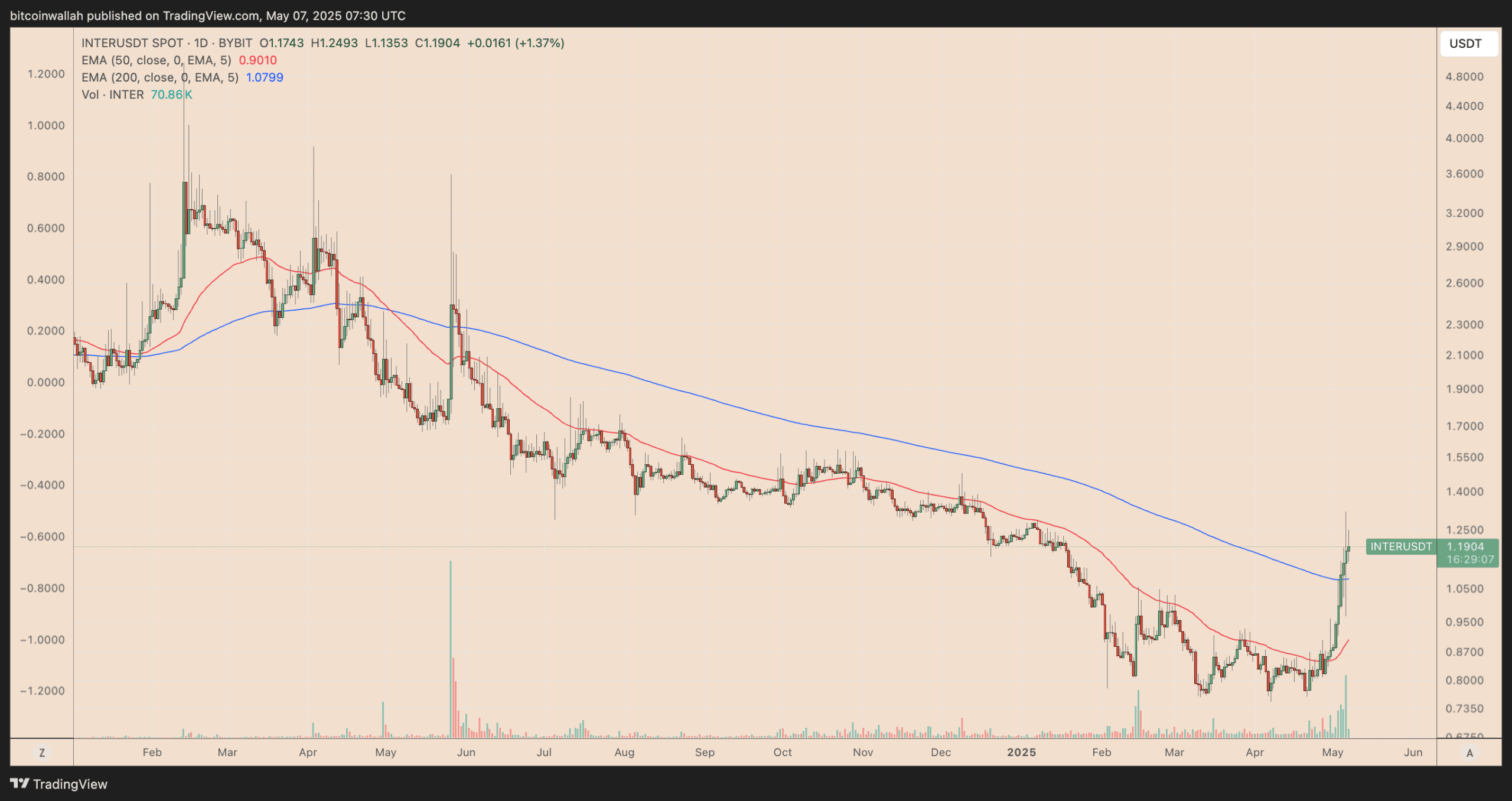

Explore the Inter Milan Fan Token’s price surge after their Champions League win, the impact of match outcomes on fan token values, and a detailed analysis of PSG and AFC tokens.

Tag: Market Analysis

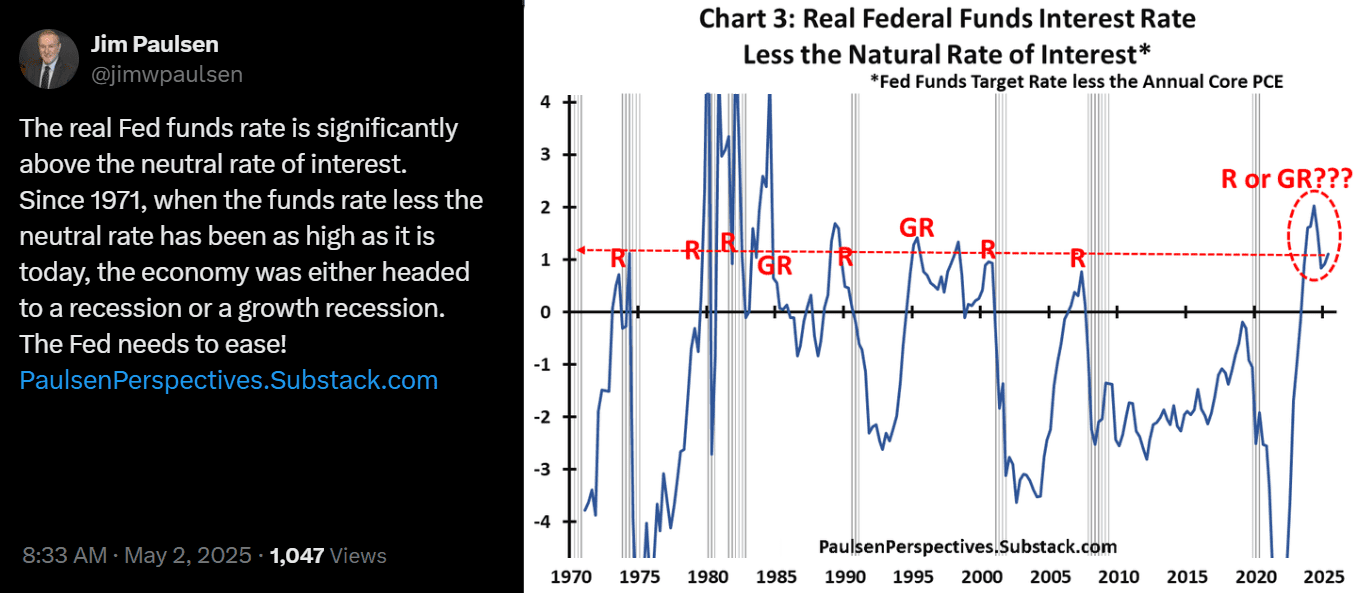

Bitcoin’s Potential Rally: How the Fed’s Decisions and Liquidity Injections Could Fuel Crypto Growth

Explore the factors influencing Bitcoin’s price, including potential Federal Reserve decisions, liquidity injections, and the weakening US dollar. Understand why some analysts believe Bitcoin could rally, acting as a hedge against economic uncertainty.

XRP Price Drop: Unpacking the Reasons Behind Today’s Downturn and What’s Next

XRP’s price is down today. We delve into the factors influencing this decline, including Ripple’s strategy shift, open interest reduction, and technical analysis indicators, offering insights into potential future price movements.

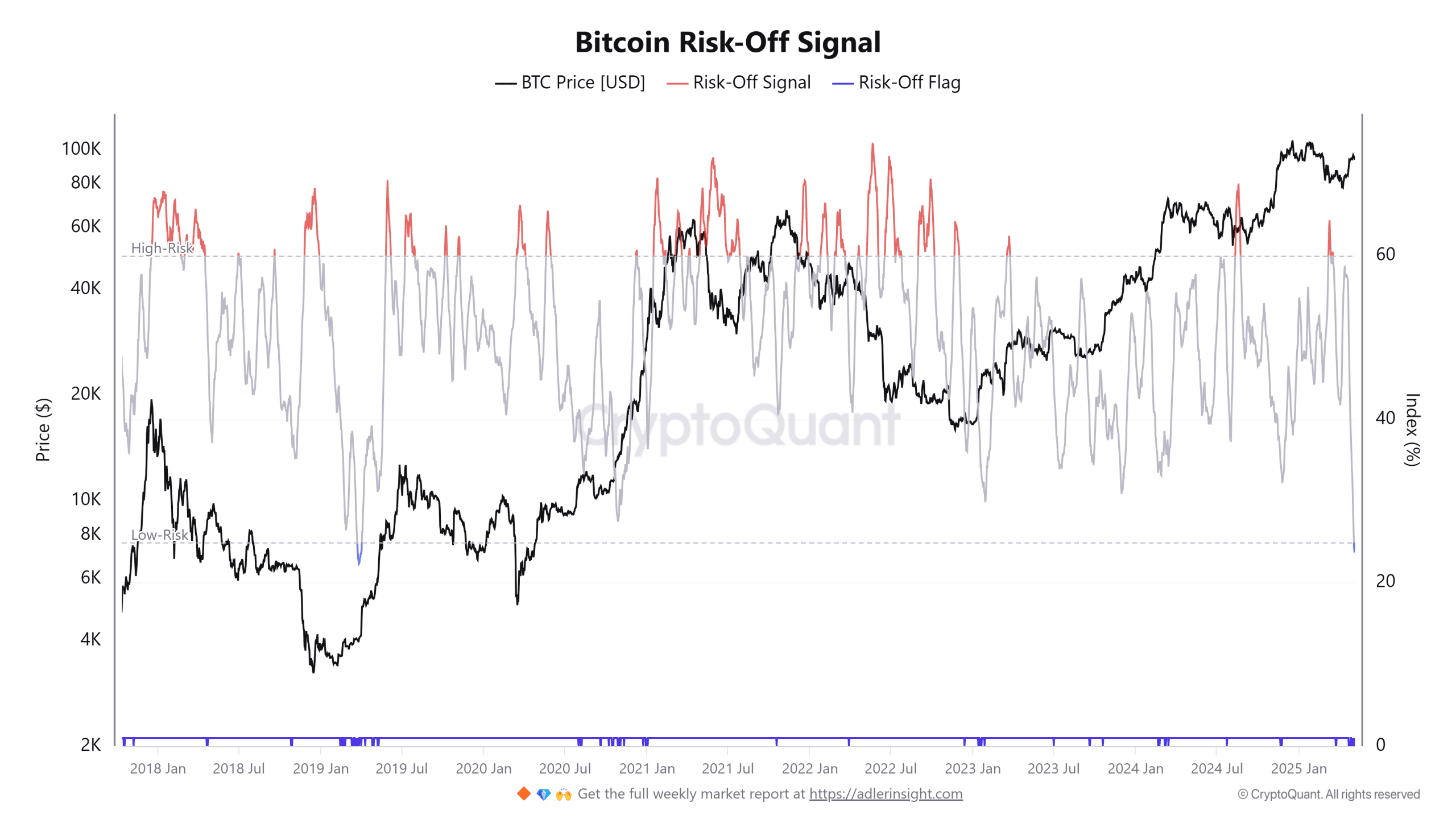

Bitcoin’s Bullish Outlook: On-Chain Signals Point to Potential Rally

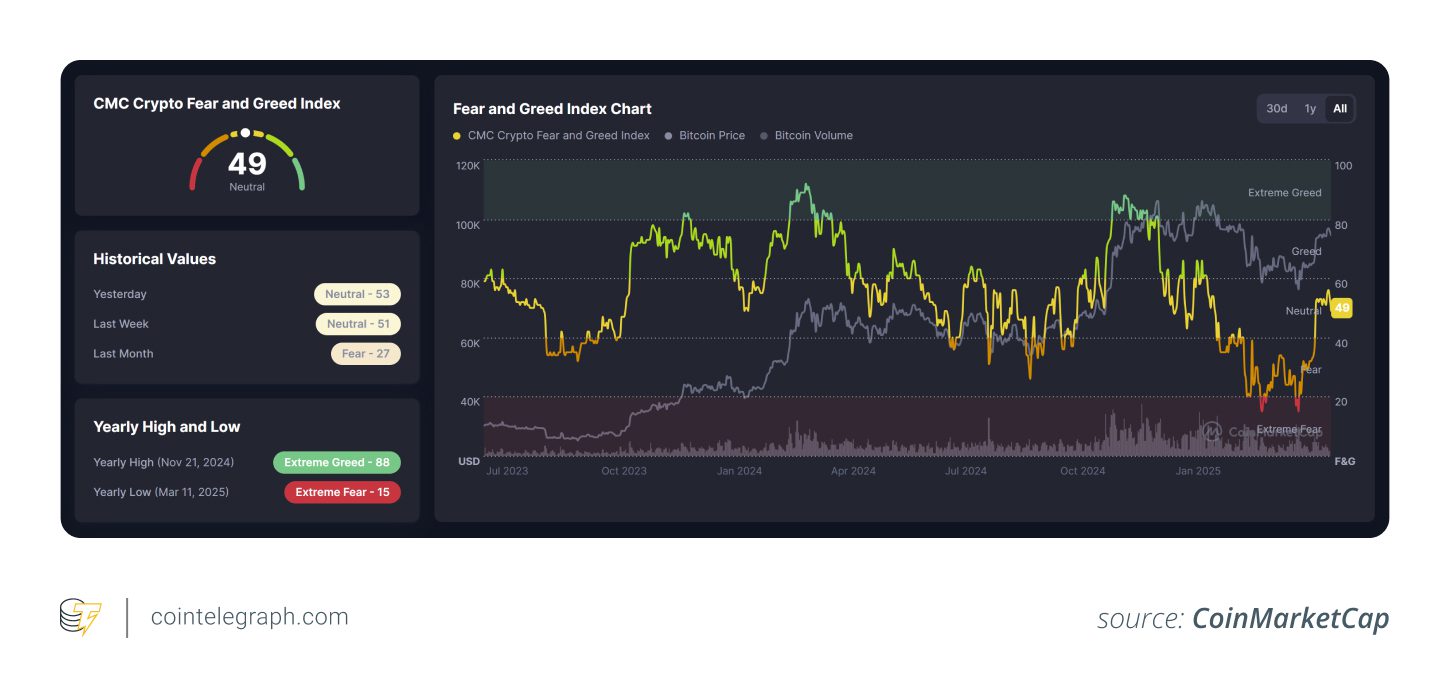

Bitcoin’s ‘Risk-Off’ signal hits a 5-year low, mirroring a pattern that preceded a 1,550% rally. Will history repeat itself? Macro indicators suggest a bullish future despite recent network activity dips.

Bull vs. Bear Market: How to Identify Trends and Trade Smart

Learn how to identify bull and bear markets in crypto using key indicators like price action, volume, sentiment, and on-chain data. Discover strategies for navigating each market phase.