Sui’s $162M Cetus Fund Freeze: A Win for Security or a Blow to Decentralization?

A $200 million-plus exploit targeting Cetus, a decentralized exchange on the Sui network, has reignited debate over decentralization in blockchain protocols after Sui validators collectively froze $162 million of the stolen funds.

Some decentralization advocates called foul, criticizing Sui validators’ ability to pause fund transfers on the blockchain as a sign of centralization. Other investors applauded the rapid response and coordination against the attackers.

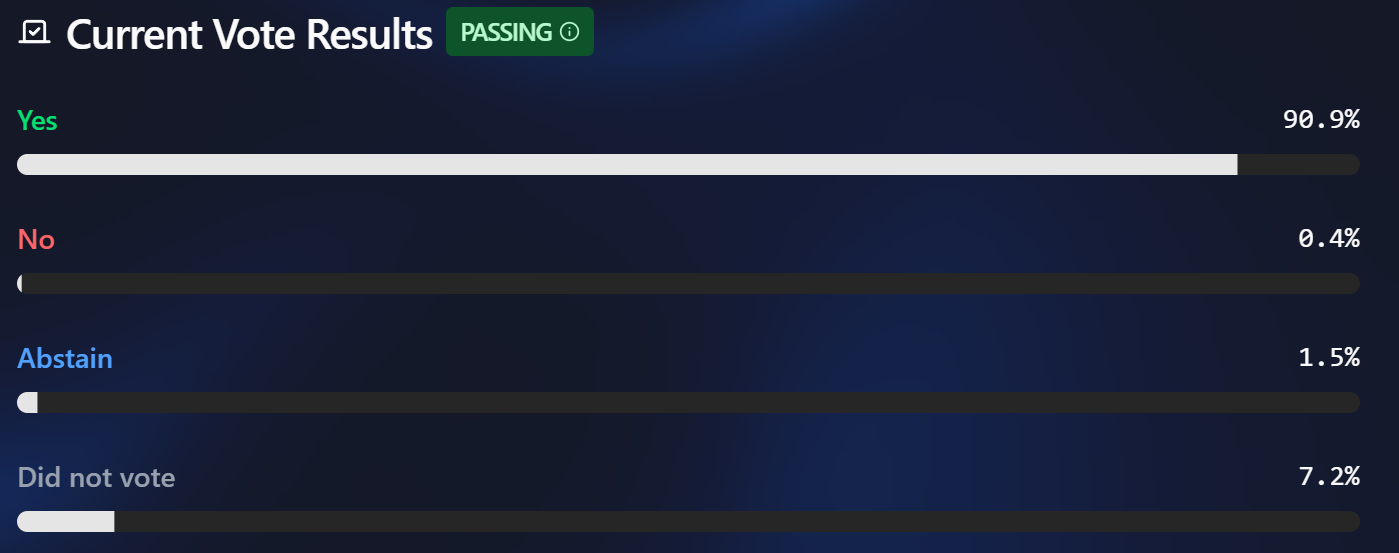

Industry watchers are now waiting for Cetus to initiate its recovery roadmap after the Sui governance vote for returning the frozen $162 million was passed on May 29.

Quick Summary of the News:

- Cetus, a DEX on the Sui network, was exploited for over $200 million.

- Sui validators quickly froze $162 million of the stolen funds.

- A governance proposal to return the frozen funds to users was passed with 90.9% approval.

- The frozen funds will be moved to a multisig wallet for distribution led by Cetus.

- The event sparked debate regarding decentralization and validator power.

Why It Matters: Security vs. Decentralization

This event highlights a central tension within the crypto space: the tradeoff between security and decentralization. While the quick action by Sui validators prevented further loss of funds, it also raises questions about the true decentralization of the network. The ability of validators to unilaterally freeze transactions challenges the core principle of immutability that many associate with blockchain technology. This incident could influence how other blockchains handle future exploits and could lead to further discussions about governance models and emergency response mechanisms.

Market Impact:

While the immediate impact on the price of SUI was minimal, the long-term effects on investor confidence and the perception of Sui as a truly decentralized platform remain to be seen.

Consider this comparison:

| Blockchain | Governance Model | Response to Exploit | Decentralization Perception |

|---|---|---|---|

| Sui | Validator-based Governance | Funds Frozen by Validators | Questioned |

| Ethereum | Community-based Governance | Hard Forks (in the past) | Generally High |

This table illustrates how different governance models can lead to varied responses to exploits, ultimately affecting the perceived level of decentralization.

Expert Take or Personal Insight:

The Sui-Cetus situation is a crucial test case for the industry. While the validators’ actions were arguably in the best interest of the users in the short term, the ease with which they were able to freeze funds sets a precedent. It opens the door to potential future interventions that might not be as universally beneficial. I believe that clear, pre-defined rules for emergency interventions, voted on by the community, are essential for maintaining trust and upholding the principles of decentralization.

Actionable Insight:

- For Traders: Monitor SUI’s price action and trading volume in the coming weeks. Increased volatility may indicate uncertainty among investors.

- For Investors: Evaluate the decentralization risks of platforms you invest in. Consider the power validators or core teams hold and how that power could be used.

- For Developers: This event highlights the importance of robust smart contract audits and security measures. Design systems that minimize the impact of potential exploits and consider decentralized recovery mechanisms.

Conclusion:

The Sui-Cetus incident serves as a reminder that the pursuit of security in the crypto space should not come at the expense of decentralization. Moving forward, expect increased scrutiny on blockchain governance models and a greater emphasis on finding the right balance between protecting users and preserving the core tenets of a decentralized future.