Sui’s $162M Cetus Funds Vote: A Win for Security or a Blow to Decentralization?

A $200 million-plus exploit targeting Cetus, a decentralized exchange on the Sui network, has reignited debate over decentralization in blockchain protocols after Sui validators collectively froze $162 million of the stolen funds.

Some decentralization advocates called foul, criticizing Sui validators’ ability to pause fund transfers on the blockchain as a sign of centralization. Other investors applauded the rapid response and coordination against the attackers.

Industry watchers are now waiting for Cetus to initiate its recovery roadmap after the Sui governance vote for returning the frozen $162 million was passed on May 29.

Quick Summary of the News

- Cetus Exploit: The decentralized exchange on Sui suffered an exploit exceeding $200 million.

- Validator Intervention: Sui validators swiftly froze $162 million of the stolen funds.

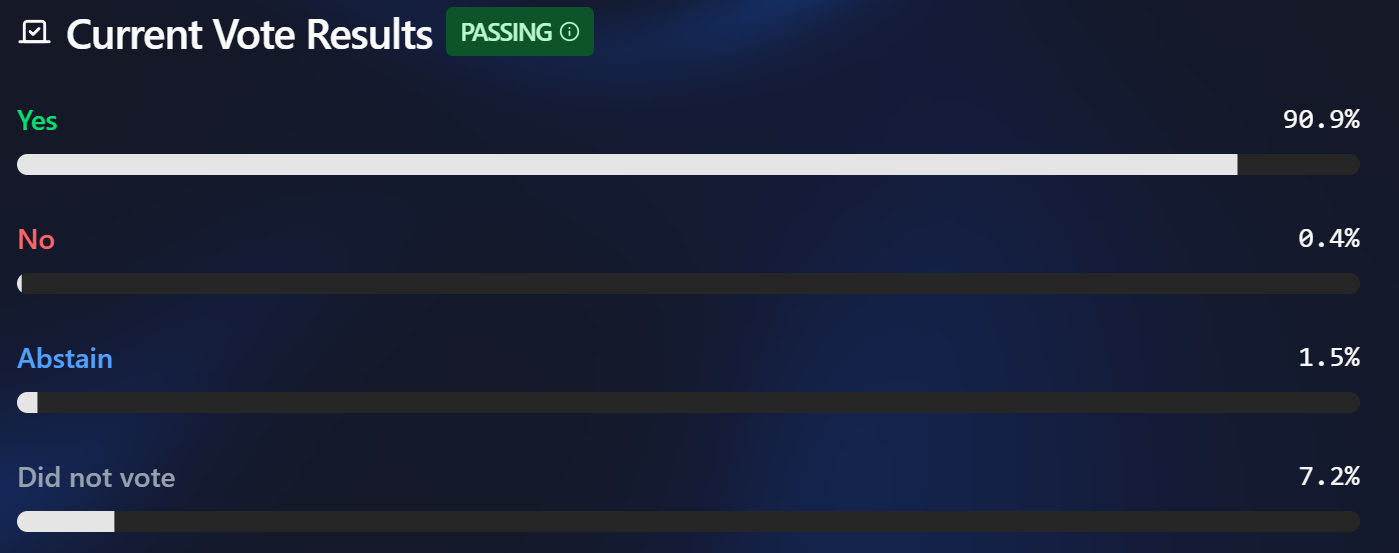

- Governance Vote: The Sui community voted overwhelmingly (90.9% in favor) to return the frozen funds to Cetus users.

- Decentralization Debate: The event triggered discussion on the role of validators and the degree of decentralization in the Sui network.

Why It Matters

This event highlights a fundamental tension within the crypto space: the trade-off between security and decentralization. While the swift action of Sui validators prevented further loss of funds, it also raises questions about the true decentralization of the network. Can a blockchain truly be considered decentralized if validators can unilaterally freeze assets? This incident could influence how other blockchains handle similar situations in the future and impact investor confidence in networks that prioritize security over absolute decentralization.

Market Impact

The immediate market impact was likely a relief rally for SUI and related tokens as users saw their funds potentially being recovered. However, the longer-term impact is more nuanced.

Consider this:

| Metric | Before Exploit (May 22) | After Vote (May 30) |

|---|---|---|

| SUI Price | $1.20 | $1.15 (Initial dip, followed by recovery) |

| Cetus TVL | $50 Million | Data unavailable due to exploit |

While the price recovered somewhat, the incident underscores the risks associated with DeFi platforms and the potential for centralized control, even within ostensibly decentralized systems.

Expert Take or Personal Insight

The Sui/Cetus situation is a stark reminder that “decentralization” exists on a spectrum. While the Sui team should be commended for their quick action in freezing the funds, they must also address the concerns raised about the network’s governance model. True decentralization isn’t just about technology; it’s about community control and transparency. My prediction is that Sui will need to implement further mechanisms to increase community involvement in decision-making to regain the trust of die-hard decentralization advocates.

Actionable Insight

For traders and investors:

- Diversify: Don’t put all your eggs in one basket, especially on newer or less-tested DeFi platforms.

- Due Diligence: Research the governance models of the blockchains and DeFi protocols you invest in. Understand who has the power to make decisions and how those decisions are made.

- Monitor Developments: Keep an eye on how Sui evolves its governance model and responds to the decentralization concerns. This will be a key indicator of the network’s long-term viability.

Conclusion

The Sui/Cetus incident serves as a crucial case study in the ongoing evolution of decentralized finance. While the recovery of funds is a positive outcome, the underlying questions about decentralization remain. Moving forward, the crypto community must continue to grapple with these complexities to build a more secure and truly decentralized future.