Millionaire crypto trader James Wynn faced a significant $25 million liquidation on a leveraged Bitcoin bet, sparking debate about market manipulation and prompting calls for dark pool DEXs.

Tag: Bitcoin Futures

James Wynn’s $25M Bitcoin Leverage Bet Goes Sour: Lessons for Crypto Traders

Millionaire crypto trader James Wynn faces a $25 million liquidation on a leveraged Bitcoin position, highlighting the risks of high-leverage trading in the volatile crypto market.

BlackRock’s IBIT Bitcoin ETF Futures Launch in Russia: A Sign of Growing Crypto Adoption?

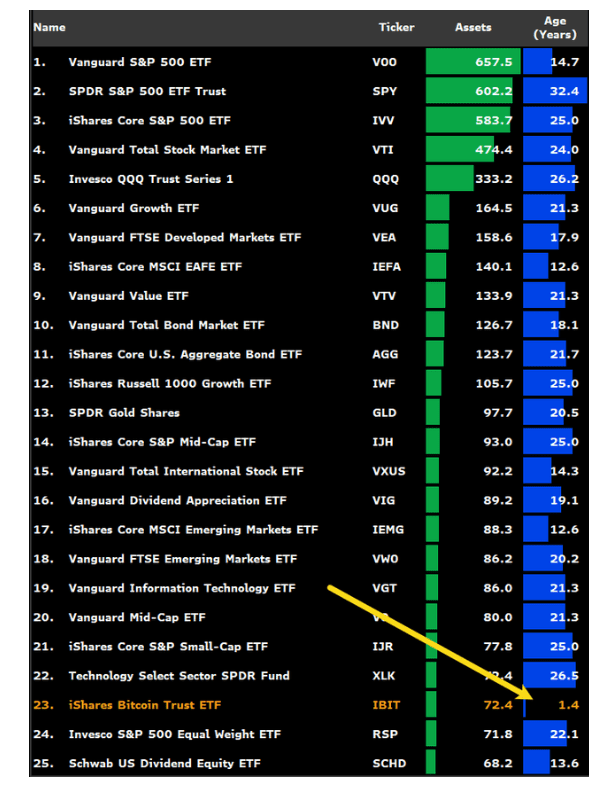

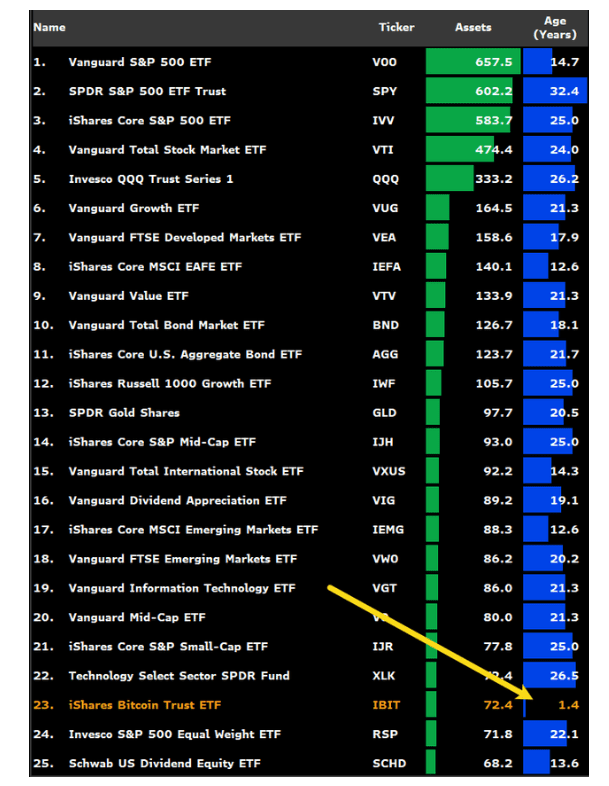

Moscow Exchange (MOEX) lists futures for BlackRock’s IBIT, coinciding with the ETF’s rise into the top 25 globally. What does this mean for crypto adoption and market access in Russia?

BlackRock IBIT Bitcoin ETF Futures Launch in Moscow: A New Frontier?

Moscow Exchange (MOEX) has launched futures trading for BlackRock’s iShares Bitcoin Trust ETF (IBIT), coinciding with the fund’s impressive ascent into the world’s top 25 ETFs by assets under management (AUM). This signals growing institutional interest in crypto within Russia, but with caveats.

Sberbank’s Bitcoin Bond: A New Gateway to Crypto for Russian Investors?

Sberbank, Russia’s largest bank, has introduced a Bitcoin-linked bond product, signaling a potential shift in the country’s approach to crypto investments. This analysis explores the implications of this move for the Russian market and beyond.