Fintech companies Taurus and Parafin have partnered to deliver blockchain infrastructure to financial institutions in Europe and Latin America, accelerating the adoption of crypto custody and settlement services across both regions. This collaboration aims to provide institutions with a comprehensive solution for managing digital assets.

Taurus has integrated its product suite into Parafin’s institutional platform, creating an end-to-end solution for digital asset management. This includes custody, governance, and compliant token issuance, according to the announcement made on May 27.

Financial institutions using the integrated Taurus-Parafin solution gain access to custody and tokenization services, real-time wallet execution, and a full range of trading capabilities. The partnership seeks to simplify and streamline digital asset management for institutions.

Taurus is known for its enterprise digital asset custody and tokenization solutions, enabling businesses to issue, store, and trade various crypto products. Parafin, while not blockchain-native, offers financial infrastructure and merchant services for small businesses. Valued at $750 million in December after a $100 million late-stage funding round, Parafin’s reach extends into traditional finance.

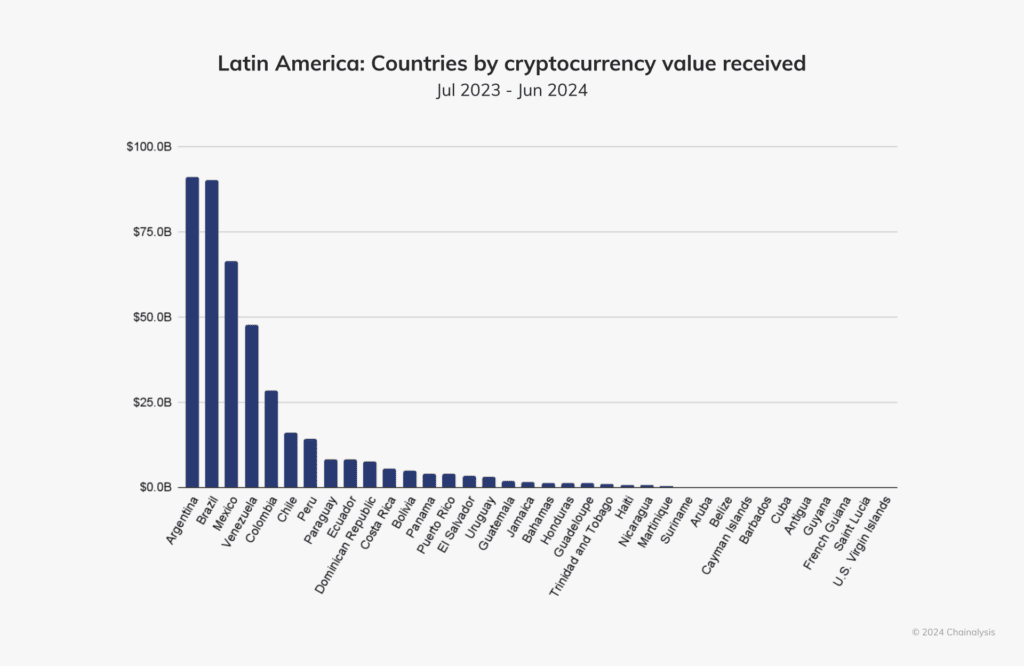

According to Taurus, the partnership expands its reach into Latin America, a region with growing crypto adoption.

Growing Institutional Interest in Crypto

The interest of financial institutions in Bitcoin and cryptocurrencies is increasing. Positive regulatory developments globally have spurred adoption. Banks are now offering custody services, facilitating crypto trading, and experimenting with blockchain technology.

In April, the US Federal Reserve eased restrictions on financial institutions engaging in cryptocurrency activities. Michael Saylor called the move a major milestone for banks looking to support digital assets.

Major banks, including Bank of America, Wells Fargo, Citigroup, and JPMorgan, have discussed potentially issuing a stablecoin, according to The Wall Street Journal. This move indicates a growing acceptance of digital assets by traditional financial institutions.

The report suggests that the US banking sector sees yield-bearing stablecoins as a potential threat to traditional business models.

Key Takeaways from the Taurus-Parafin Partnership

- Expanded Crypto Infrastructure: Taurus and Parafin provide broader blockchain infrastructure in Europe and Latin America.

- Comprehensive Solutions: The partnership delivers end-to-end digital asset management solutions for institutions.

- Increased Adoption: Aimed at accelerating the adoption of crypto services among financial institutions.

- Regulatory Impact: Positive regulatory developments and easing restrictions are driving institutional crypto interest.

- Stablecoin Interest: Major banks are exploring issuing stablecoins, indicating a shift in the financial landscape.

The Future of Institutional Crypto Adoption

The collaboration between Taurus and Parafin, along with other industry developments, signifies a growing trend of institutional adoption of cryptocurrencies. Factors influencing this trend include:

- Regulatory Clarity: Clearer regulatory frameworks provide institutions with the confidence to engage in crypto activities.

- Technological Advancements: Improved blockchain infrastructure and custody solutions make it easier for institutions to manage digital assets.

- Market Demand: Growing demand from clients for crypto services drives institutions to offer these products.

- Competitive Pressure: As more institutions enter the crypto space, others feel compelled to follow suit to remain competitive.

The partnership between Taurus and Parafin is a step towards bridging the gap between traditional finance and the digital asset world. As institutions increasingly embrace crypto, it could lead to further innovation and growth in the financial industry.