Explore how corporate adoption, inflation hedge narratives, and potential Fed actions are supporting Bitcoin’s price, despite recession concerns and market volatility. Is Bitcoin becoming an antifragile asset?

Tag: Interest Rate

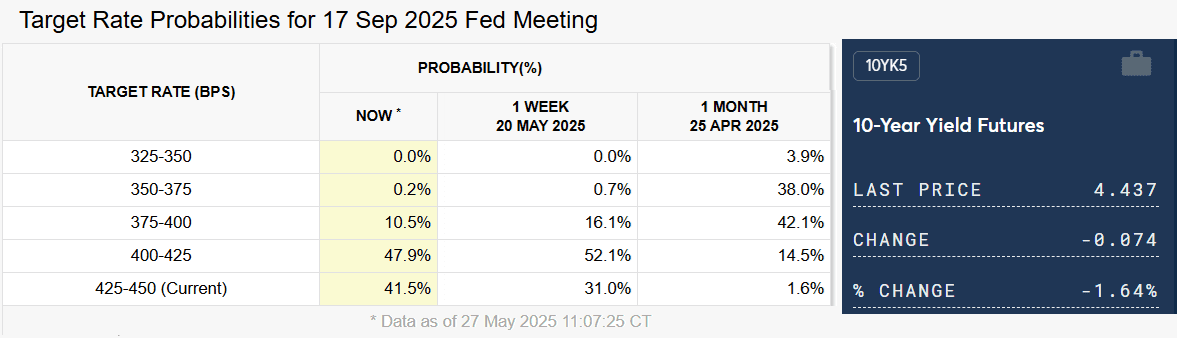

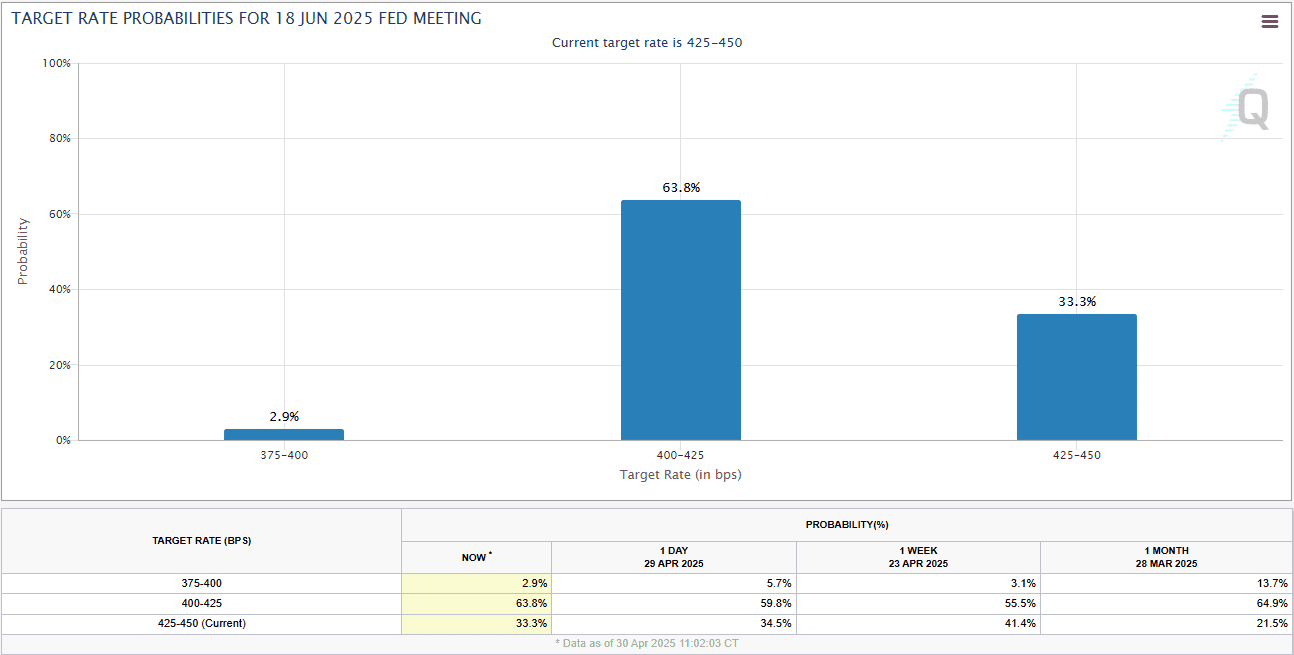

Bitcoin Eyes $98K Amidst Shifting Fed Rate Cut Expectations: A Comprehensive Analysis

A detailed analysis of Bitcoin’s recent price surge towards $98,000, influenced by macroeconomic factors, Federal Reserve policy, and evolving market sentiment regarding future interest rate cuts.

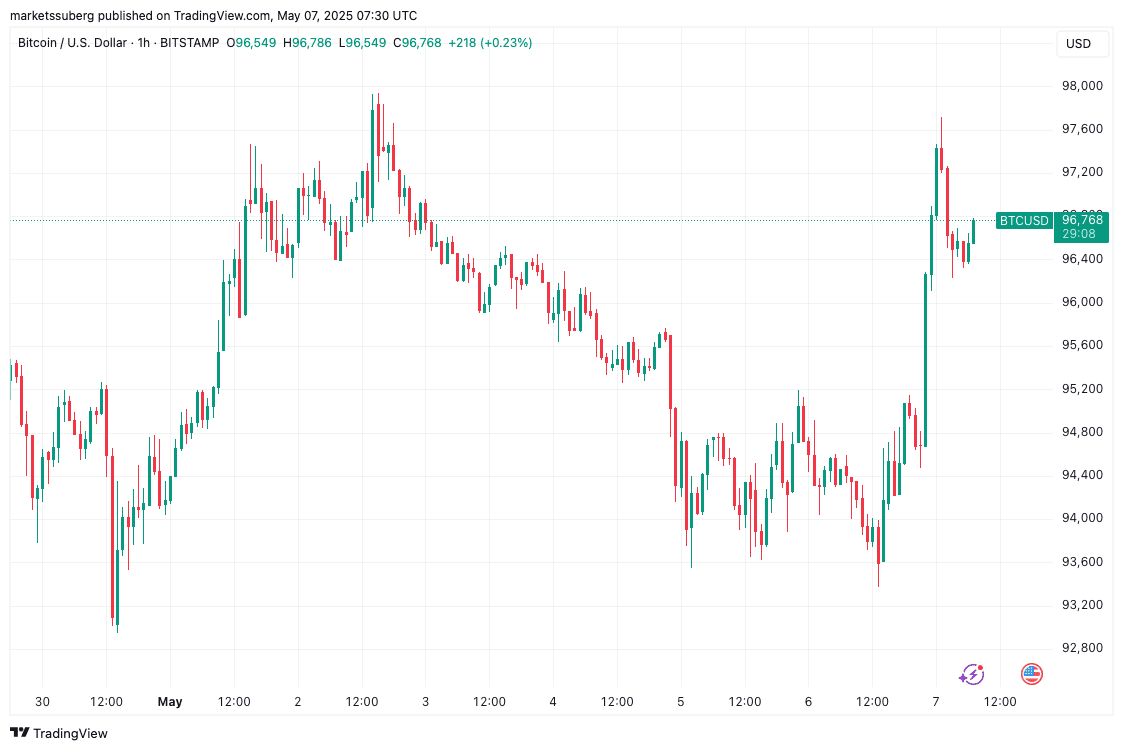

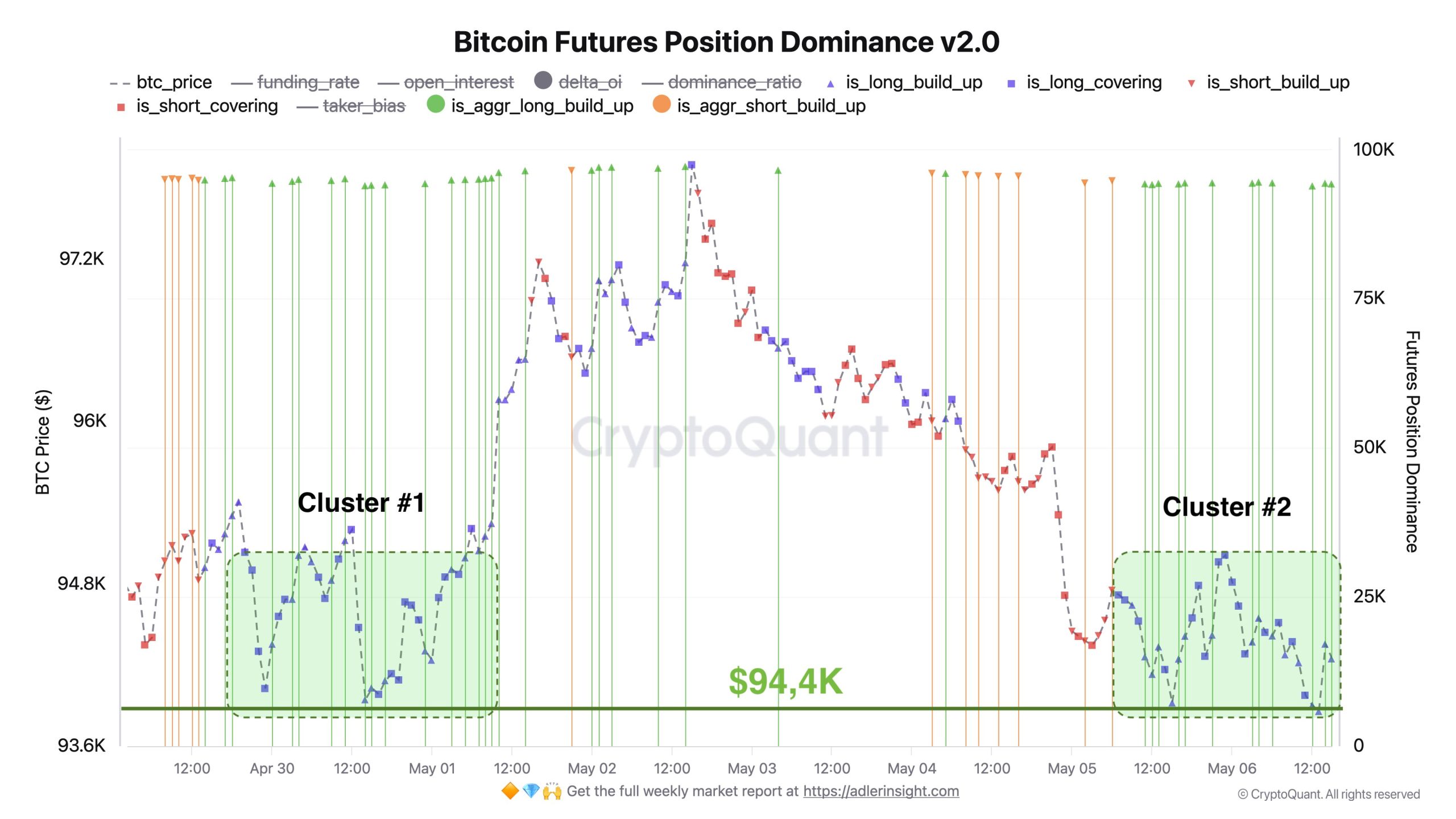

Bitcoin Bulls Anticipate FOMC Meeting: Long Positions Surge Ahead of Potential Volatility

Bitcoin bulls are increasing long positions as the market awaits the Federal Open Market Committee (FOMC) meeting. Analysts predict potential volatility following the Fed’s statements, with Bitcoin’s price momentum historically slowing before FOMC decisions.

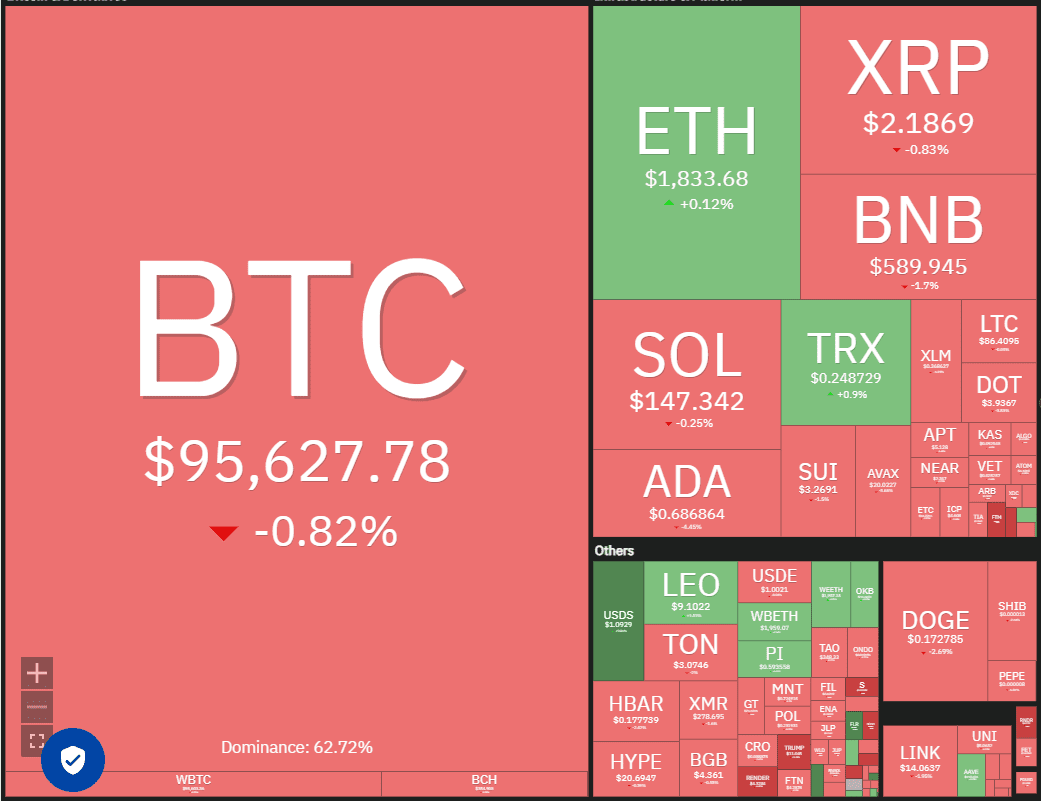

Bitcoin Price Analysis: Will the Fed Rate Hike Week Cool the Bullish Momentum? Analyzing HYPE, AAVE, RNDR, and FET

Bitcoin’s price faces a crucial test amid Federal Reserve rate hike expectations. This analysis explores the potential impact on Bitcoin and examines bullish setups in HYPE, AAVE, RNDR, and FET.

Bitcoin Rebounds to $95K Amid US GDP Concerns: A Comprehensive Analysis

Bitcoin price recovers to near $95,000 despite bearish US GDP data. Explore factors driving the rebound, including potential Fed easing and investor sentiment.