Sweden, a frontrunner in the cashless society movement, is now reconsidering its stance due to concerns about cyber threats and overall instability. This shift has prompted Ethereum co-founder Vitalik Buterin to emphasize the vulnerabilities of centralized digital payment systems and the opportunities presented by decentralized alternatives like Ethereum.

Buterin argues that while centralized digital payment solutions offer efficiency, their reliability can be compromised during times of crisis. He points to Sweden’s reversal as evidence of this fragility.

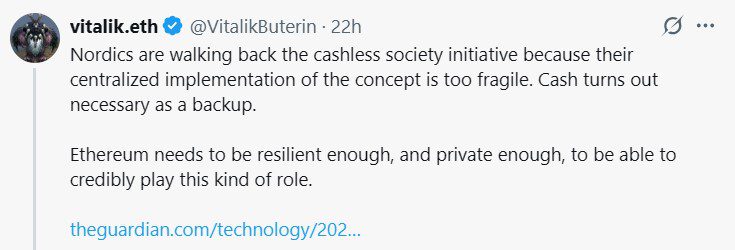

“Nordics are walking back the cashless society initiative because their centralized implementation of the concept is too fragile,” Buterin stated, referencing an article highlighting Sweden’s renewed emphasis on physical cash reserves. “Cash turns out necessary as a backup.”

Ethereum as a Crisis Financial Fallback

While Sweden has embraced digital payments, with only a small percentage of transactions now conducted in cash, the government is urging citizens to maintain cash reserves in preparation for potential emergencies. This highlights a critical concern: the reliance on centralized digital infrastructure that may not withstand periods of instability.

Buterin posits that Ethereum, with its decentralized nature, could serve as a reliable financial fallback in such situations. He emphasizes the need for Ethereum to be robust and private enough to fulfill this role credibly.

“Ethereum needs to be resilient enough, and private enough, to be able to credibly play this kind of role,” Buterin explained.

Regarding the feasibility of fully offline, zero-knowledge technology-secured private transfers, Buterin acknowledged that while the technical expertise exists, limitations remain, specifically concerning the reliance on trusted hardware or post-hoc enforcement against double-spending.

He explained, “We basically know how to do it, but with the limitation that any solution depends on trusted hardware and/or post hoc enforcement against double-spenders.”

The Broader Payment Landscape: Crypto and Fiat Coexistence

The discussion surrounding Sweden’s shift and Ethereum’s potential role raises broader questions about the future of payments. While cryptocurrency payment solutions are gaining traction, the prevailing view is that they will likely coexist with, rather than replace, traditional fiat currencies.

Petr Kozyakov, co-founder and CEO of Mercuryo, a crypto payment solutions provider, believes that cryptocurrencies will not fully displace fiat. He observes increased demand and adoption of crypto payments but envisions a future where both fiat and crypto serve different purposes.

Kozyakov suggests that individuals will opt for crypto payments when they offer greater convenience and practicality.

Key Takeaways:

- Sweden’s reconsideration of a cashless society: Highlights the vulnerability of centralized digital payment systems.

- Vitalik Buterin’s perspective: Ethereum can provide a decentralized financial backup during crises.

- Ethereum’s resilience and privacy: Crucial for its viability as a reliable alternative.

- Technology limitations: Fully offline private transfers still face challenges.

- Crypto and fiat coexistence: The most likely future of payments.

In conclusion, Sweden’s reassessment of its cashless approach underscores the importance of having diverse and resilient payment options. Vitalik Buterin’s vision of Ethereum as a decentralized financial safety net presents a compelling argument for the role of blockchain technology in a world increasingly reliant on digital solutions, especially during times of instability and uncertainty. The future of payments likely involves a blend of traditional and decentralized systems, each offering unique benefits and catering to specific needs and circumstances.