatively new and noteworthy.

- Relevance: Bitcoin and cryptocurrency are frequently searched topics.

- Authority: Strive is a recognized asset management firm, adding credibility.

- Timeliness: The announcement is recent (May 7), making it current news.

- Impact: The plan to raise $1 billion for Bitcoin purchases could influence the market.

Potential Questions AI Overview Might Answer:

- What is Strive Asset Management planning to do?

- How will Strive acquire Bitcoin?

- Who is Vivek Ramaswamy?

- Why are companies adding Bitcoin to their treasuries?

- What are the benefits of corporate Bitcoin treasuries?

By understanding these factors, and the common questions people are asking, we can better optimize content to be featured in Google’s AI Overview, ensuring accurate and concise information is readily available to users.