Regulatory Developments: The SEC has approved generic listing standards to expedite crypto ETF approvals. Additionally, the first U.S. XRP ETF is set to launch on […]

Tag: Central Bank

Crypto Market Update: BOJ Meeting, Corporate BTC Buys, and Paraguay’s Bitcoin U-Turn

A look at today’s top crypto news: Arthur Hayes’ prediction of a Bitcoin rally based on the Bank of Japan’s policy meeting, increasing corporate Bitcoin acquisitions, and a denial from Paraguay regarding Bitcoin as legal tender.

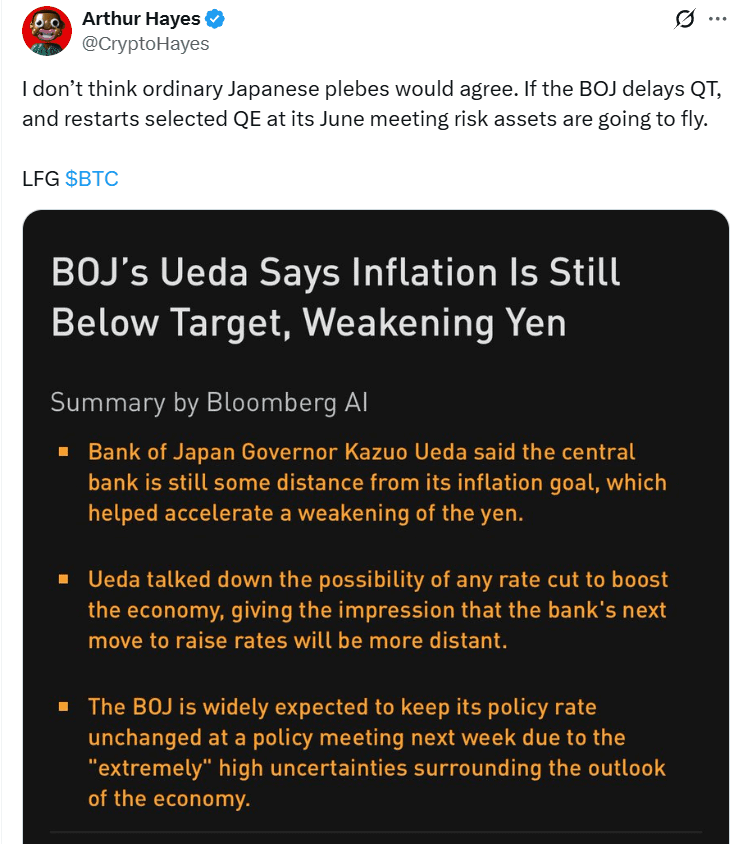

Bank of Japan’s Potential QE Pivot: Will it Fuel the Next Bitcoin Rally?

Arthur Hayes believes the Bank of Japan’s upcoming monetary policy meeting in June could be a major catalyst for Bitcoin and other risk assets if they decide to pivot back to quantitative easing.

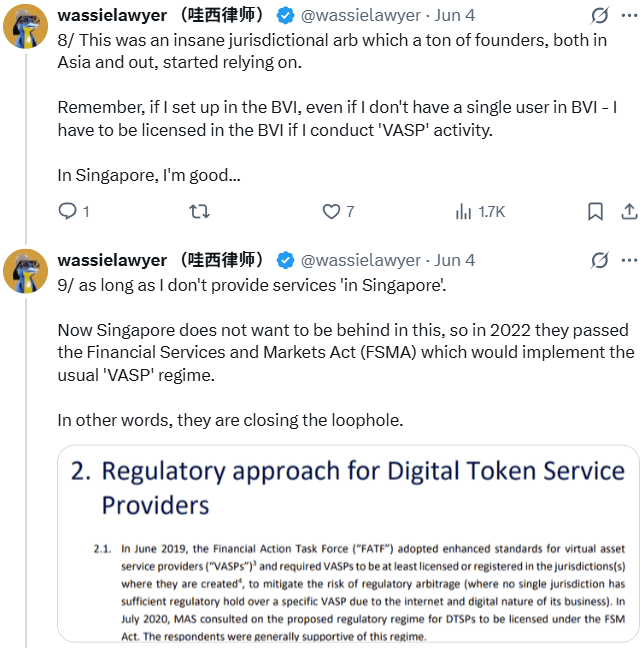

Singapore’s Crypto Crackdown: No Easy Escape for Unlicensed Firms

Singapore’s recent directive for unlicensed crypto firms to cease serving overseas customers signals a tightening regulatory environment globally, making it harder for companies to avoid compliance by relocating.

Singapore’s Crypto Crackdown: No Escape for Regulatory Arbitrage?

Singapore’s recent directive against unlicensed crypto firms serving overseas clients signals a tightening grip on regulatory loopholes, impacting the global crypto landscape.