Growing momentum for United States stablecoin regulation is reportedly pushing major tech firms like Apple, X, and Airbnb to explore digital token integration

According to a June 6 report from Fortune, at least four tech companies, including Apple, X, Airbnb and Google, are exploring stablecoins as a means to lower fees and improve cross-border payments. Each company is in a different stage of implementation, with Google perhaps the farthest ahead, having facilitated two stablecoin payments already.

Payment infrastructure companies are playing a role. For instance, Airbnb has been talking with Worldpay about using stablecoins, seeking to cut fees from credit card payment processors like Visa and Mastercard.

Social platform X has been talking with crypto companies about integrating stablecoins into its X Money app, the report says. Elon Musk has previously stated that he wants to broaden X’s reach to allow users to send and receive money. The company has already pursued money transmitter licenses across the US.

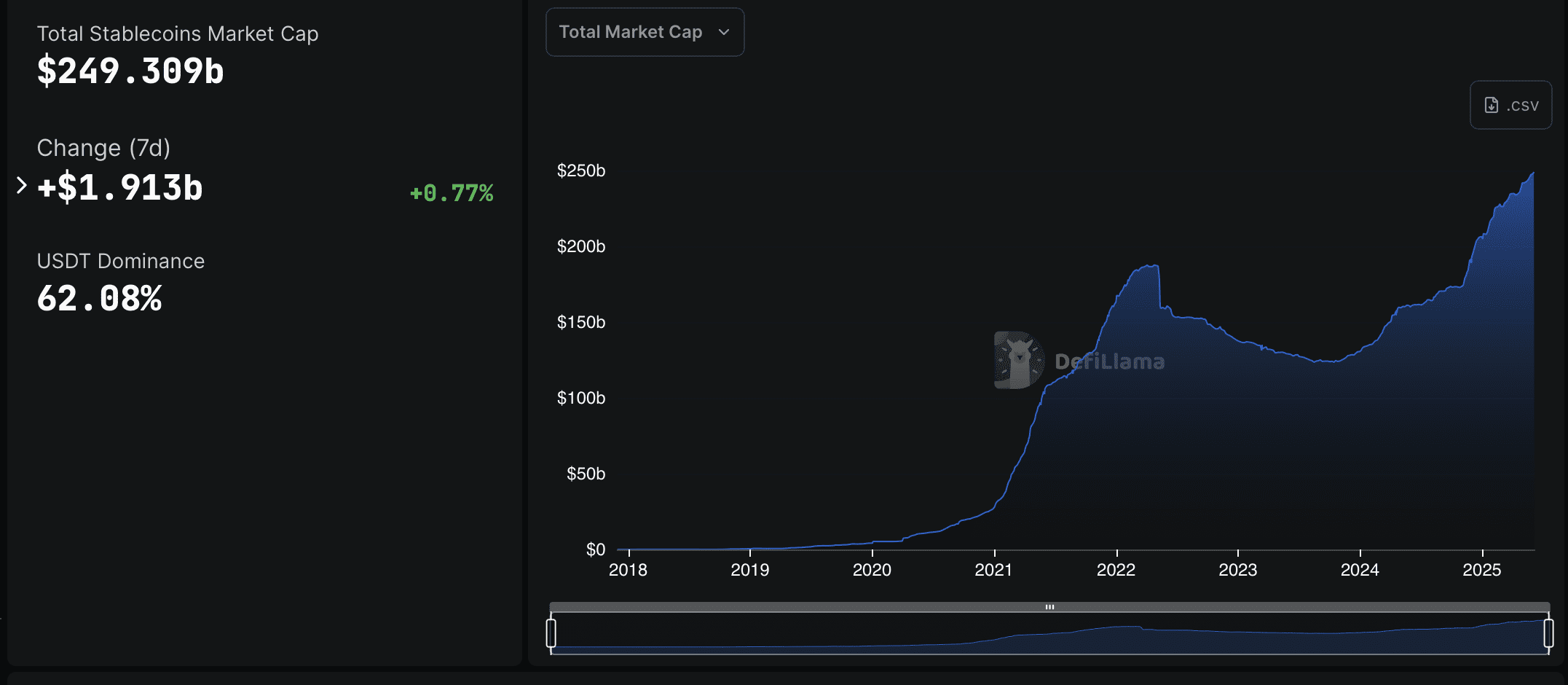

Stablecoins have become one of crypto’s most popular use cases. The market capitalization for such assets has risen to $249.3 billion from $131.3 billion since January 2024, a jump of 90%.

Partnerships between stablecoin infrastructure and tech companies have been on the rise as well. Among the partnerships are Mastercard’s alliance with MoonPay and Visa’s deal with Bridge. In October 2024, Stripe announced its $1.1 billion acquisition of Bridge, which Fortune labeled the “starting gun” for people in Silicon Valley to take stablecoin technology seriously.

Paxos, a crypto company known for stablecoins, has partnered with both Stripe and PayPal to provide services. For Stripe, Paxos planned to launch a new stablecoin payments platform. Paxos is also the company supporting PayPal’s PYUSD stablecoin, which has a $978 million market capitalization.

Related: Musk confirms X Money beta testing ahead of planned 2025 launch

GENIUS Act sparks debate in US Senate

The “Guiding and Establishing National Innovation for U.S. Stablecoins Act,” otherwise known as the GENIUS Act, is one of the developments pushing companies to explore digital assets.

The bill seeks to provide a regulatory framework for stablecoins and their issuers in the country, but has been met with debate about Big Tech’s potential participation in the crypto industry.

According to The New York Times, Republican Senator Josh Hawley recently said he would vote against the bill in its current form as it would allow tech companies the ability to issue digital currencies that would compete with the dollar.

Democrats plan to add an amendment that would ban Big Tech companies from creating their own stablecoins, according to the NYT, citing a person with knowledge of the plan. The move would force tech companies operating in the US to use established stablecoin companies, including Tether and Circle.

Magazine: Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight