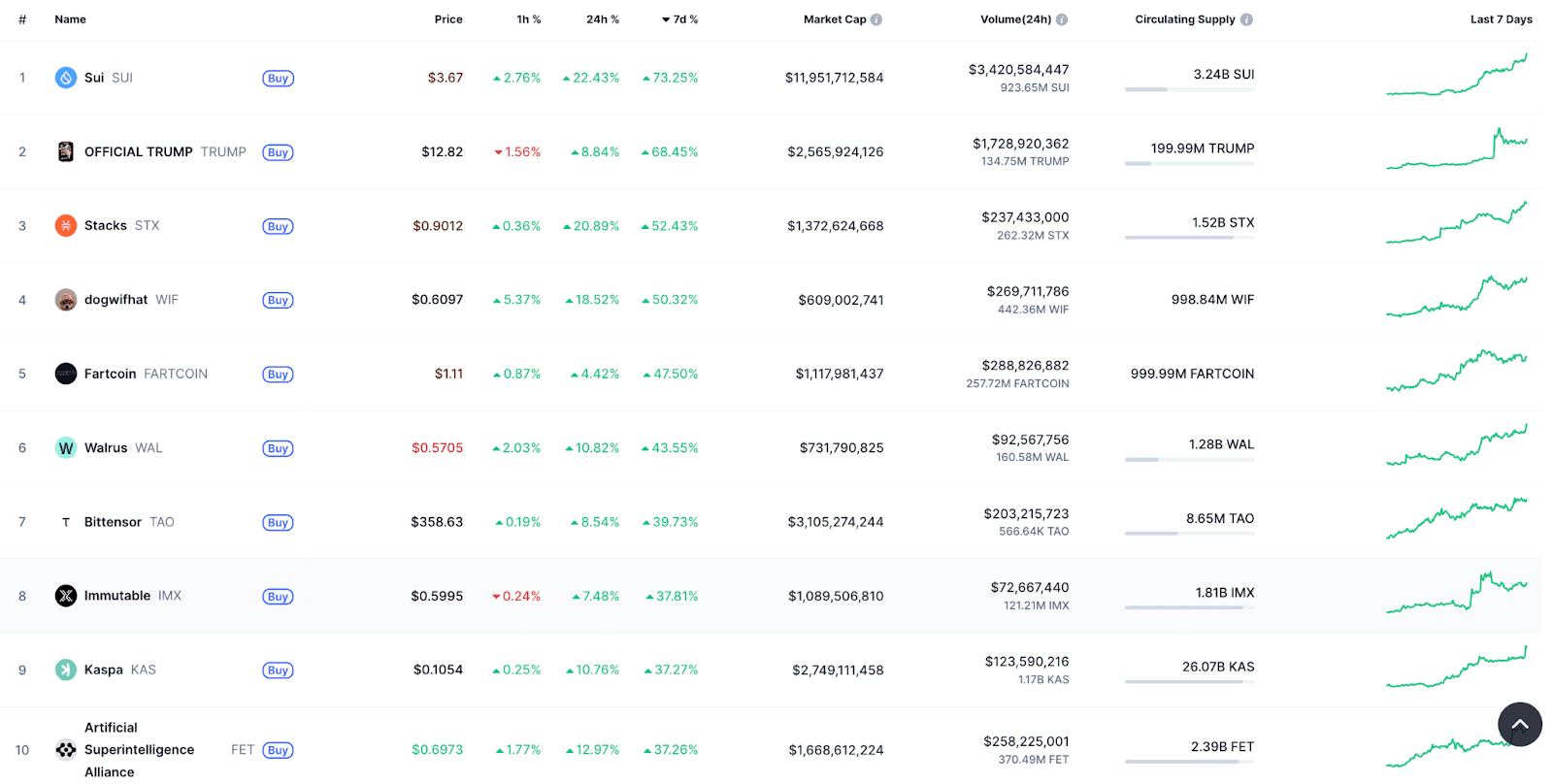

SUI (SUI) is currently trading at $3.67, marking a 23% increase in the last 24 hours and a staggering 73% surge over the past week. This impressive performance has positioned SUI as the top gainer among the top 100 cryptocurrencies by market capitalization.

Key Factors Driving SUI’s Price Surge:

- Grayscale SUI Trust Launch: The introduction of the Grayscale SUI Trust allows accredited investors to gain exposure to SUI, signaling institutional interest and boosting investor confidence.

- xPortal/xMoney Mastercard Partnership: SUI’s partnership with xPortal and xMoney enables 2.5 million European users to spend SUI via a virtual Mastercard, increasing its utility and accessibility.

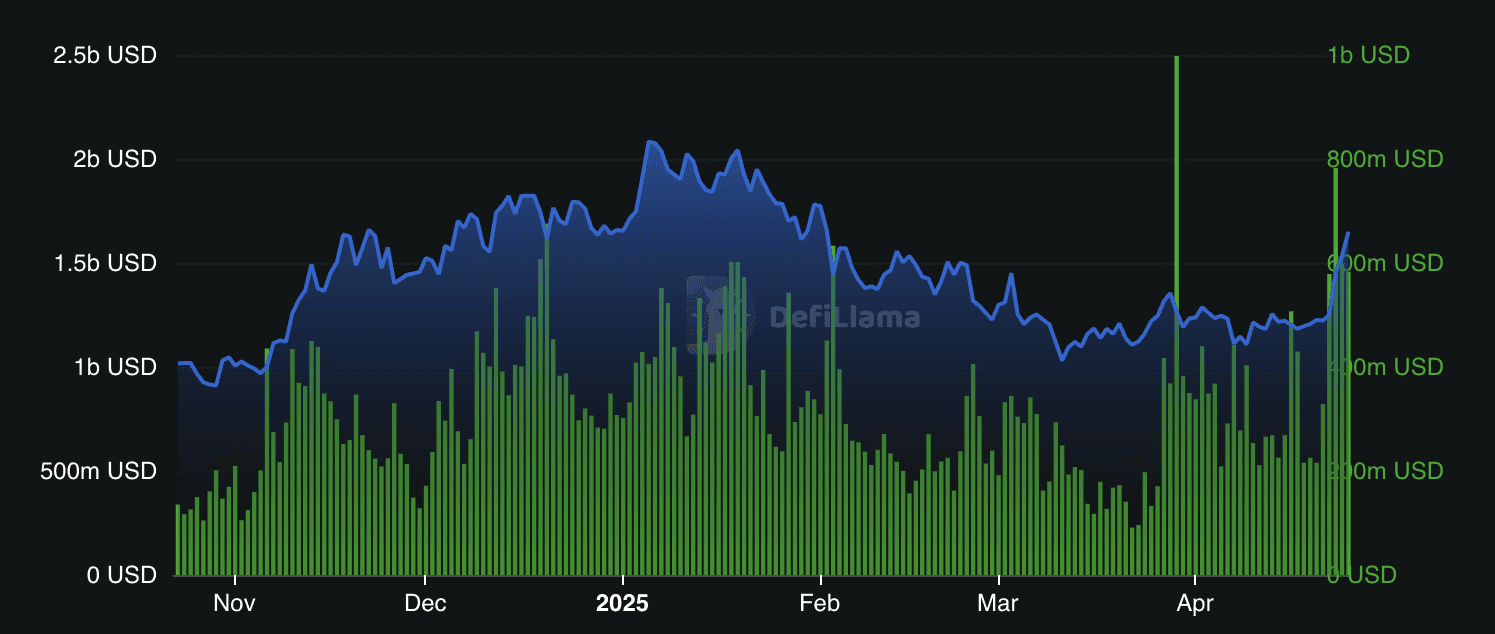

- Thriving DeFi Ecosystem: SUI’s total value locked (TVL) has increased by 40% in the last week, demonstrating strong growth and adoption within its decentralized finance (DeFi) ecosystem. Daily DEX volumes have also surged by 177%, indicating increased trading activity and liquidity.

Analyzing the Fundamentals:

Several key factors underpin SUI’s recent price rally:

- Increased Investor Confidence: The Grayscale SUI Trust launch validates SUI’s potential and attracts institutional investors.

- Enhanced Utility: The xPortal/xMoney partnership expands SUI’s use cases and makes it easier for users to spend their tokens.

- Ecosystem Growth: The surge in TVL and DEX volumes reflects a healthy and expanding DeFi ecosystem, attracting more users and developers to the SUI network.

SUI’s DeFi Ecosystem in Detail

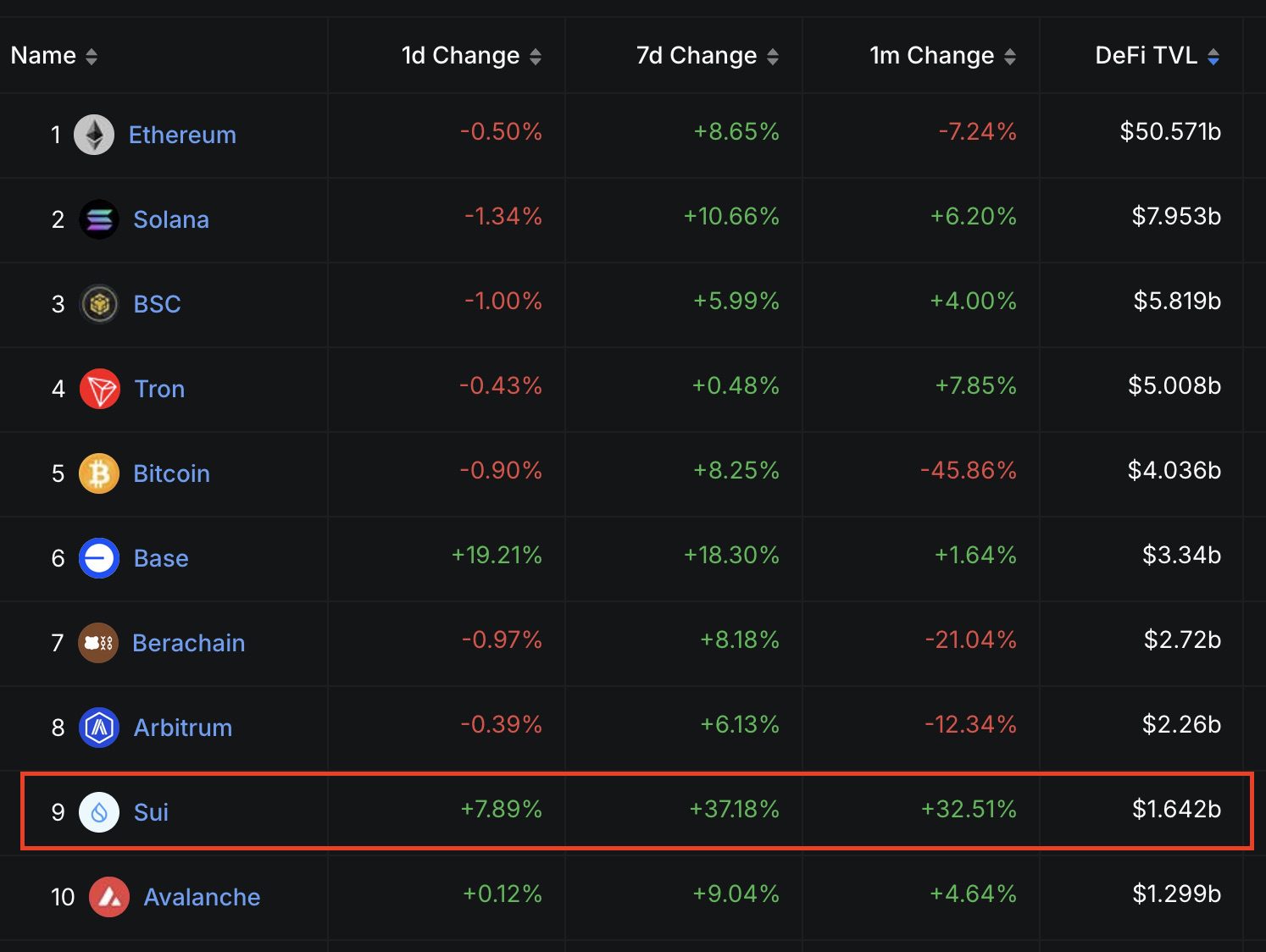

Sui has cemented its place among the top 10 layer-1 blockchains, boasting a TVL exceeding $1.65 billion. The increase signifies increased confidence in the platform and the DeFi projects building on it. Comparing SUI’s performance to other leading layer-1 networks reveals its dominance in TVL gains across daily, weekly, and monthly timeframes.

SUI’s daily DEX volumes have experienced a remarkable surge, exceeding 177% over the past week, reaching $599 million. This growth surpasses that of other prominent blockchains like BNB Chain and Solana, highlighting SUI’s increasing dominance in the DeFi space.

Technical Analysis and Price Predictions:

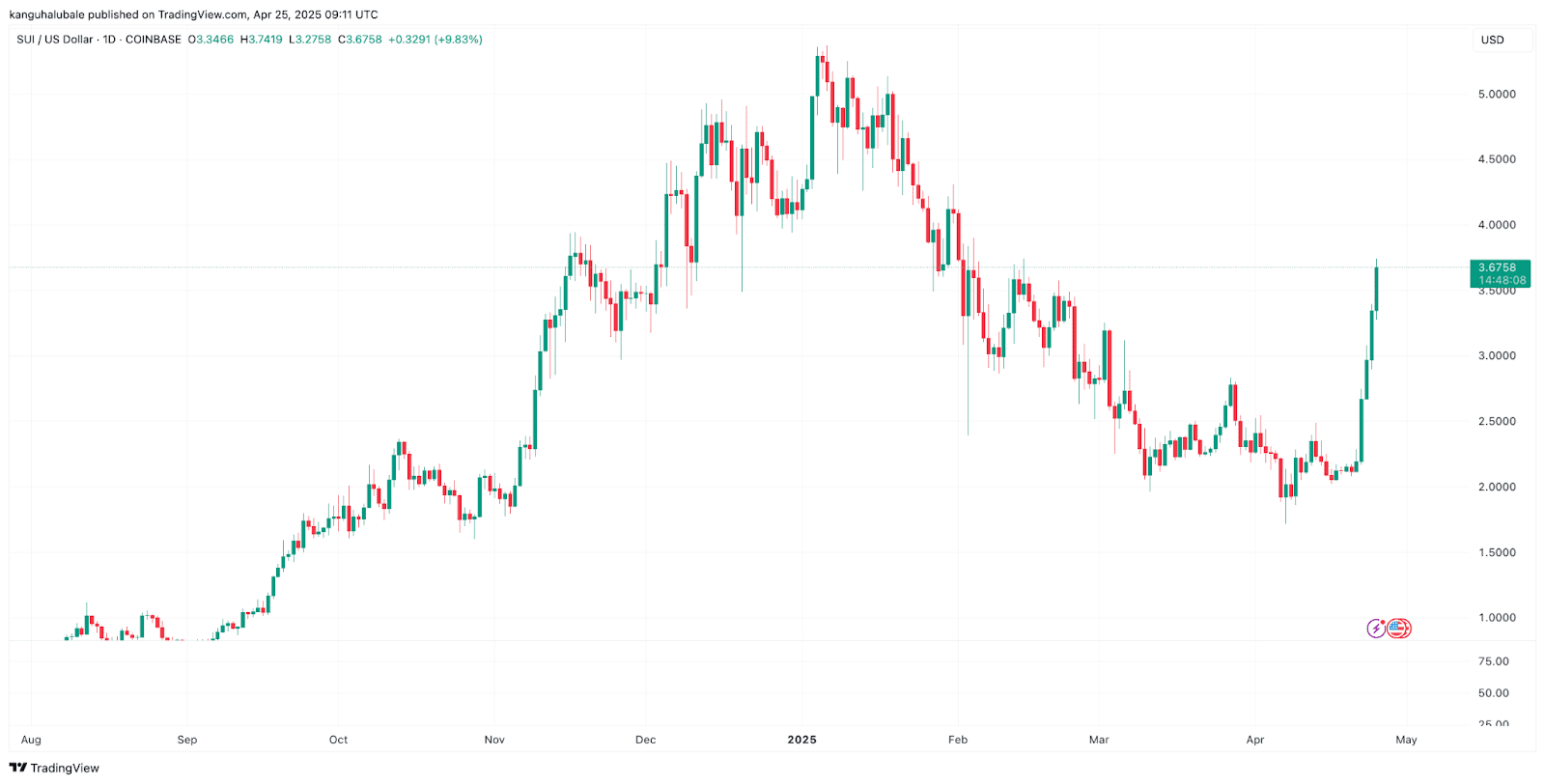

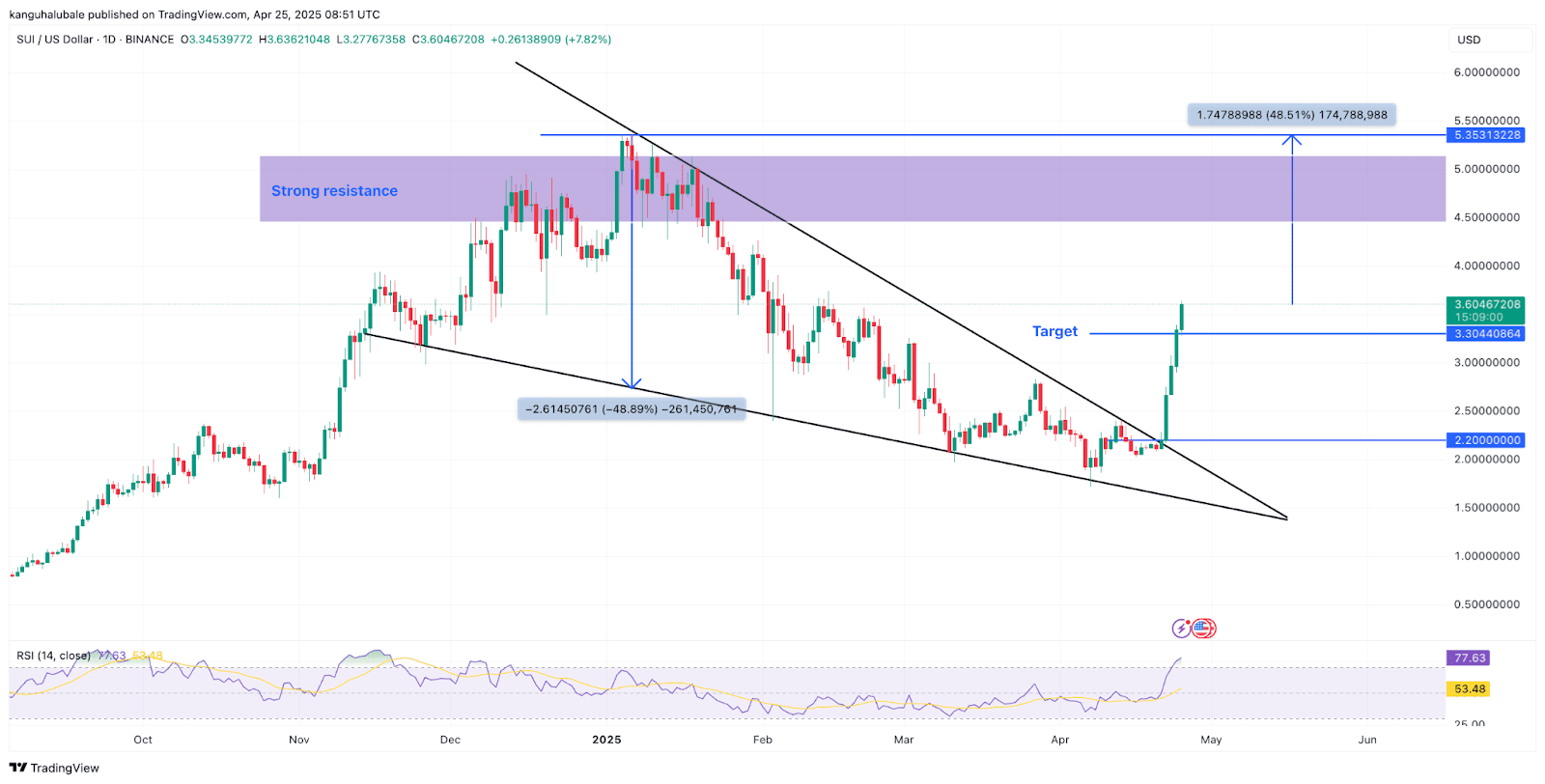

From a technical standpoint, SUI’s price gained significant momentum after breaking out of a falling wedge pattern on the daily chart. After surpassing the multimonth resistance near $2.20, SUI achieved the wedge’s technical target of $3.30. The next target for bulls is the all-time high of $5.35, reached on January 6th.

The relative strength index (RSI) has risen sharply from 45 to 78 since April 20th, confirming the strength of the bullish momentum. To sustain this upward trend, SUI must first overcome the resistance between $4.50 and $5.10 before potentially entering price discovery.

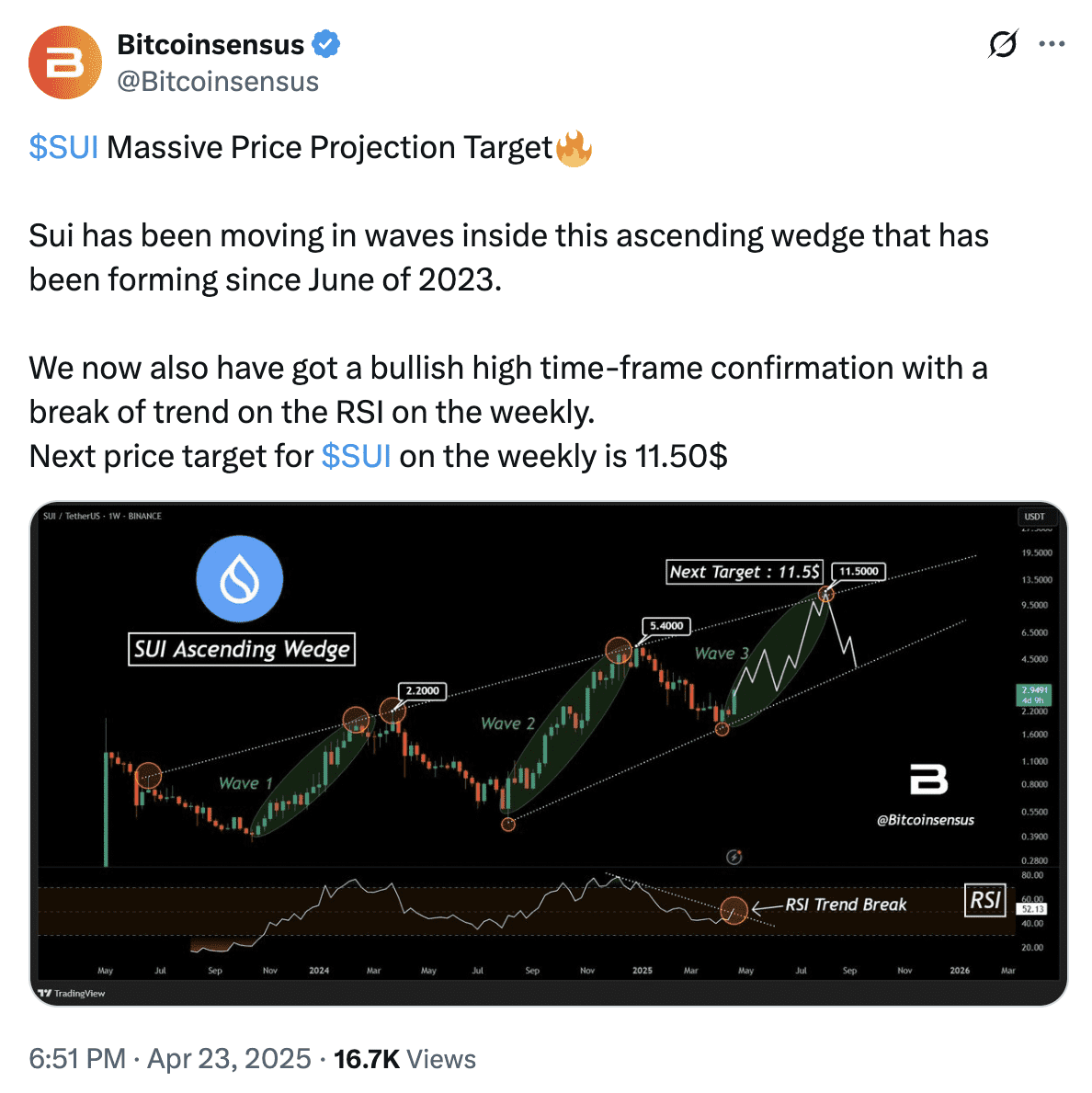

According to Elliott Wave analysis, one analyst, Bitcoinsensus, has set a target for SUI at $11.50.

Is a New All-Time High Imminent?

SUI’s recent performance has sparked optimism about its potential to reach new all-time highs. The combination of strong fundamentals, growing ecosystem, and positive technical indicators suggests that SUI has the potential to continue its upward trajectory.

Potential Challenges:

- Market Volatility: The cryptocurrency market is known for its volatility, and SUI is not immune to price swings.

- Regulatory Uncertainty: Evolving regulatory landscapes could impact SUI’s future growth and adoption.

- Competition: The blockchain space is highly competitive, and SUI faces challenges from other layer-1 networks and DeFi platforms.

Conclusion:

SUI’s recent price surge is supported by strong fundamentals, a thriving DeFi ecosystem, and growing institutional interest. While challenges remain, SUI’s current trajectory suggests that it has the potential to reach new all-time highs. Investors should conduct thorough research and consider the risks before making any investment decisions.