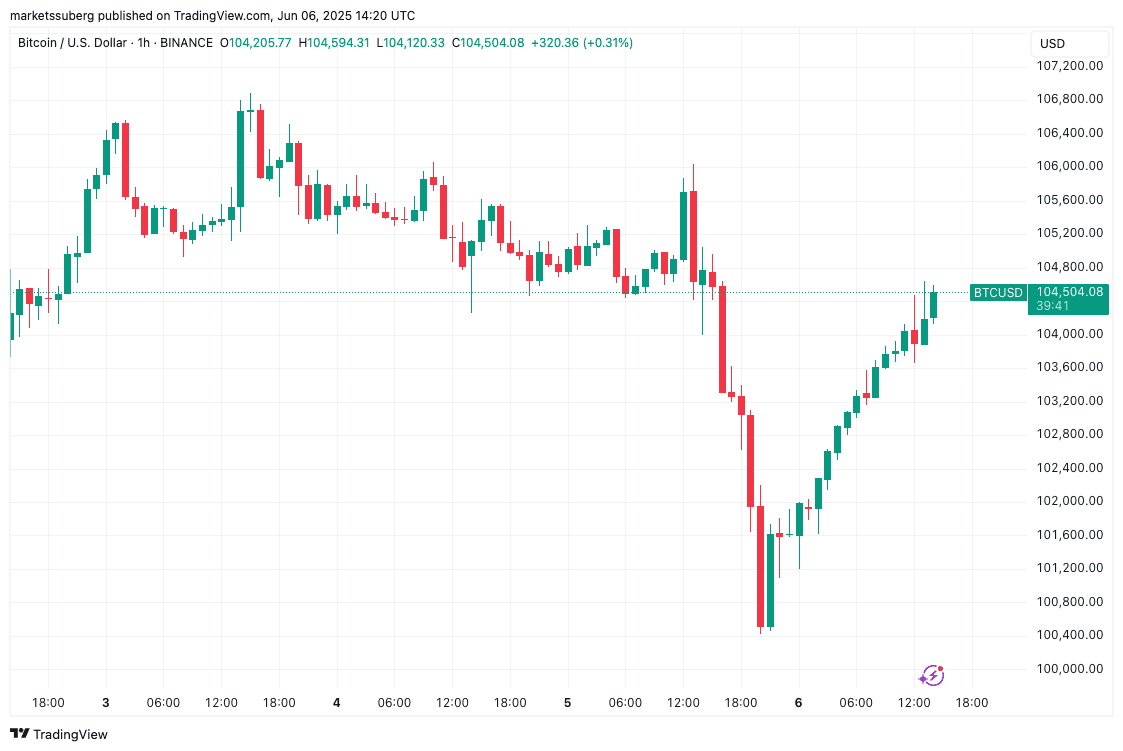

Bitcoin continues its recovery while Donald Trump pressures the Federal Reserve for a ‘full point’ interest rate cut, adding a layer of complexity to the market outlook.

Tag: Federal Reserve

Bitcoin to $112K? Analyst Says Fed Rate Cut Timing is Key

A market analyst suggests an earlier-than-expected interest rate cut by the U.S. Federal Reserve could propel Bitcoin toward the $112,000 mark.

Michelle Bowman’s Fed Confirmation: A Green Light for Crypto Innovation?

The confirmation of Michelle “Miki” Bowman as the Fed’s vice chair for supervision signals a potential shift in the regulatory landscape for digital assets. Here’s why it matters.

Bitcoin to $150K? VC Firm Highlights Regulatory Catalysts and Stablecoin Impact

Foresight Ventures believes regulatory clarity around Bitcoin reserves and stablecoins could propel Bitcoin to new heights in 2025. Here’s a breakdown of their analysis and what it means for the market.

Bitcoin to $150K? Expert Says US Policy & Stablecoins are Key

A venture capital expert believes that regulatory clarity in the US, particularly regarding Bitcoin reserves and stablecoins, could drive Bitcoin to new heights in the current market cycle.