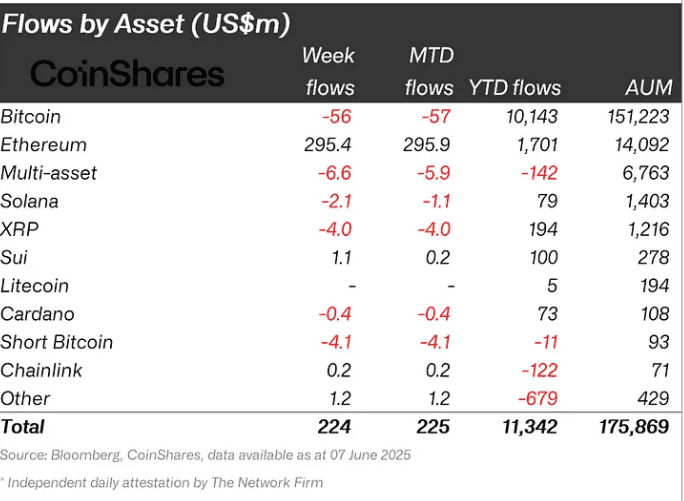

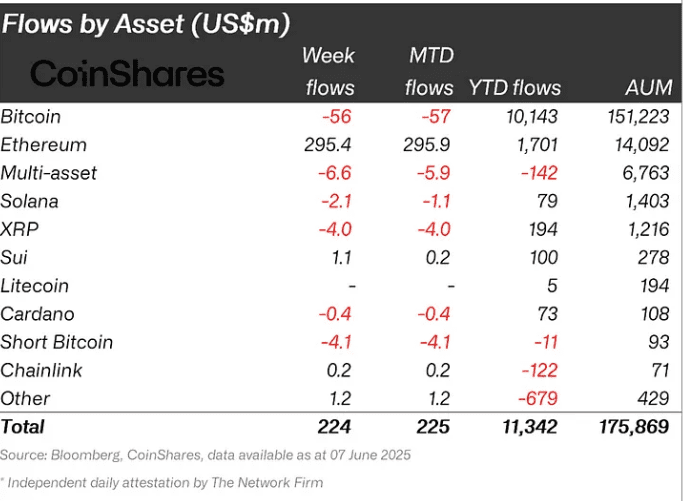

Ether-based investment products are leading the way in crypto investment inflows, marking a significant shift in sentiment despite overall market caution surrounding US Federal Reserve decisions.

Tag: Bitcoin Analysis

Ether Funds Surge: $296M Inflows Signal Renewed Investor Confidence

Ether (ETH) investment products experienced significant inflows last week, contrasting with Bitcoin outflows amidst US Federal Reserve uncertainty.

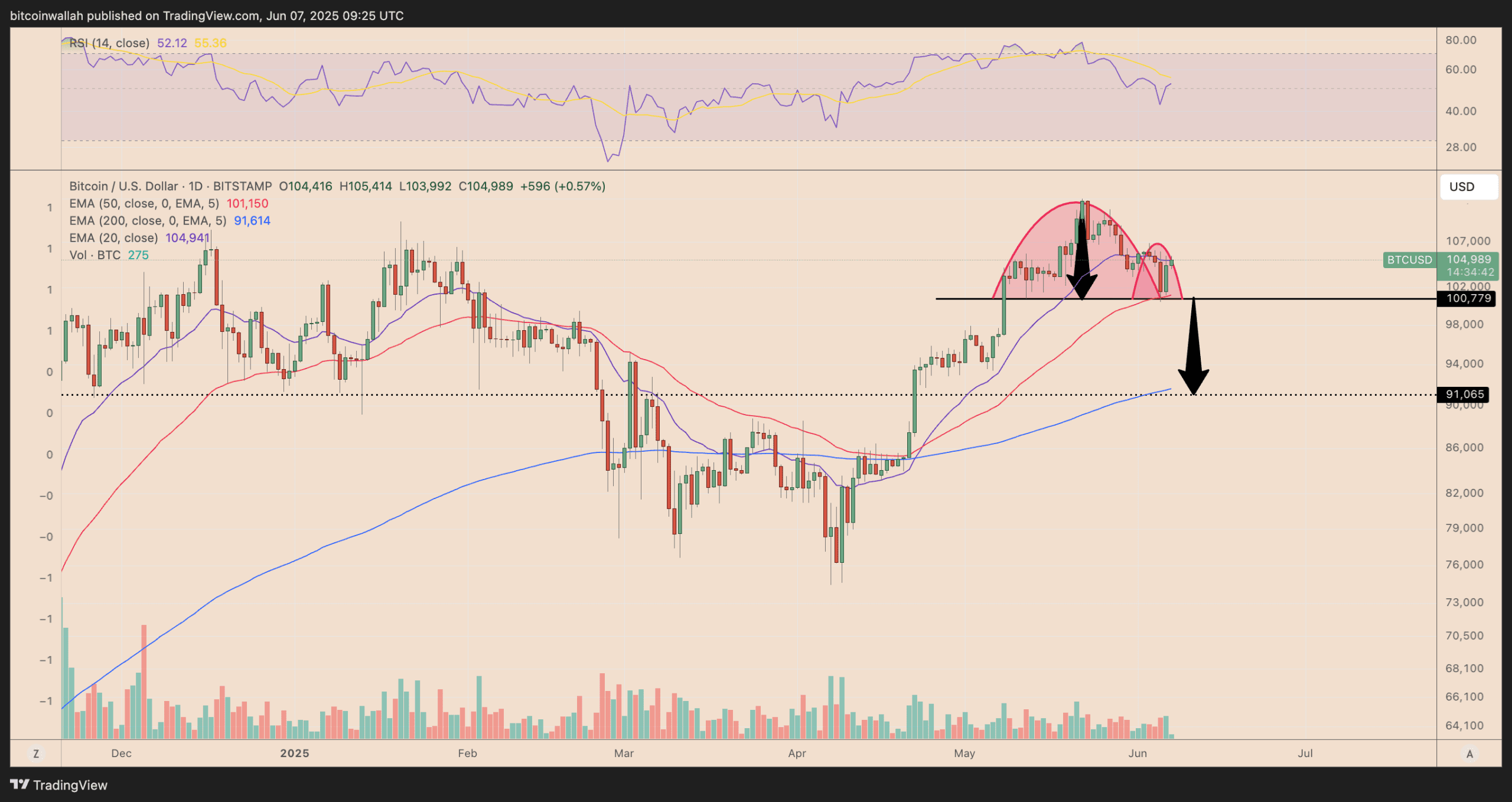

Bitcoin’s $150K Dream: Bearish Signals Threaten Year-End Rally

A bearish RSI divergence, similar to 2021, suggests Bitcoin could face a 50%+ correction toward $64,000, challenging the $150K year-end target.

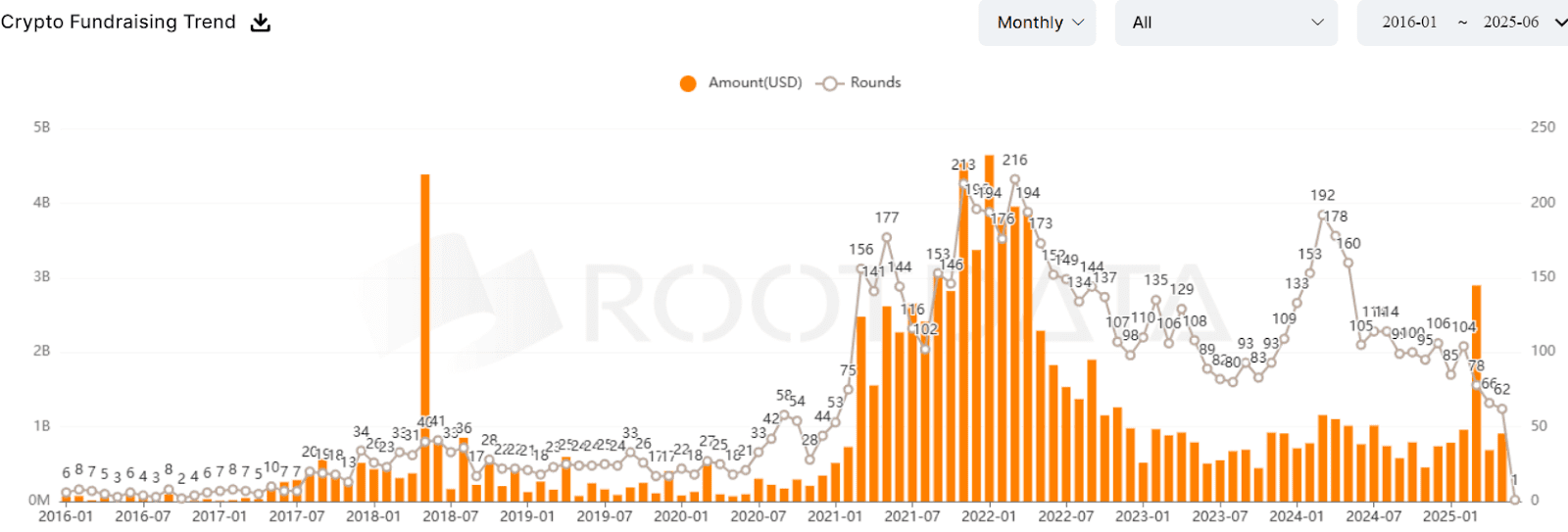

Stablecoin Regulation as a Bitcoin Catalyst: $150K Target in Sight?

Upcoming stablecoin regulations, particularly the GENIUS Act, are predicted to potentially drive Bitcoin to a cycle peak exceeding $150,000 in 2025. This analysis explores the implications of this legislation.

Will Stablecoin Regulation Fuel a $150K Bitcoin Rally in 2025?

Upcoming stablecoin legislation, particularly the GENIUS Act, is being eyed as a potential catalyst for a significant Bitcoin price surge, potentially pushing it above $150,000 in the next cycle.