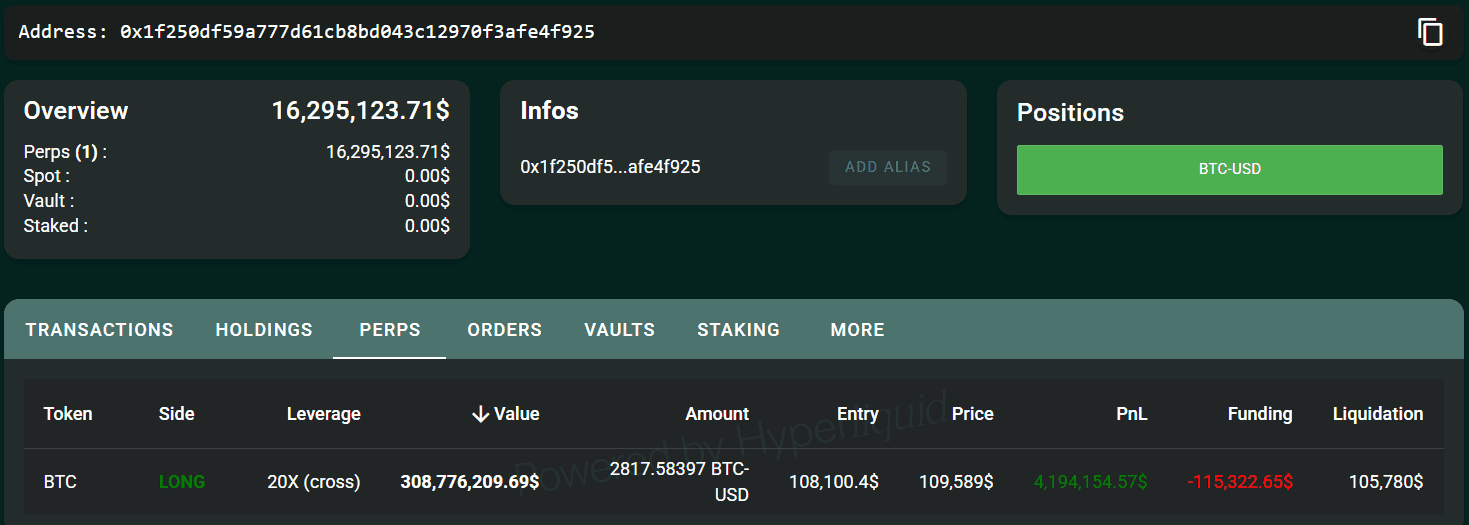

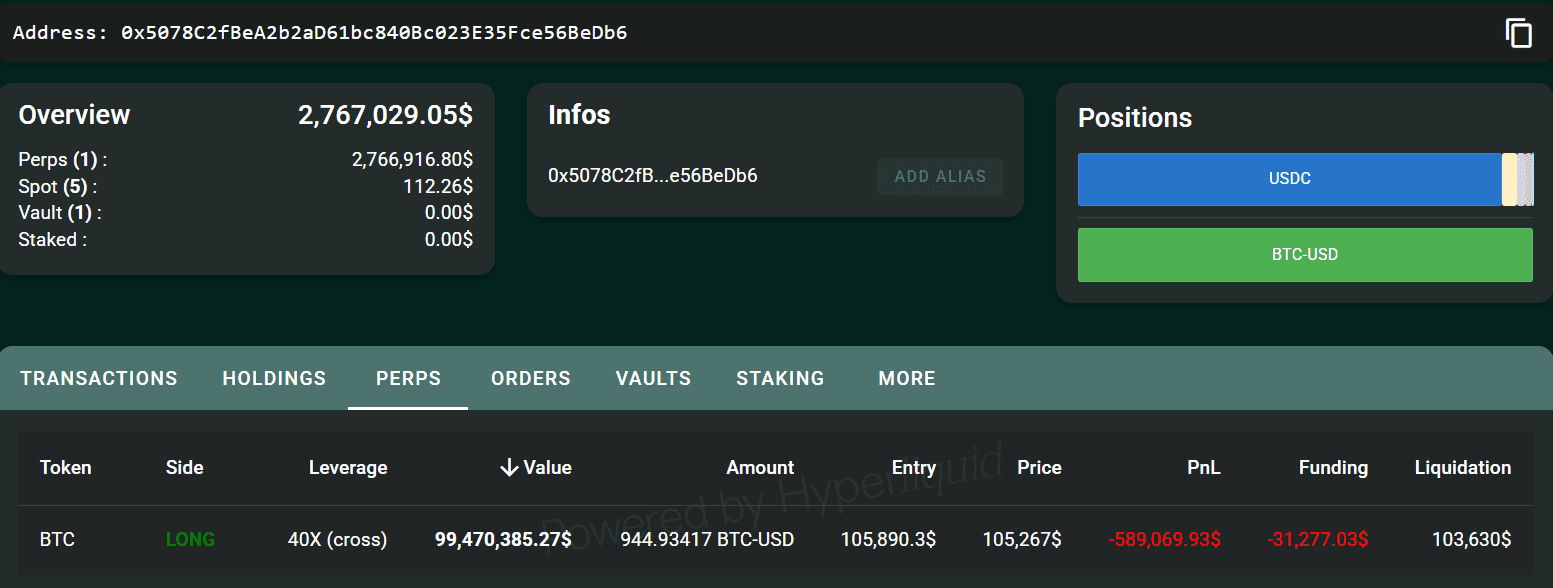

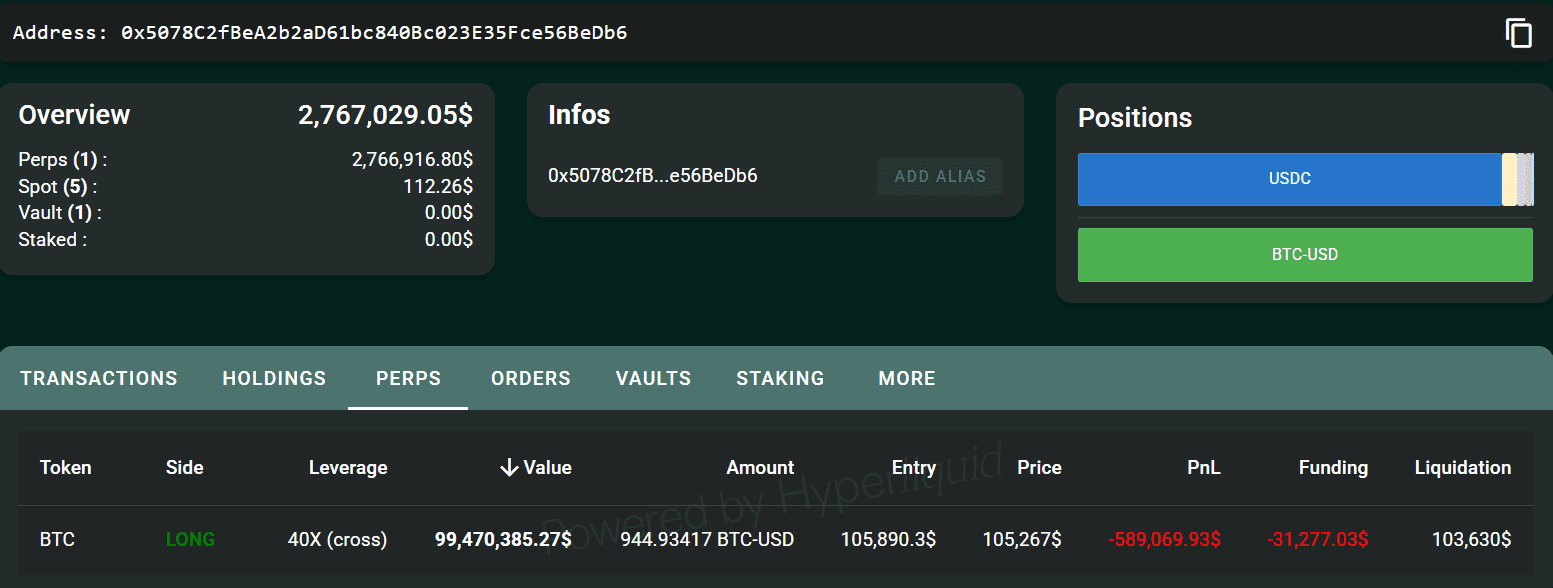

A massive $300 million leveraged Bitcoin position has been opened, sparking speculation about the identity of the trader, with some pointing to James Wynn.

Tag: Leverage

Whale Alert: James Wynn’s Second $100M Bitcoin Bet – Market Manipulation?

Crypto trader James Wynn makes another high-stakes Bitcoin bet after recent liquidation, alleging market manipulation. What does this mean for Bitcoin’s price?

Whale Alert: James Wynn's Second $100M Bitcoin Bet Fuels Market Manipulation Claims

Multimillionaire James Wynn doubles down with another $100M leveraged Bitcoin position, triggering allegations of market manipulation after his previous liquidation.

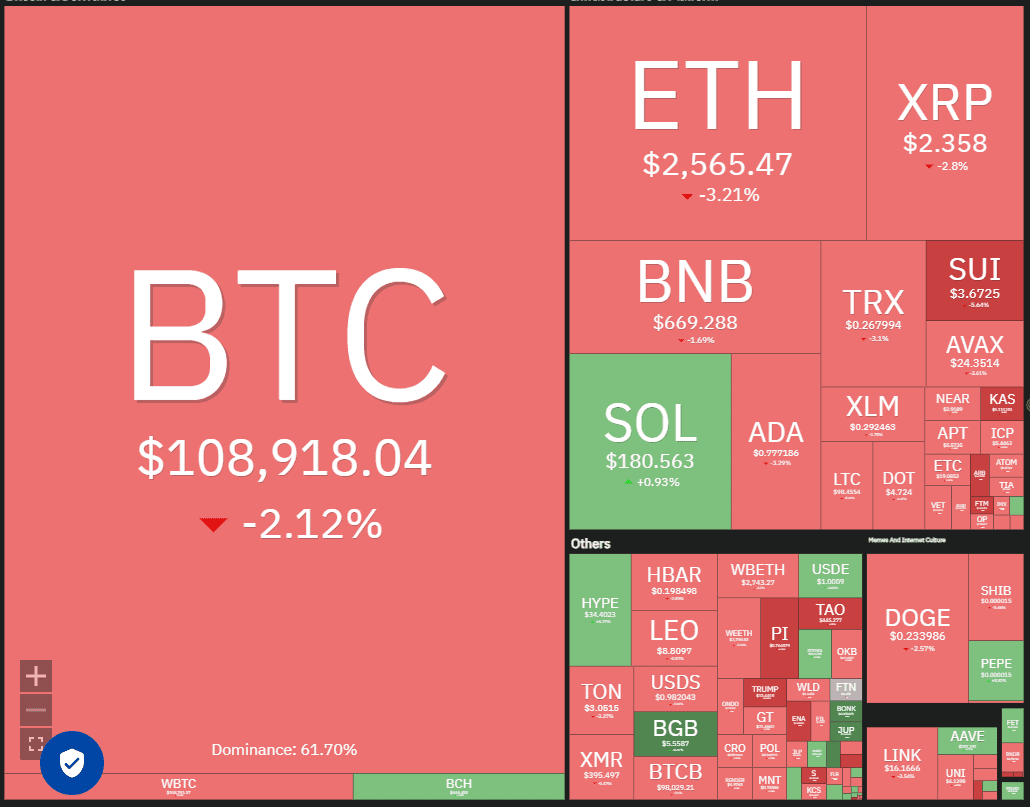

Crypto Price Predictions (May 23): BTC, ETH, XRP, BNB, SOL, DOGE, ADA, SUI, HYPE, LINK – Analysis & Forecast

Comprehensive price predictions and technical analysis for Bitcoin (BTC), Ethereum (ETH), XRP, BNB, Solana (SOL), Dogecoin (DOGE), Cardano (ADA), Sui (SUI), Hyperliquid (HYPE), and Chainlink (LINK) as of May 23. Get insights into key support and resistance levels, potential breakout scenarios, and expert opinions on market trends.

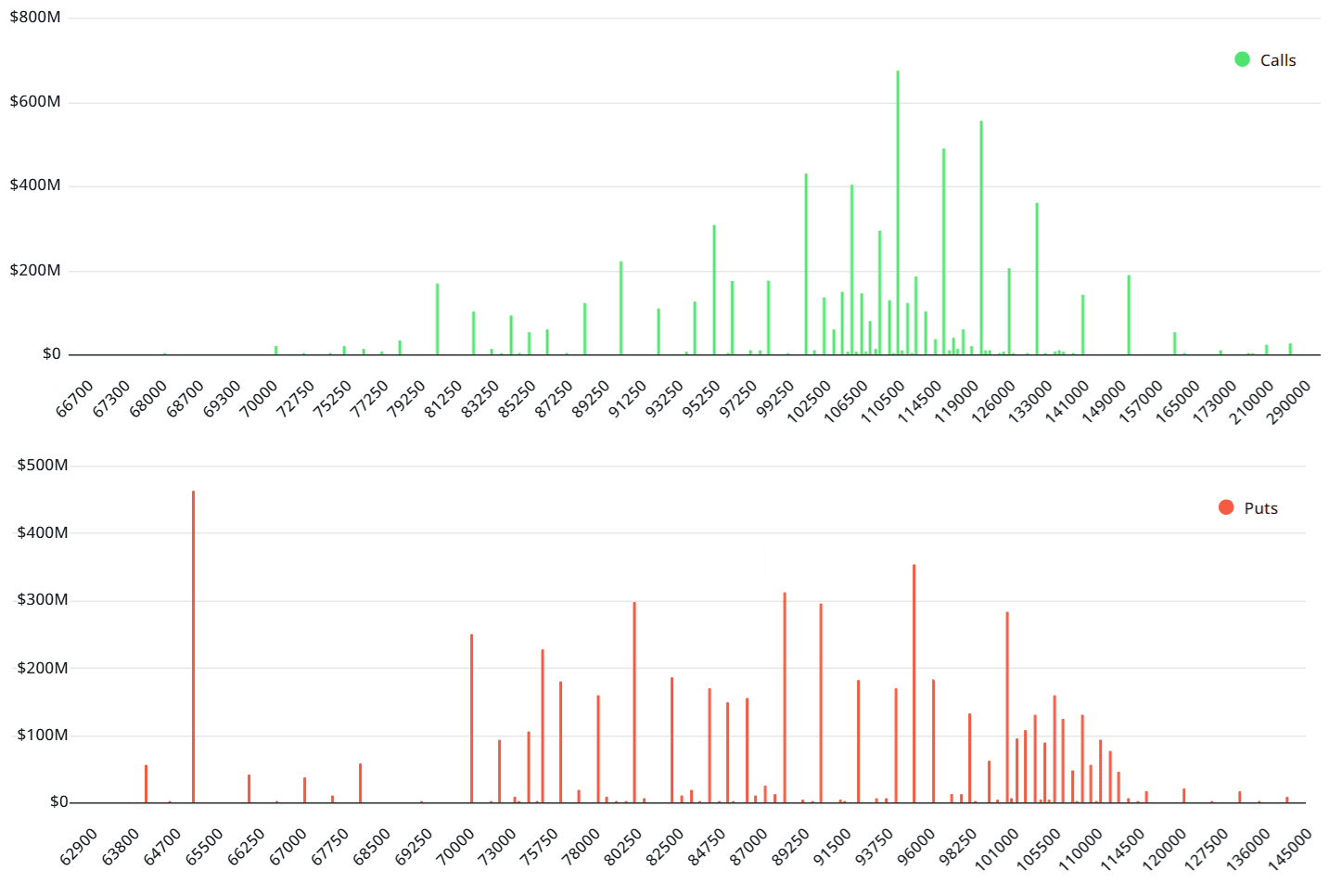

Bitcoin Bulls Eye $110K Target Before $13.8B Options Expiry: A Comprehensive Analysis

A deep dive into Bitcoin’s upcoming $13.8 billion options expiry, analyzing the potential for bulls to push BTC above $110,000 and the factors influencing the market, including ETF inflows and options strategies.