Experts predict a potential rally for Bitcoin and altcoins following a 90-day tariff agreement between the US and China, exploring the implications for the cryptocurrency and stock markets.

Tag: Dollar

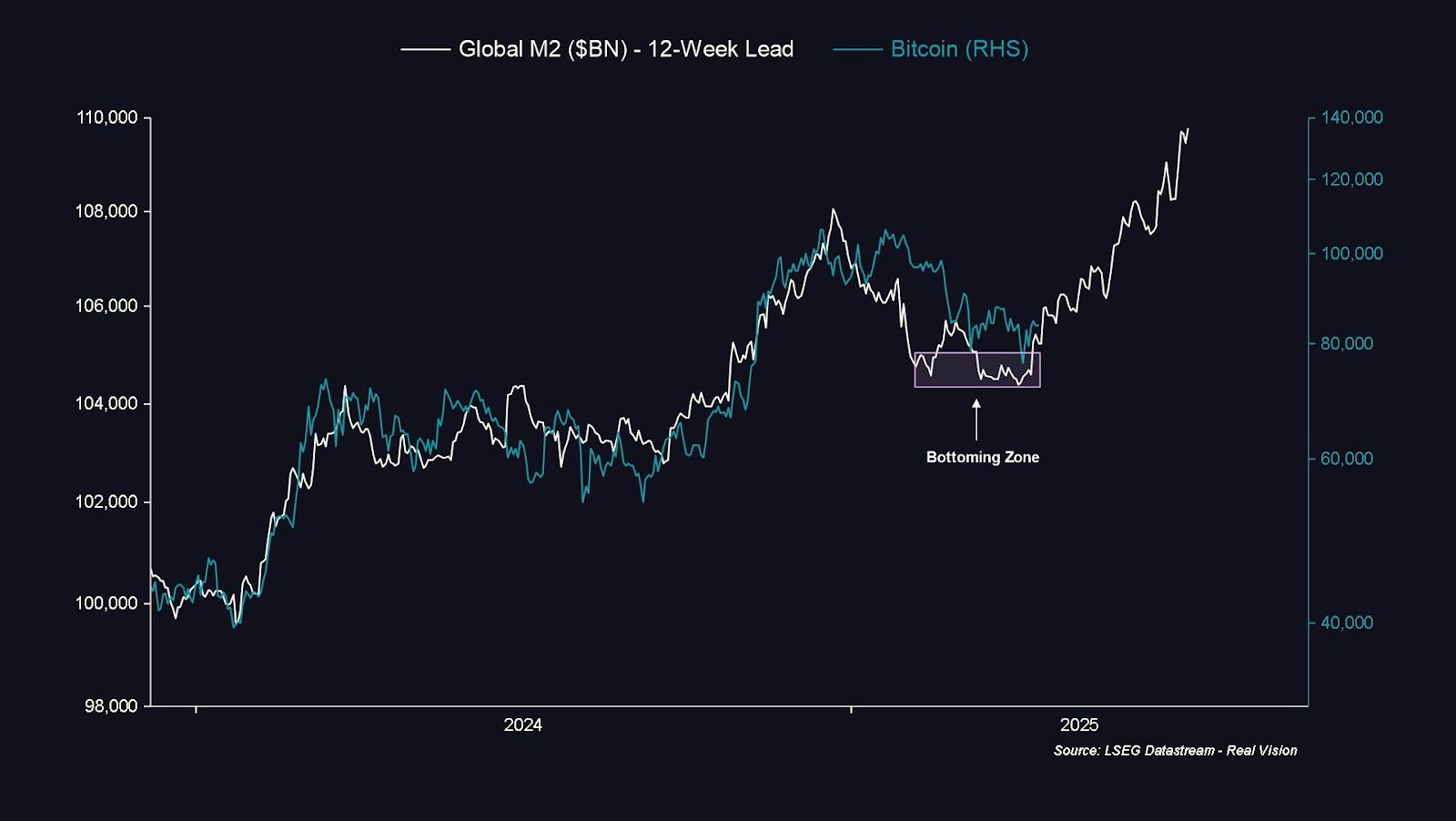

Bitcoin Price and Global Liquidity: Analyzing the Correlation and Future Outlook

Explore the strong correlation between Bitcoin’s price and global liquidity, analyzing the drivers and potential future impacts on the cryptocurrency market. Understand how global economic factors and central bank policies influence Bitcoin’s value and what to watch for in the coming years.

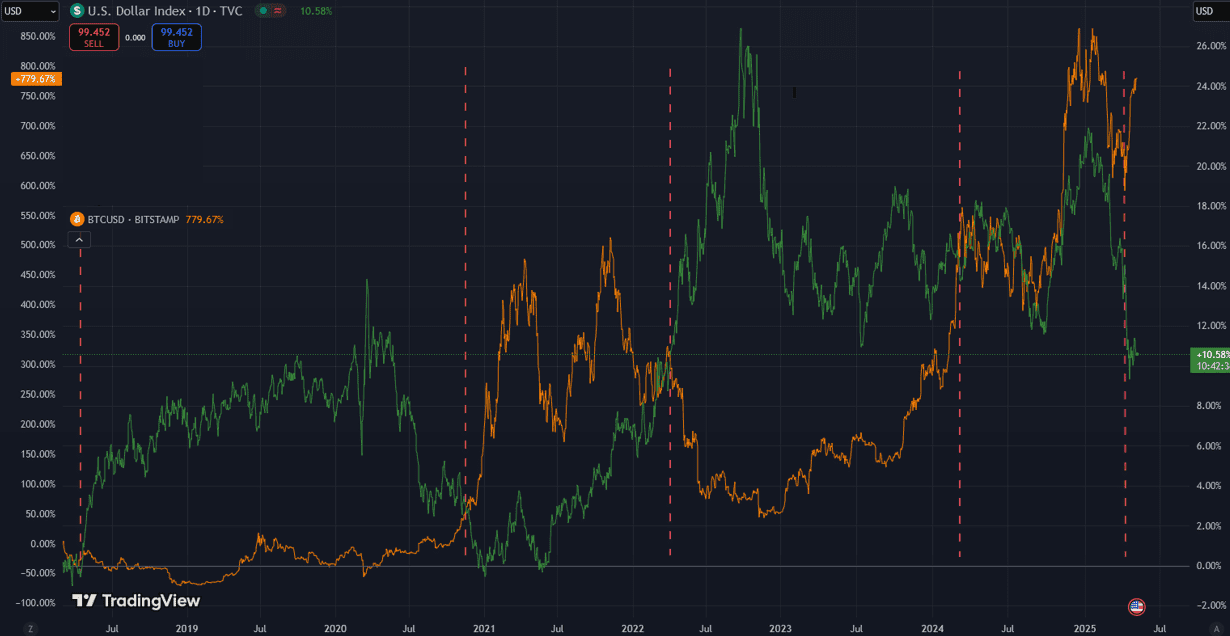

Bitcoin’s Future as the US Dollar’s Dominance Declines: An In-Depth Analysis

Explore how the weakening US dollar, part of a potential long-term financial strategy, could position Bitcoin and other alternative assets for significant growth. Understand the implications of de-dollarization and where to invest in a changing monetary landscape.

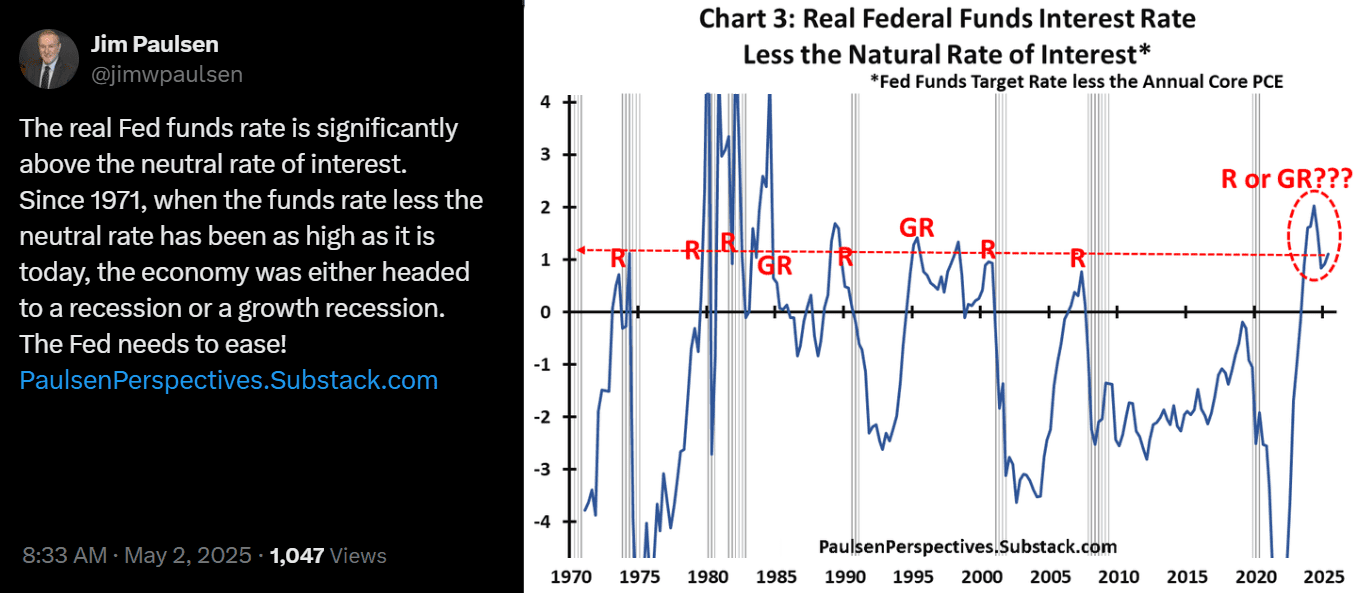

Bitcoin’s Potential Rally: How the Fed’s Decisions and Liquidity Injections Could Fuel Crypto Growth

Explore the factors influencing Bitcoin’s price, including potential Federal Reserve decisions, liquidity injections, and the weakening US dollar. Understand why some analysts believe Bitcoin could rally, acting as a hedge against economic uncertainty.

XRP Price Drop: Unpacking the Reasons Behind Today’s Downturn and What’s Next

XRP’s price is down today. We delve into the factors influencing this decline, including Ripple’s strategy shift, open interest reduction, and technical analysis indicators, offering insights into potential future price movements.