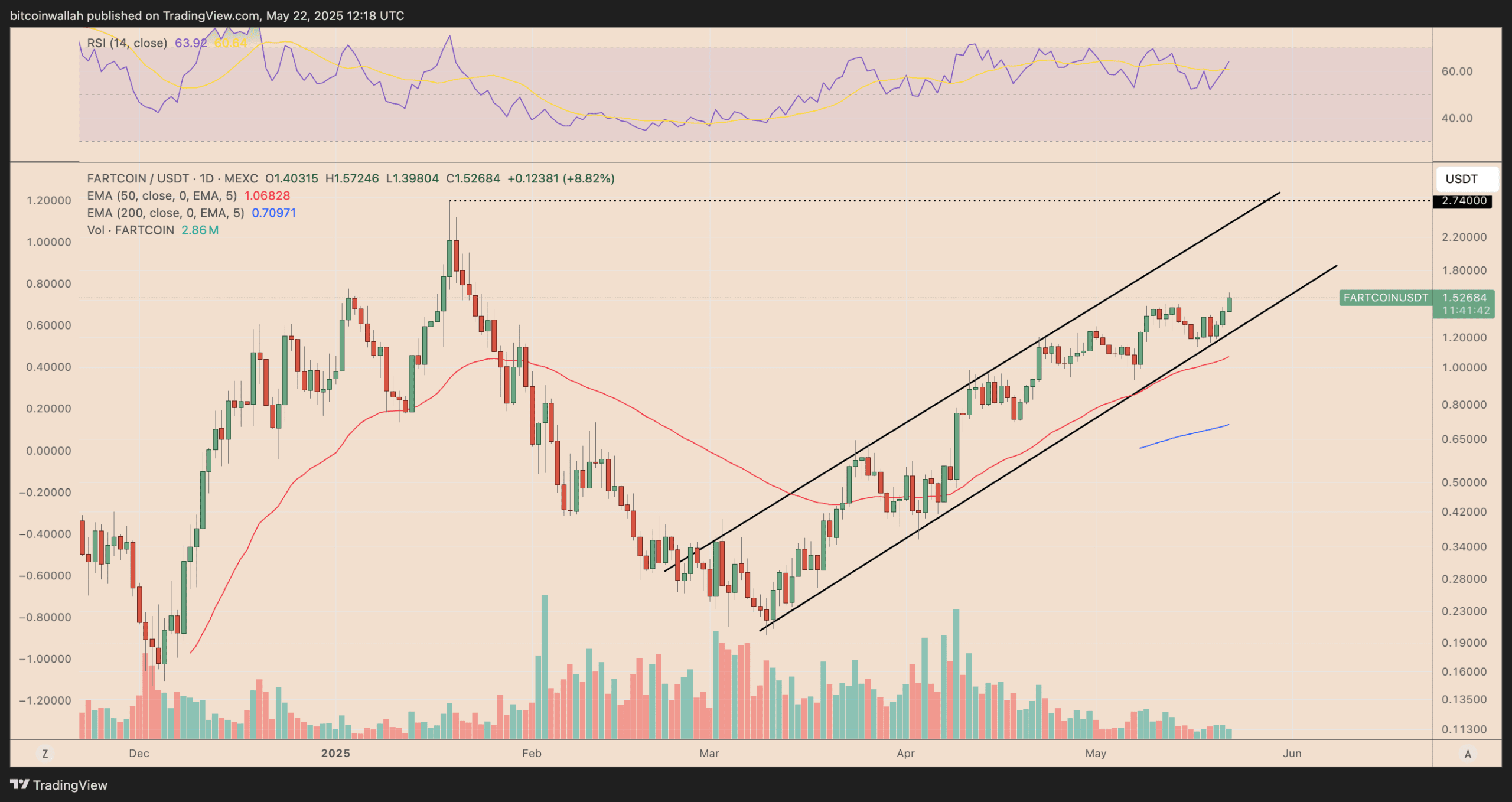

Amid renewed crypto market euphoria, several memecoins, including Fartcoin, WIF, SPX6900, and Popcat, are showing potential to surpass Bitcoin’s gains. This analysis explores the technical patterns driving their bullish momentum.

Tag: BTC Markets

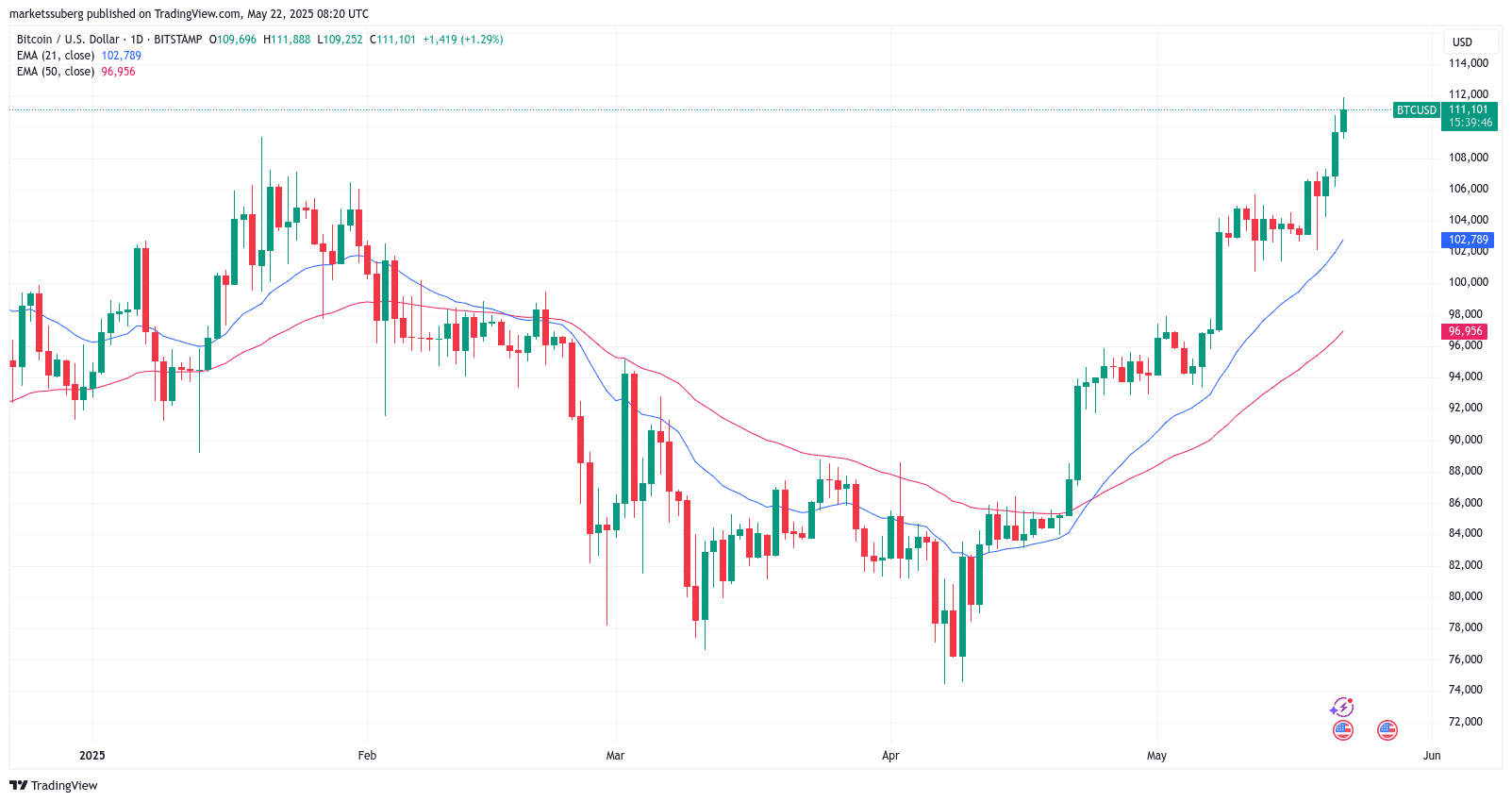

Bitcoin’s Untapped Potential: Why the Rally Could Continue Higher

Bitcoin’s recent surge to new all-time highs wasn’t fueled by speculative trading, suggesting further growth potential. Explore the factors driving this rally and what analysts predict for Bitcoin’s future.

Solana (SOL) Price Analysis: Bull Flag, Fractal Patterns, and Analyst Predictions

Solana’s price is showing potential for a rally to $260 based on a bull flag pattern and fractal analysis. Expert opinions suggest caution due to low trading volumes, but overall, the outlook remains bullish. Explore key support levels, potential targets, and factors influencing SOL’s price movement.

Bitcoin Price Analysis: Is the Bull Run Exhausted? Key Levels and Predictions

Bitcoin’s recent surge to all-time highs is met with skepticism as traders anticipate a correction. This analysis explores key indicators and expert opinions on potential price pullbacks and long-term cycle peaks.

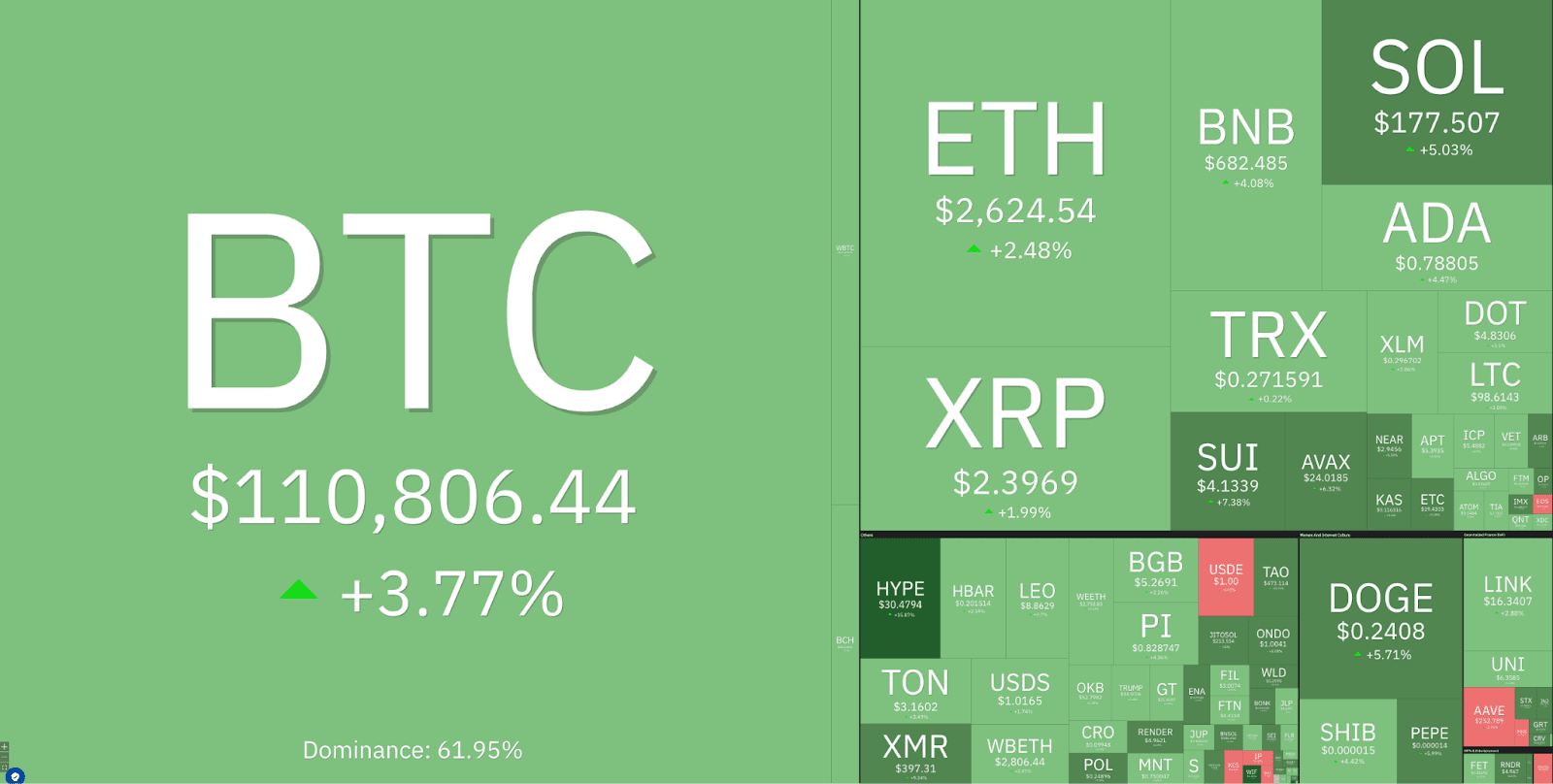

Crypto Market Surge: Understanding Today’s Price Rally

Explore the factors driving today’s cryptocurrency market surge, including Bitcoin’s new all-time high, short liquidations, and technical indicators. Discover why investors are turning bullish on crypto assets.