South Korea’s ruling party is pushing forward with a crypto bill to legalize stablecoins, fulfilling a key campaign promise. What does this mean for the Korean crypto market and the broader industry?

Tag: Stablecoin

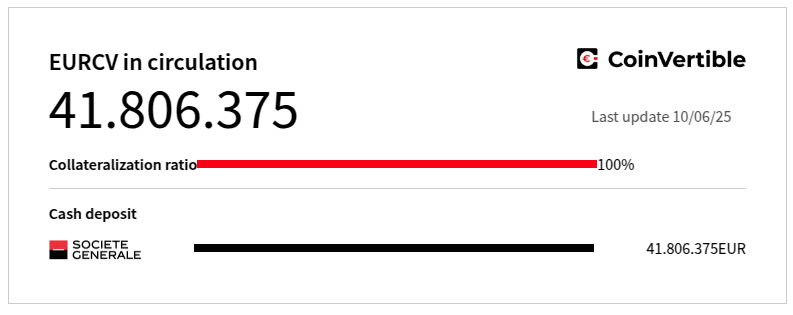

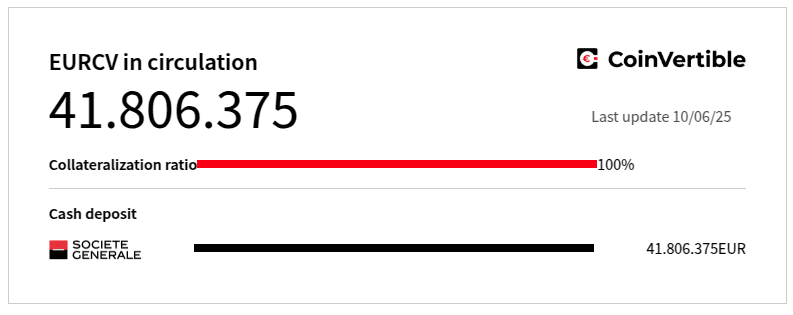

Société Générale Enters Stablecoin Arena with USD CoinVertible (USDCV) on Ethereum and Solana

Société Générale’s crypto division, SG Forge, has launched a USD-backed stablecoin, USDCV, on Ethereum and Solana, signaling traditional finance’s growing interest in digital assets.

South Korea to Legalize Stablecoins: What it Means for the Crypto Market

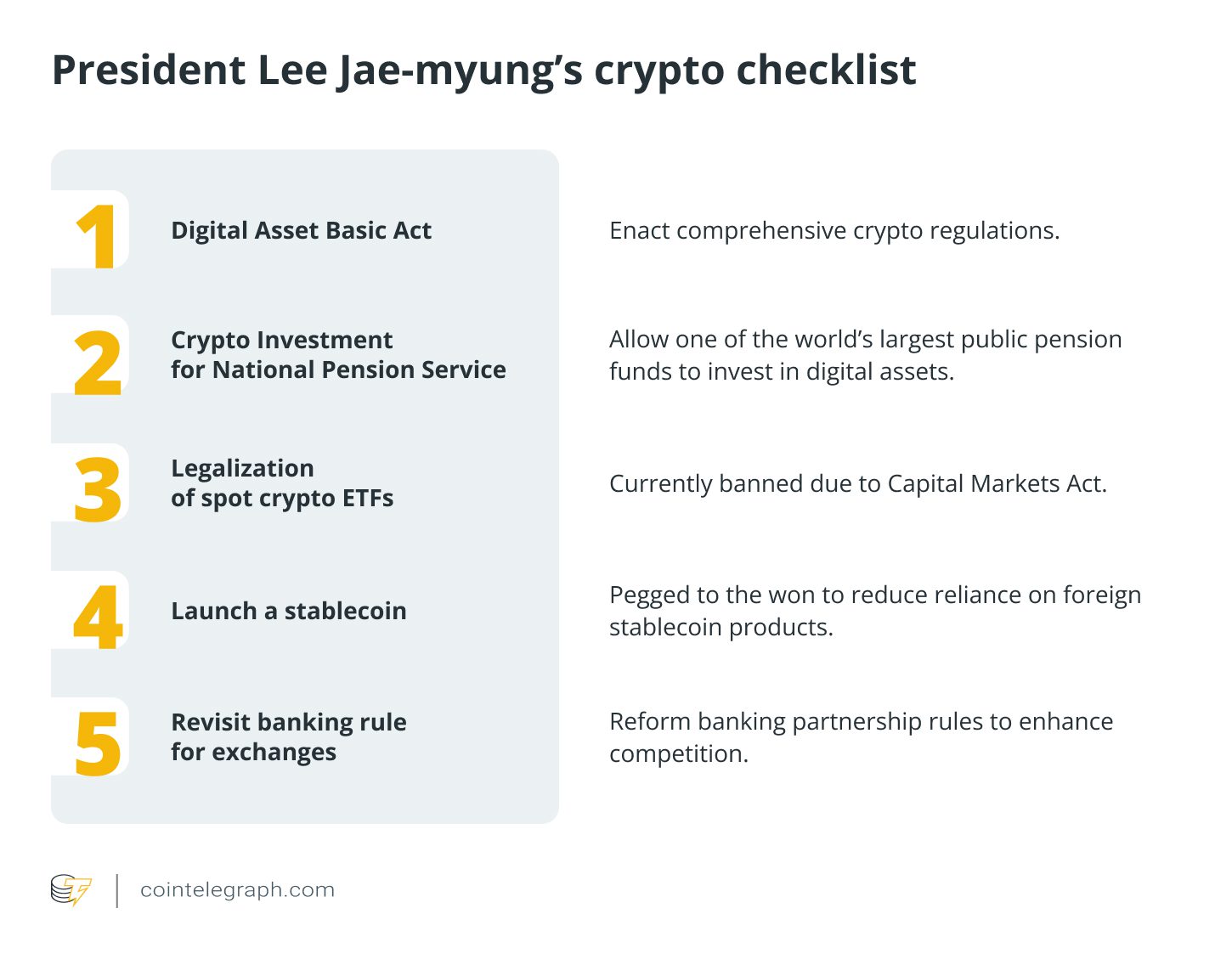

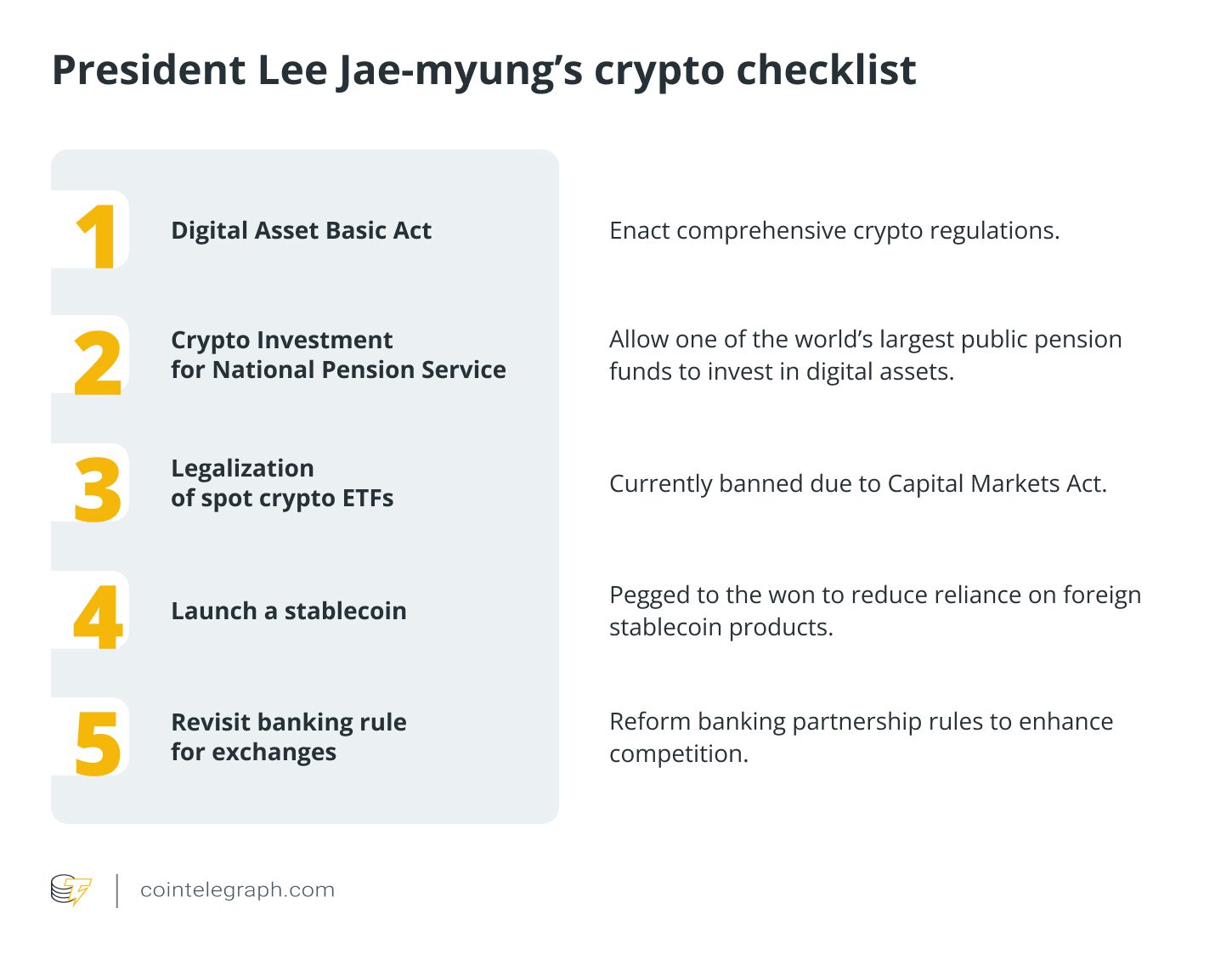

South Korea is moving towards legalizing stablecoins with a new crypto bill proposed by President Lee Jae-myung’s party. This aims to boost transparency and competition in the crypto sector.

Societe Generale Enters the USD Stablecoin Arena with USDCV Launch on Ethereum and Solana

Societe Generale’s crypto division, SG Forge, has launched USD CoinVertible (USDCV), a new USD-backed stablecoin on Ethereum and Solana, signaling traditional finance’s increasing interest in stablecoin markets.

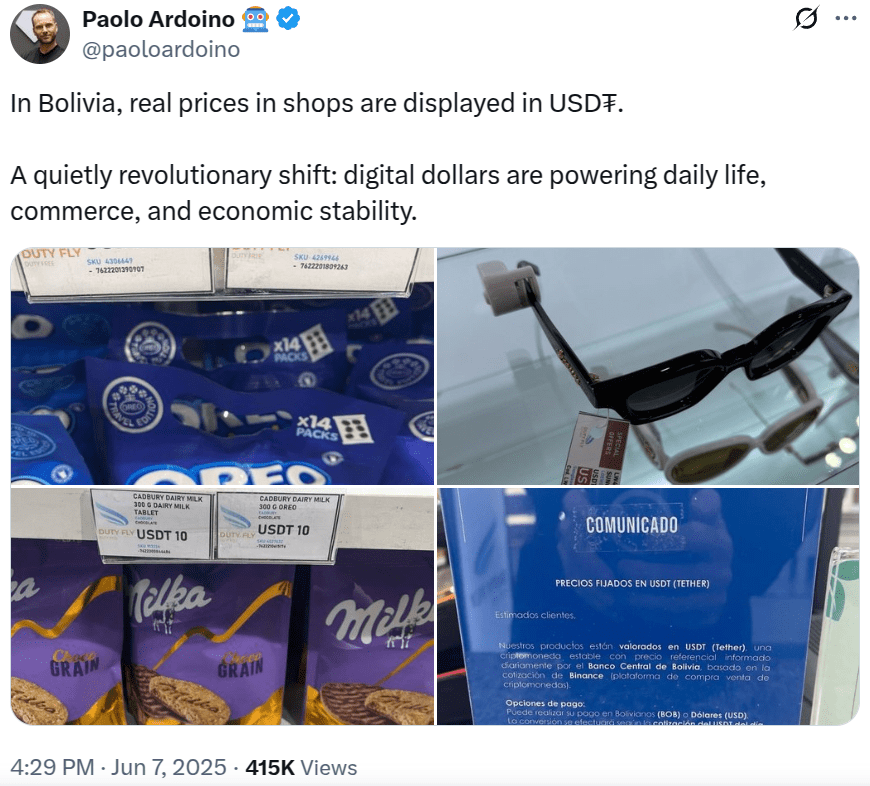

Tether’s USDT Emerges on Bolivian Price Tags Amid Economic Woes

The appearance of Tether’s USDT on price tags in a Bolivian airport shop, as highlighted by Tether CEO Paolo Ardoino, signals a growing reliance on stablecoins as a pricing benchmark in the nation’s struggling economy.