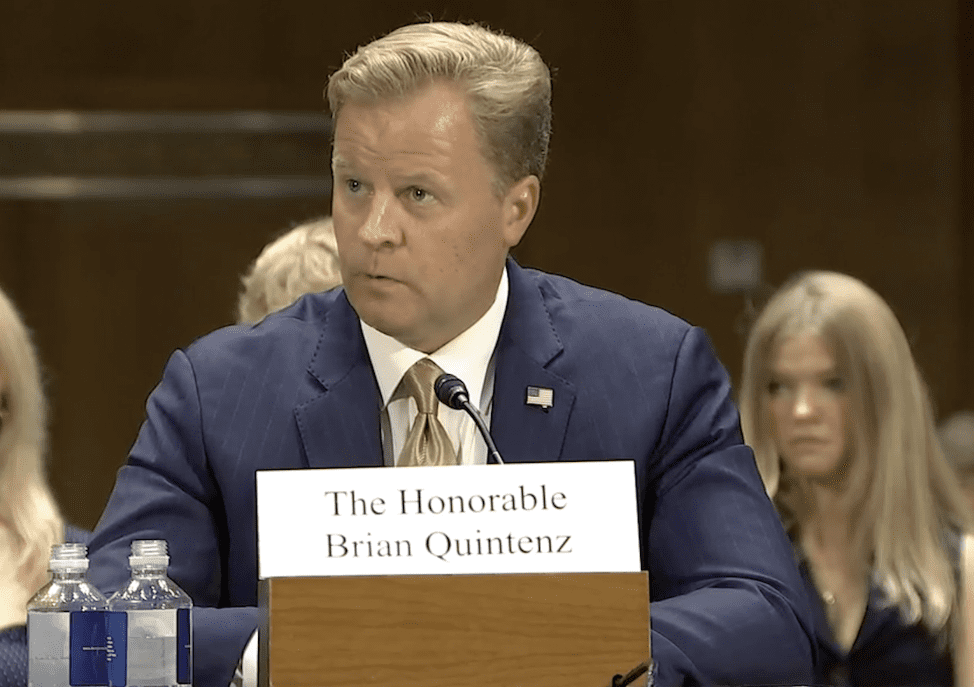

Brian Quintenz, Trump’s nominee for CFTC chair, recently testified before the Senate, addressing his potential approach to crypto regulation and the importance of a bipartisan commission.

Tag: Banking

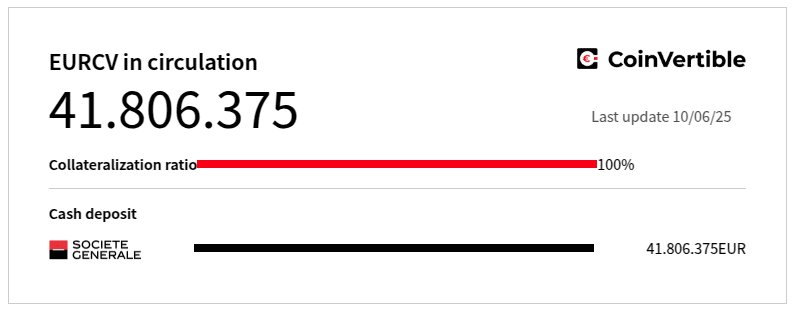

Societe Generale Enters the USD Stablecoin Arena with USDCV on Ethereum and Solana

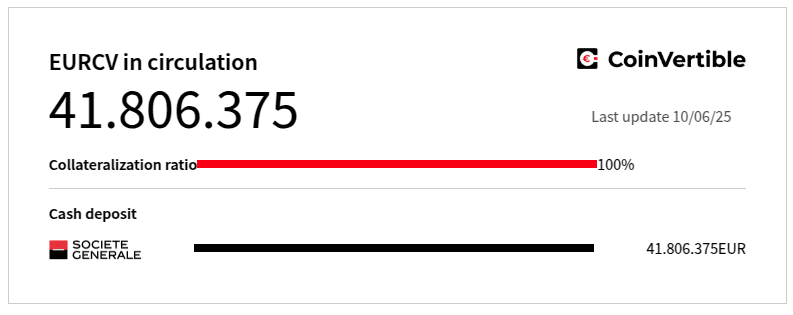

Societe Generale’s crypto division, SG Forge, has launched USD CoinVertible (USDCV), a USD-pegged stablecoin on Ethereum and Solana, marking a significant step in institutional adoption.

Société Générale Enters Stablecoin Arena with USD CoinVertible (USDCV) on Ethereum and Solana

Société Générale’s crypto division, SG Forge, has launched a USD-backed stablecoin, USDCV, on Ethereum and Solana, signaling traditional finance’s growing interest in digital assets.

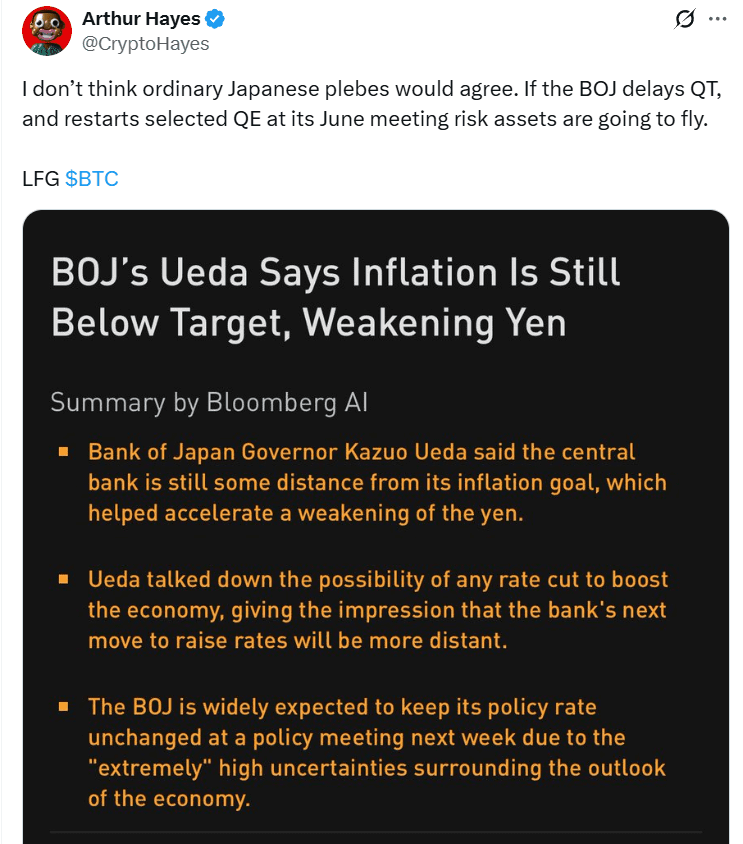

Bank of Japan’s Potential QE Pivot: Will it Fuel the Next Bitcoin Rally?

Arthur Hayes believes the Bank of Japan’s upcoming monetary policy meeting in June could be a major catalyst for Bitcoin and other risk assets if they decide to pivot back to quantitative easing.

Societe Generale Enters the USD Stablecoin Arena with USDCV Launch on Ethereum and Solana

Societe Generale’s crypto division, SG Forge, has launched USD CoinVertible (USDCV), a new USD-backed stablecoin on Ethereum and Solana, signaling traditional finance’s increasing interest in stablecoin markets.