U.S. Bancorp is actively exploring a potential role in the stablecoin market, coinciding with renewed interest in its crypto custody services, fueled by a more favorable regulatory outlook.

Tag: Banks

Societe Generale Enters the USD Stablecoin Arena with USDCV on Ethereum and Solana

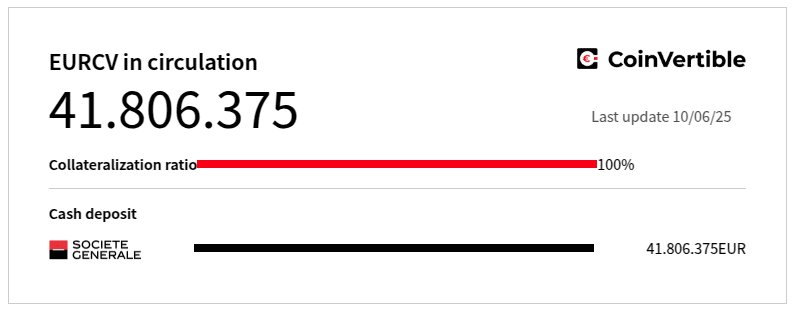

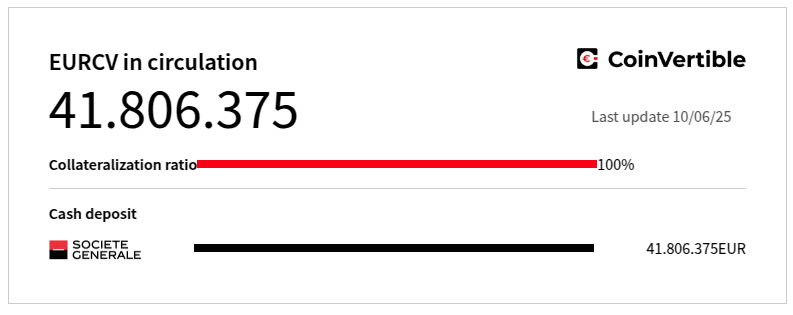

Societe Generale’s crypto division, SG Forge, has launched USD CoinVertible (USDCV), a USD-pegged stablecoin on Ethereum and Solana, marking a significant step in institutional adoption.

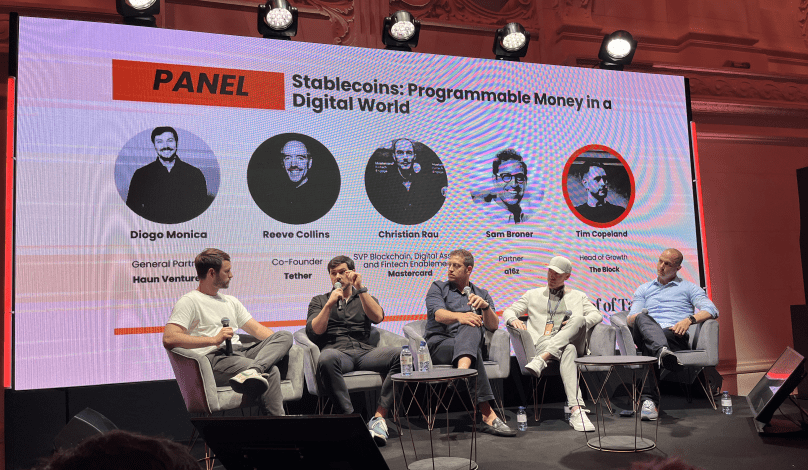

Are Stablecoins Safer Than Bank Deposits? A DeFi Expert Weighs In

Recent comments from Haun Ventures’ Diogo Monica suggest stablecoins, backed by top-tier assets, might be safer than traditional bank deposits. We delve into the arguments and potential implications.

Société Générale Enters Stablecoin Arena with USD CoinVertible (USDCV) on Ethereum and Solana

Société Générale’s crypto division, SG Forge, has launched a USD-backed stablecoin, USDCV, on Ethereum and Solana, signaling traditional finance’s growing interest in digital assets.

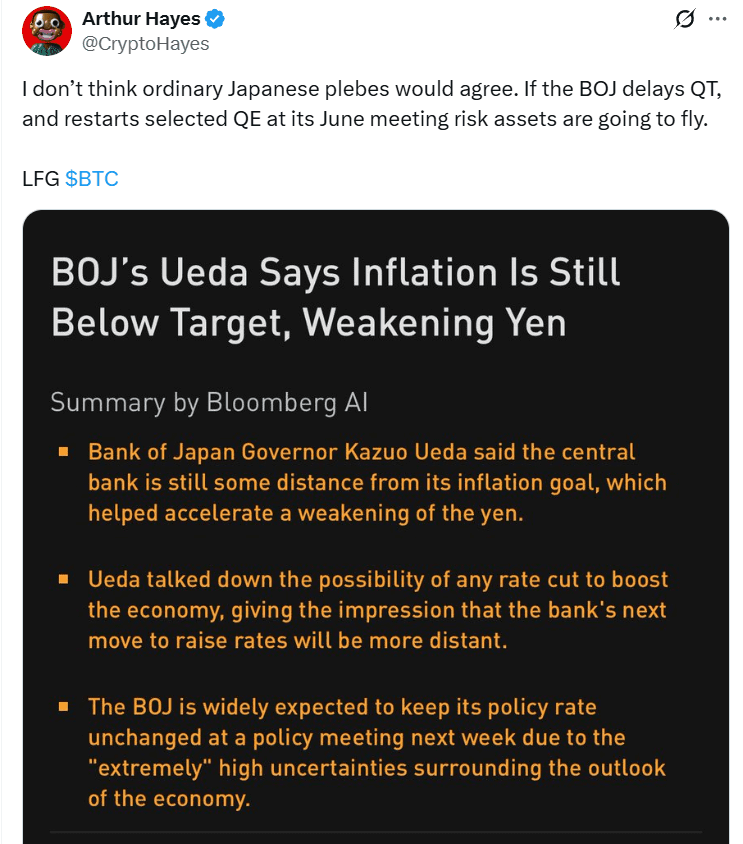

Bank of Japan’s Potential QE Pivot: Will it Fuel the Next Bitcoin Rally?

Arthur Hayes believes the Bank of Japan’s upcoming monetary policy meeting in June could be a major catalyst for Bitcoin and other risk assets if they decide to pivot back to quantitative easing.