Circle, the issuer of USDC, went public on the NYSE, and JPMorgan will accept crypto ETFs as loan collateral. Here’s a breakdown of why these developments matter for the crypto market.

Tag: JPMorgan Chase

JPMorgan Embraces Crypto ETFs as Loan Collateral: A Game Changer?

JPMorgan Chase is reportedly planning to accept crypto ETFs as collateral for loans, signaling a major shift in institutional acceptance of digital assets and potentially impacting market liquidity.

Crypto News Today: Circle Upsizes IPO, JPMorgan Embraces Crypto ETFs, Bitcoin Supply Squeeze Looms

A quick rundown of today’s top crypto news: Circle increases its IPO size, JPMorgan will accept crypto ETFs as collateral, and Sygnum warns of a potential Bitcoin supply squeeze and price surge.

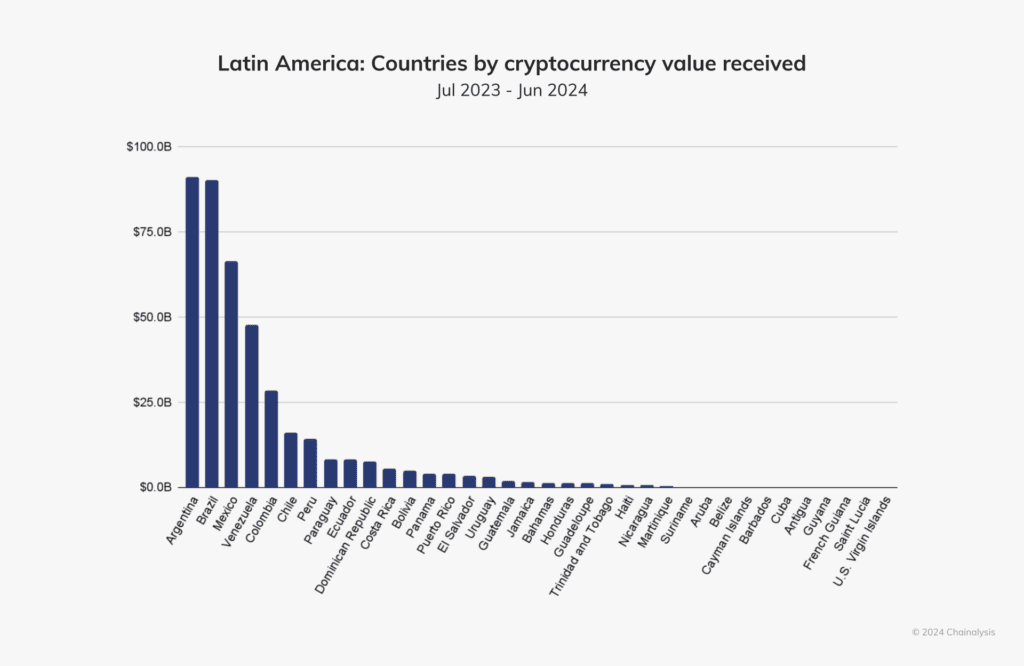

Taurus and Parafin Partner to Provide Crypto Infrastructure to Institutions in Europe and Latin America

Taurus and Parafin have joined forces to offer blockchain infrastructure to financial institutions in Europe and Latin America, aiming to boost crypto adoption. The partnership provides custody, governance, and compliant token issuance solutions.

US Banks Explore Joint Stablecoin: A Deep Dive into the Potential Implications

Major US banks, including JPMorgan, Bank of America, Citigroup, and Wells Fargo, are reportedly in preliminary discussions to launch a joint stablecoin. This move could revolutionize digital payments and challenge the traditional banking model. Learn more about the potential impact and regulatory landscape.