Sui’s $162M Cetus Funds Vote: A Win for Security, a Blow to Decentralization?

A $200 million-plus exploit targeting Cetus, a decentralized exchange on the Sui network, has reignited debate over decentralization in blockchain protocols after Sui validators collectively froze $162 million of the stolen funds.

Some decentralization advocates called foul, criticizing Sui validators’ ability to pause fund transfers on the blockchain as a sign of centralization. Other investors applauded the rapid response and coordination against the attackers.

Industry watchers are now waiting for Cetus to initiate its recovery roadmap after the Sui governance vote for returning the frozen $162 million was passed on May 29.

Sui community passes vote to repay $162 million to Cetus exploit victims

Sui validators approved a governance proposal to return $162 million in frozen assets linked to a recent exploit of the decentralized exchange Cetus, marking a key step toward full user repayment.

Cetus was exploited for over $220 million worth of digital assets on May 22, but validators managed to freeze $162 million of the funds shortly after the incident.

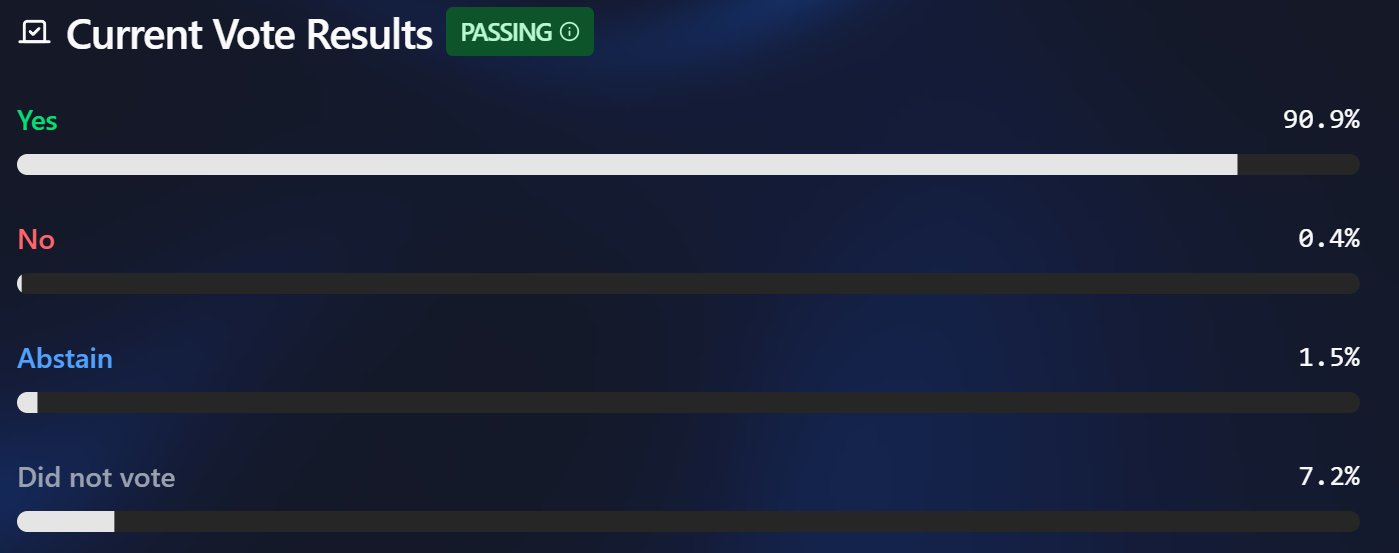

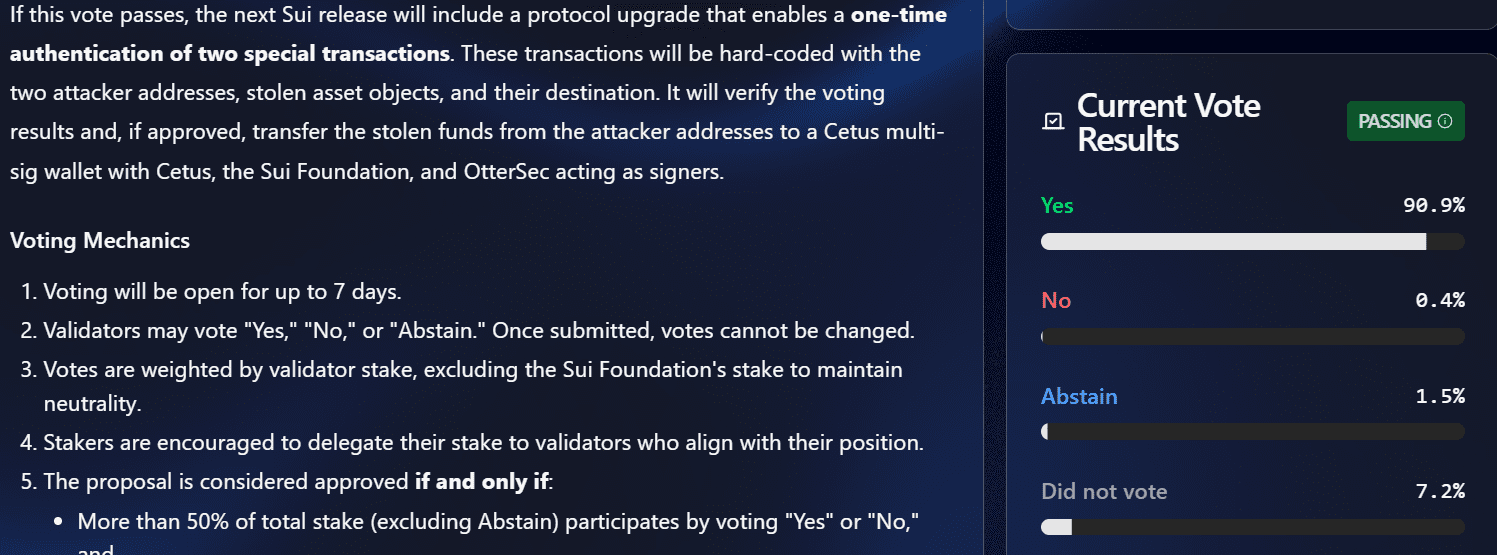

In a governance vote concluded on May 29, Sui validators passed the recovery proposal with 90.9% voting in favor, 1.5% abstaining and 7.2% not participating, according to the network’s official governance page.

“With this result, the impacted funds will be moved to a multisig wallet and held in trust until they can be returned to users according to the plan led by Cetus,” Sui said in a May 29 X post.

The decision follows debate within the crypto community over the role of validators in freezing onchain funds.

Quick Summary of the News

- Cetus Exploit: Decentralized exchange Cetus on the Sui network was exploited for over $200 million.

- Validator Intervention: Sui validators froze $162 million of the stolen funds shortly after the exploit.

- Governance Vote: A Sui governance proposal to return the frozen funds to users passed with overwhelming support (90.9%).

- Funds Recovery: The frozen funds will be moved to a multi-sig wallet and held in trust for distribution to affected users.

- Decentralization Debate: The event reignited discussions about the balance between security and decentralization in blockchain protocols.

Why It Matters

This event highlights the ongoing tension between the ideals of decentralization and the practical need for security in the crypto space. The Sui validators’ intervention prevented a complete loss of funds, showcasing the potential benefits of a degree of centralized control. However, it also raises questions about the immutability and censorship-resistance that are core tenets of blockchain technology. The situation impacts investor confidence in DeFi platforms and influences the ongoing debate about governance models for blockchain networks.

Market Impact

The immediate market reaction was likely a sigh of relief from Cetus users and SUI holders, as the potential for significant losses was mitigated. However, the long-term impact is more nuanced. This event could:

- Increase scrutiny of Sui: Investors may demand more transparency and clarity regarding the validator’s powers and decision-making processes.

- Impact DeFi trust: Other DeFi platforms may face increased pressure to implement similar security measures, potentially at the cost of decentralization.

- Drive innovation in security: The incident could spur development of new on-chain security protocols that balance security with decentralization.

Expert Take or Personal Insight

While the Sui validators’ actions were arguably necessary to protect users in this specific instance, it’s crucial to acknowledge the potential slippery slope. A system where validators can unilaterally freeze funds undermines the core principles of decentralization. The key lies in finding a transparent and community-driven process for such interventions, with clear guidelines and limitations. This situation emphasizes the need for DeFi projects to prioritize robust security audits and implement measures to prevent exploits in the first place.

Actionable Insight

For traders and investors, this event offers several key takeaways:

- Diversify your holdings: Don’t put all your eggs in one basket, especially when dealing with relatively new or unaudited DeFi platforms.

- Research validator governance: Understand the powers and responsibilities of validators in any blockchain network you invest in.

- Stay informed about security audits: Prioritize platforms with frequent and transparent security audits.

- Monitor the SUI ecosystem: Keep an eye on how the SUI community and developers respond to this event and whether they implement changes to address decentralization concerns.

Conclusion

The Sui/Cetus incident serves as a crucial reminder that the pursuit of decentralization should not come at the expense of security. The crypto community must continue to grapple with the complexities of balancing these two fundamental principles. Moving forward, expect to see increased focus on hybrid governance models that combine elements of decentralization with mechanisms for responsible intervention in exceptional circumstances. The evolution of DeFi will depend on striking the right balance.