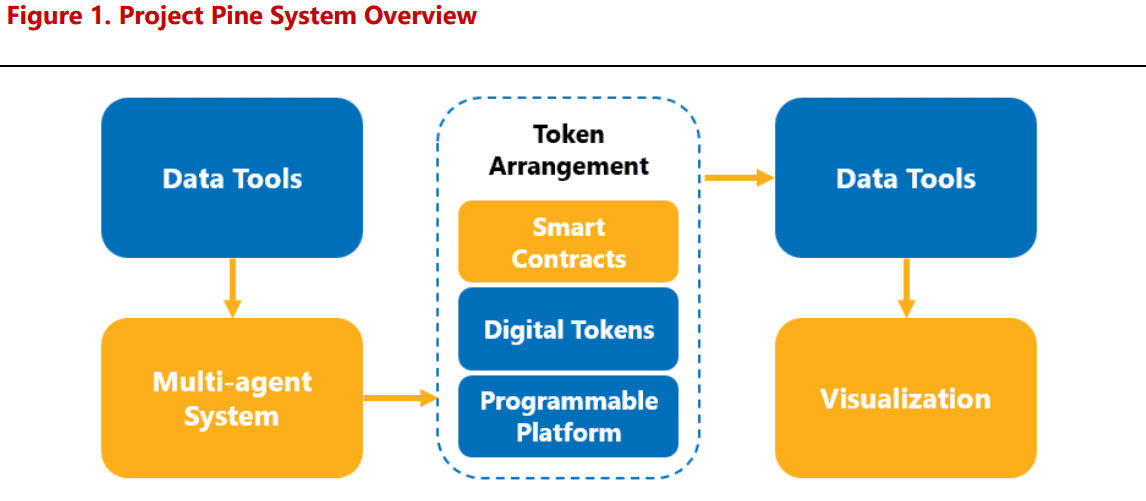

Central banks are experimenting with smart contract toolkits, as demonstrated by the BIS Project Pine, to enhance monetary policy implementation in tokenized environments. This exploration aims to provide faster and more flexible responses to financial events, though infrastructure limitations remain a challenge.

Tag: RWA Tokenization

Asset Tokenization to Revolutionize Capital Flows, Chainlink’s Nazarov Predicts

Chainlink co-founder Sergey Nazarov highlights asset tokenization’s potential to accelerate capital movement across traditional markets. Learn about Chainlink’s partnerships and the future of tokenized real-world assets.

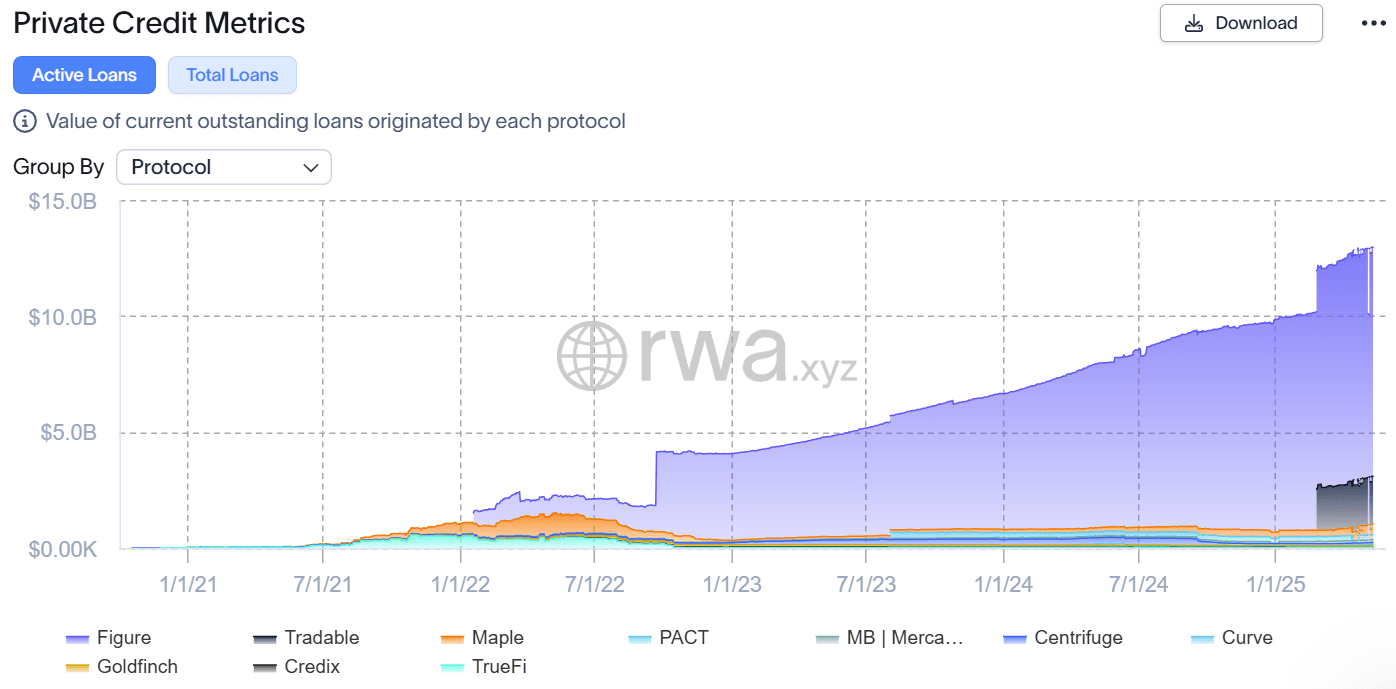

Pareto’s USP: Synthetic Dollar Bridging Private Credit and DeFi

Pareto has launched USP, a synthetic dollar backed by real-world private credit, aiming to connect institutional investors with Decentralized Finance (DeFi) opportunities. This move highlights the increasing integration of stablecoins within the financial sector.

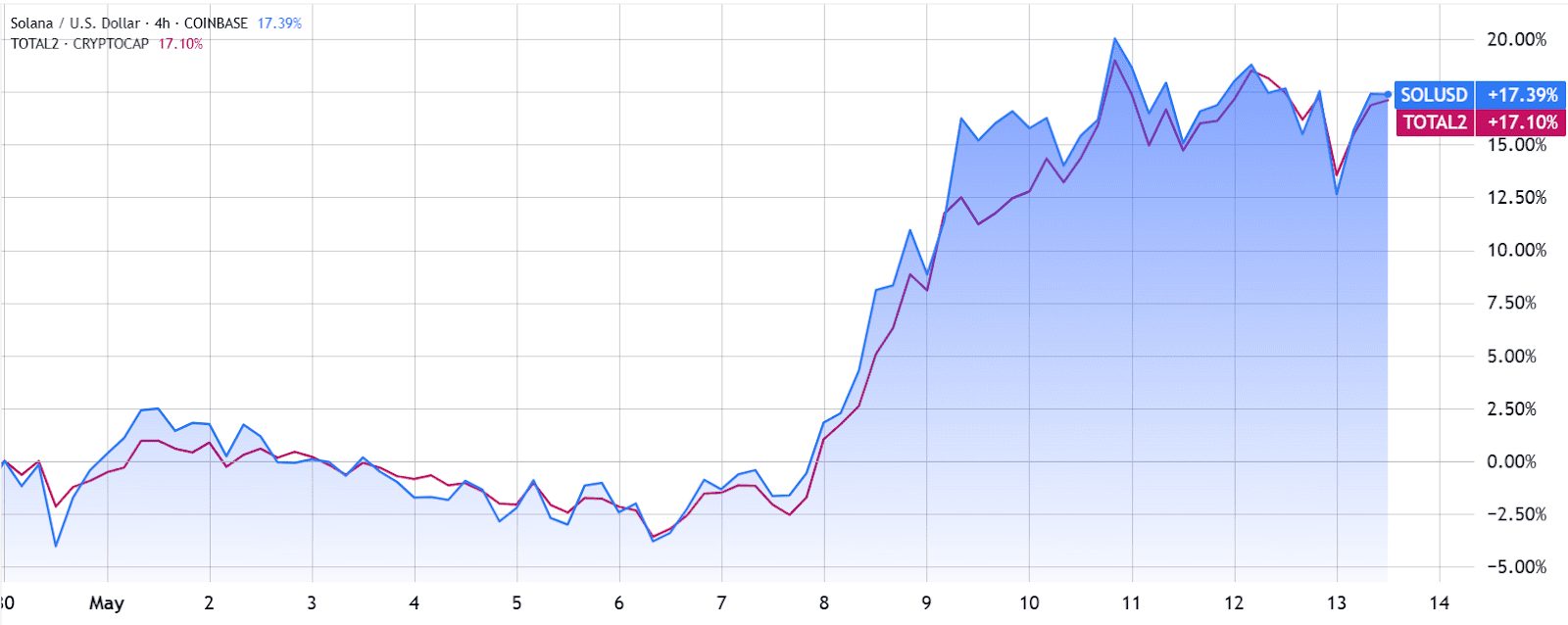

Solana (SOL) Price Prediction: Network Activity, DeFi Growth, and Potential for a Rally to $200

Analysis of Solana’s on-chain metrics, DeFi activity, and market sentiment suggests a potential price rally for SOL toward $200. Explore the factors driving Solana’s growth and future prospects.

US Real Estate Asset Manager Launches $100M Tokenized Fund with Institutional Backing on Chintai Blockchain

Patel Real Estate Holdings (PREH) introduces a $100 million tokenized fund on the Chintai blockchain, offering accredited investors access to institutional-grade real estate opportunities. The PREH Multifamily Fund focuses on vintage Class A multifamily units across the top 20 US growth markets, enhancing transparency and liquidity in private market placements.