Telegram, a popular messaging platform particularly within the crypto community, successfully raised $1.7 billion from investors in a recent bond offering that closed on May 28. The offering featured a 9% coupon.

According to Bloomberg, Telegram intends to allocate a significant portion of the proceeds, approximately $955 million, to settle existing debt from a previous bond issuance slated to mature in 2026. The remaining $745 million will serve as fresh capital, fueling further growth initiatives and covering operational expenses.

Telegram co-founder Pavel Durov highlighted the strong investor interest in a Telegram post:

“The response from investors was phenomenal. We are deeply grateful to the investment funds that have supported us over the years. Due to strong demand, we expanded the offering beyond the initial $1.5 billion — yet demand still far exceeded what we could allocate.”

Telegram’s continued ability to attract investor attention underscores its expanding global reach and feature set, cementing its position as a key platform within the crypto ecosystem. Its widespread adoption within the crypto community positions it as a potential catalyst for further mainstream adoption of cryptocurrencies and blockchain technology.

Notably, investors participating in the bond sale, including prominent entities such as BlackRock and Abu Dhabi investment firm Mubadala, have been granted the option to acquire Telegram shares at a 20% discount should the company proceed with an initial public offering (IPO) in the future. This incentivizes early investment and highlights expectations of Telegram’s continued growth.

Why It Matters

This successful bond offering highlights several key points:

- Financial Strength: It demonstrates Telegram’s robust financial position and ability to attract significant investment.

- Growth Trajectory: The raised capital will be used for growth and operational costs, suggesting Telegram has ambitious plans for expansion.

- Crypto Integration: Telegram’s deep integration with the crypto community, including its TON blockchain, makes it a strategically important player.

Market Impact

Telegram’s actions can have a tangible impact on the crypto market. Consider the following recent event:

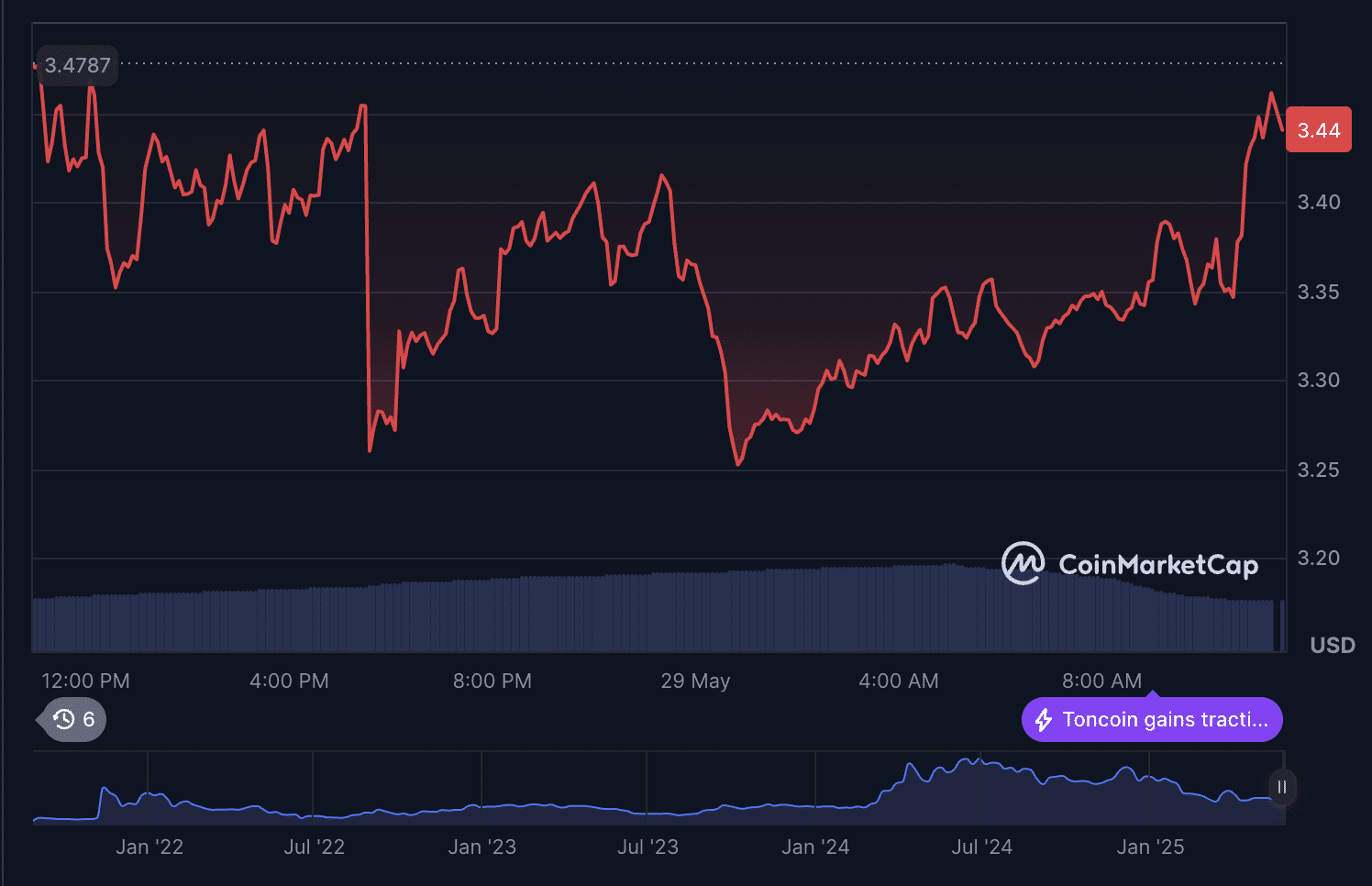

Toncoin (TON), Telegram’s primary digital asset used for app services, experienced a surge of over 20% on May 28, reaching $3.69, following an announcement regarding a potential partnership with Elon Musk’s xAI. While the partnership details are still being finalized, the market reaction underscores the sensitivity of crypto assets to news surrounding Telegram.

Expert Take or Personal Insight

Telegram’s strategy is becoming increasingly clear: solidify its position as the go-to messaging platform for the crypto world, and then leverage that position to drive adoption of its own blockchain and related services. The potential IPO discount for bondholders suggests Telegram is seriously considering going public, which would further legitimize the platform and potentially unlock significant value for investors.

However, it is worth noting that reliance on a single platform controlled by a centralized entity introduces some element of risk. Regulatory changes or shifts in Telegram’s policies could have a negative impact on the crypto projects and communities that rely on it.

Actionable Insight

Traders and investors should pay close attention to further developments regarding Telegram’s plans for TON and any potential partnerships or integrations. Monitor TON’s price action for any correlation with Telegram-related news. Additionally, keep an eye out for any announcements regarding a potential IPO, as this could be a significant catalyst for both Telegram and the broader crypto market.

Conclusion

Telegram’s successful bond offering signals its growing ambitions and its commitment to playing a major role in the future of crypto. As Telegram continues to evolve, its impact on the market is likely to increase. Investors should stay informed and be prepared to react to any significant developments.