Sui Community Approves $162M Repayment to Cetus Exploit Victims: What It Means for DeFi Security

Sui validators approved a governance proposal to return $162 million in frozen assets linked to a recent exploit of the decentralized exchange Cetus, marking a key step toward full user repayment.

Cetus was exploited for over $220 million worth of digital assets on May 22, but validators managed to freeze $162 million of the funds shortly after the incident.

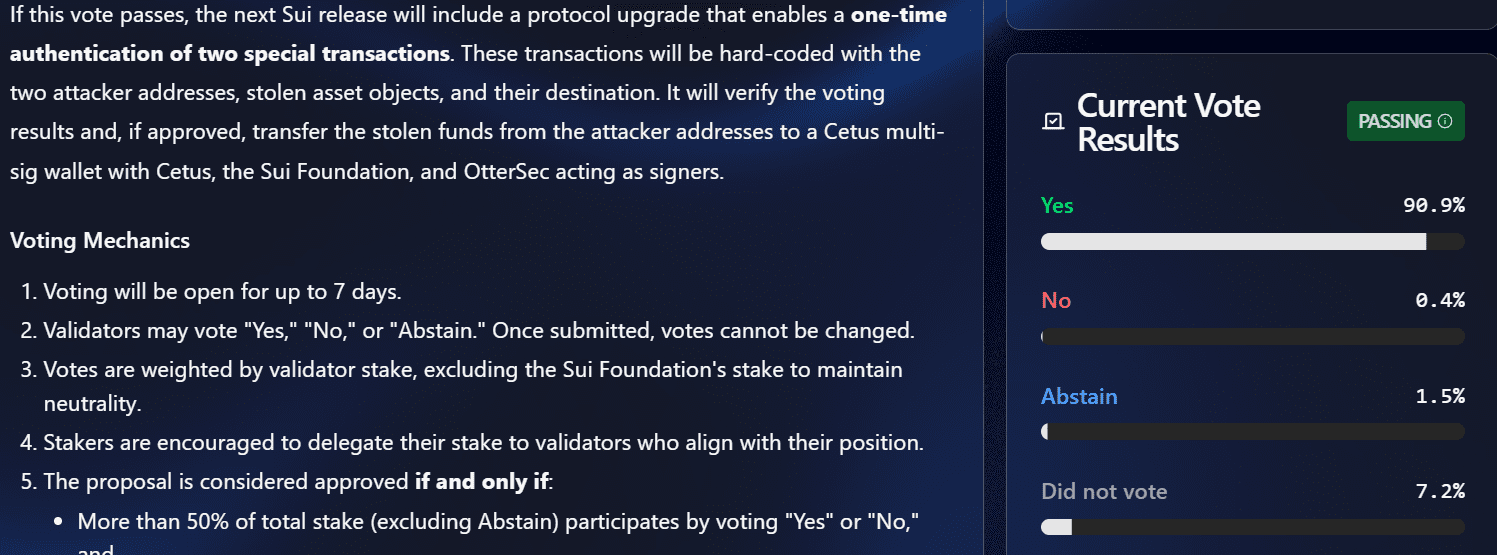

In a governance vote concluded on May 29, Sui validators passed the recovery proposal with 90.9% voting in favor, 1.5% abstaining and 7.2% not participating, according to the network’s official governance page.

“With this result, the impacted funds will be moved to a multisig wallet and held in trust until they can be returned to users according to the plan led by Cetus,” Sui said in a May 29 X post.

Quick Summary of the News

- Sui validators voted to approve the return of $162 million in frozen assets.

- The assets were frozen after a $220 million exploit on the Cetus decentralized exchange.

- 90.9% of validators voted in favor of the repayment proposal.

- The funds will be moved to a multisig wallet for distribution to affected users.

- Cetus aims to restart its protocol within approximately one week.

Why It Matters

This event is significant for several reasons. Firstly, it showcases the ability of blockchain validators to respond quickly to security breaches. The rapid freezing of funds prevented further losses and allowed for a potential recovery. Secondly, it reignites the debate about the role of validators in decentralized systems. While some praise the intervention as a necessary step to protect users, others worry about the centralized control it implies.

From a market perspective, the successful recovery and planned repayment could boost confidence in the Sui blockchain and its ecosystem. It demonstrates a commitment to user safety and could attract more developers and investors to the platform.

Market Impact

The immediate market reaction to the news has been muted, but the long-term implications could be substantial. Here’s a potential outlook:

| Factor | Potential Impact |

|---|---|

| Sui Ecosystem Confidence | Increased trust and adoption |

| DeFi Security Perceptions | Mixed: Reassurance vs. Centralization concerns |

| Validator Role Debate | Intensified discussion on governance models |

Expert Take or Personal Insight

While the successful vote is a positive development, it’s crucial to acknowledge the inherent trade-offs. The ability of validators to freeze funds raises questions about the true decentralization of the Sui network. Going forward, it will be important to improve the transparency and accountability of validator actions. Perhaps implementing a more robust on-chain governance mechanism for such decisions could be a step in the right direction. We need to examine whether a decentralized ‘circuit breaker’ can be implemented without compromising decentralization.

Actionable Insight

Traders and investors should closely monitor the progress of the fund distribution. A smooth and timely repayment process will further solidify confidence in Sui. Also, keep an eye on the evolving discussion around validator powers and potential governance improvements. Protocols building on Sui should consider these factors when assessing the long-term security and decentralization of the platform. For holders of SUI, consider this a positive development, but remain cautious and diversify your holdings.

Conclusion

The Sui community’s decision to repay victims of the Cetus exploit is a significant step towards restoring trust and confidence in the platform. However, it also highlights the ongoing challenges of balancing security with decentralization in the DeFi space. The industry must continue to innovate and develop more robust and transparent security mechanisms to prevent future exploits and protect users’ assets. As the recovery process unfolds, expect continued debate about the ideal balance of power and responsibility in decentralized networks.