Tether, the company behind the world’s largest stablecoin, USDT, has achieved a significant milestone, surpassing Germany in its holdings of United States Treasury bills. This move underscores Tether’s growing influence in the financial landscape and its strategic approach to managing its reserves.

Tether’s Treasury Triumph: A Detailed Look

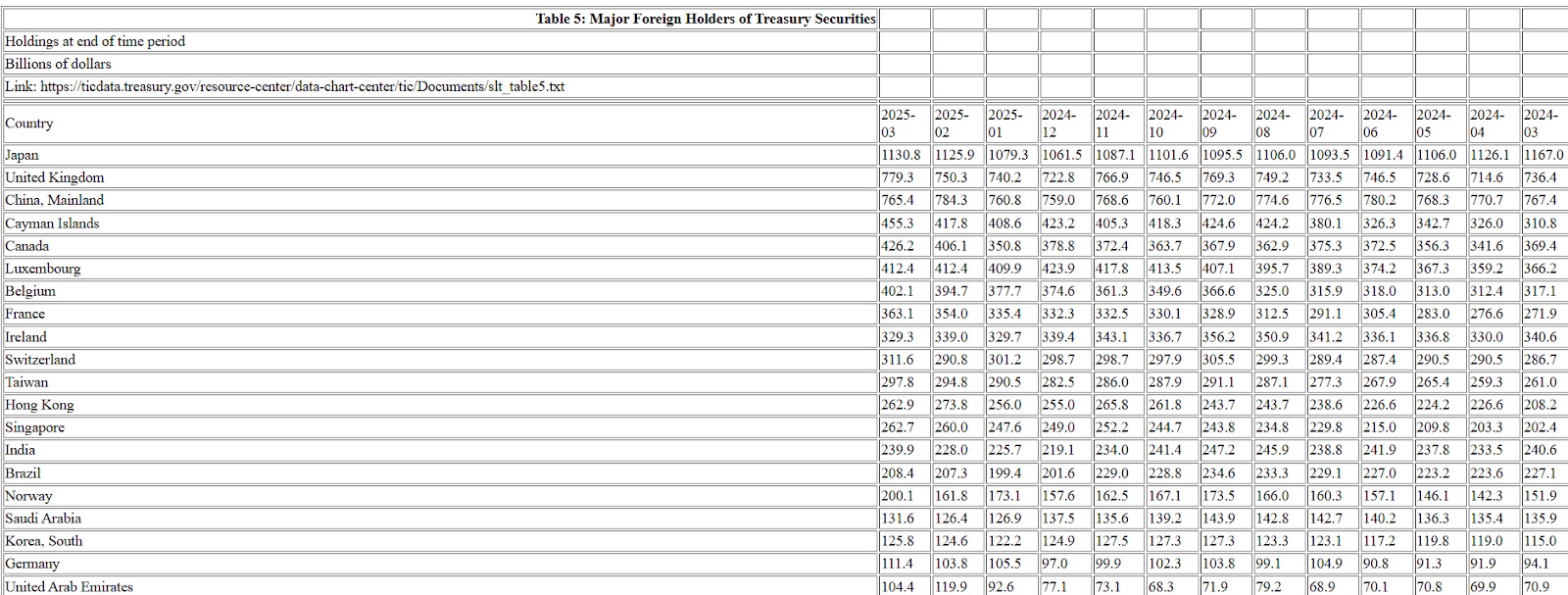

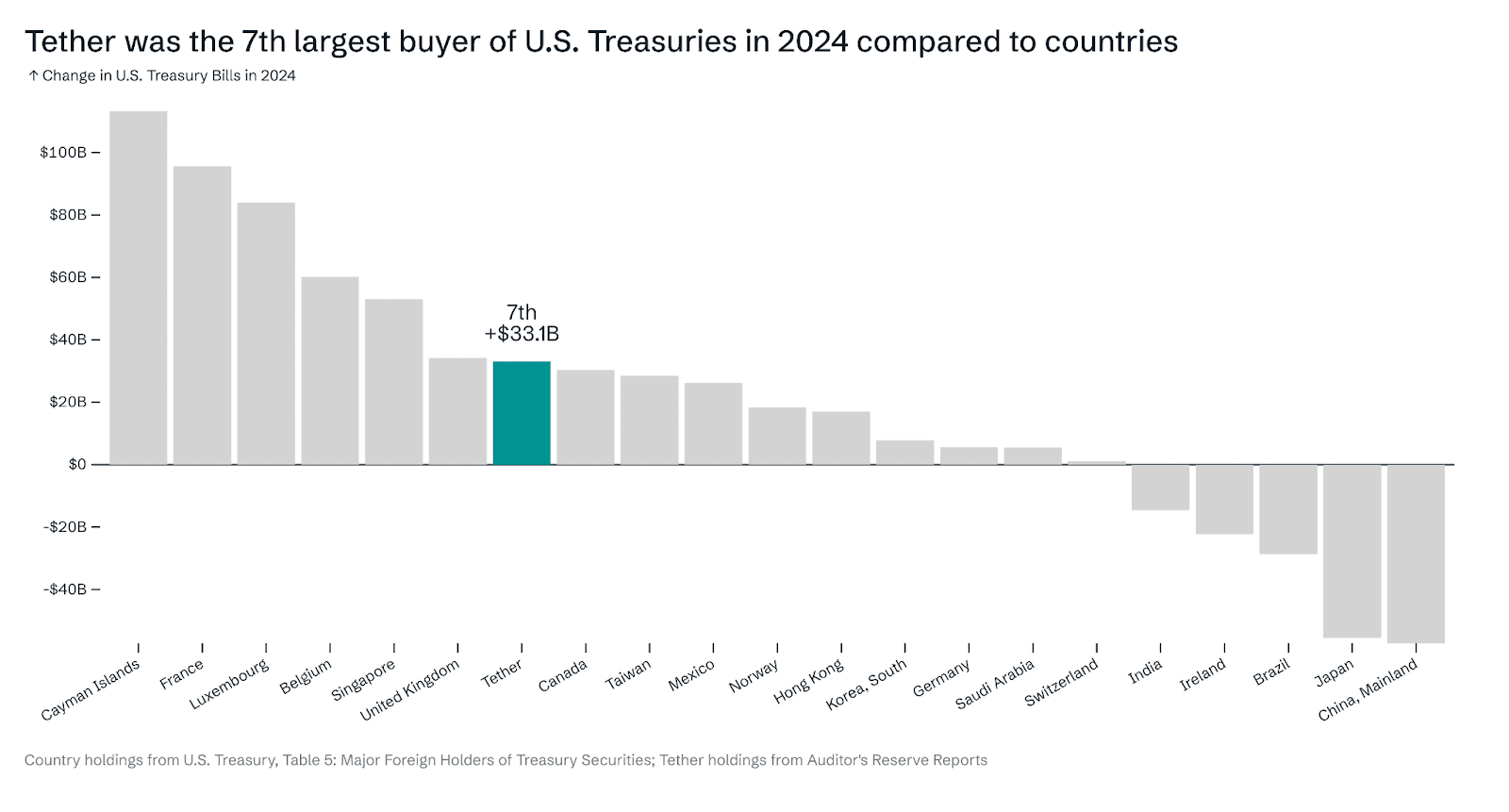

According to data from the US Department of the Treasury, Tether’s holdings of US Treasuries now exceed $120 billion, placing it ahead of Germany’s $111.4 billion. This achievement positions Tether as the 19th largest holder of US T-bills among all countries and entities.

Key Takeaways:

- Tether’s US Treasury holdings surpass $120 billion.

- Ranks 19th globally in T-bill investments.

- Demonstrates a conservative reserve management strategy.

- Highlights Tether’s role in distributing dollar-denominated liquidity.

Paolo Ardoino, Tether’s CEO, stated that this milestone reinforces the company’s commitment to stability and transparency. Investing in US Treasuries provides a safe and liquid asset backing for USDT, ensuring its value remains pegged to the US dollar.

The Significance of US Treasury Holdings

US Treasuries are debt securities issued by the US government, widely considered one of the safest investments globally. They are backed by the full faith and credit of the United States and offer a low-risk way to store value. For Tether, investing in Treasuries provides a stable foundation for its USDT stablecoin, helping maintain its peg and providing confidence to its users.

Tether’s Growth and Reserve Strategy

Tether’s growth has been remarkable in recent years, driven by the increasing demand for stablecoins in the cryptocurrency market. As the leading stablecoin, USDT plays a crucial role in facilitating trading, lending, and other activities within the crypto ecosystem. To support this growth, Tether has adopted a diversified reserve strategy, investing in a mix of assets, including:

- US Treasury bills

- Cash and bank deposits

- Money market funds

- Other liquid assets

- Gold

This diversified approach helps mitigate risk and ensures that Tether has sufficient reserves to meet redemption requests from its users.

Tether’s Financial Performance and Stability

In the first quarter of 2025, Tether reported over $1 billion in operating profit from its traditional investments, largely driven by its US Treasury portfolio. The performance of gold also helped offset volatility in crypto markets. This financial strength underscores Tether’s ability to navigate the challenges of the crypto industry and maintain its stability.

The Regulatory Landscape for Stablecoins

The regulatory environment for stablecoins is evolving rapidly, with policymakers around the world seeking to establish clear rules and guidelines. In the United States, there are several legislative initiatives underway aimed at regulating stablecoins, including:

- The STABLE Act: Aims to provide transparency and accountability for stablecoin issuers.

- The GENIUS Act: Seeks to establish collateralization guidelines and ensure compliance with Anti-Money Laundering laws.

These regulatory efforts could lead to increased clarity and legitimacy for stablecoins, potentially driving further adoption and investment in USDT.

The Future of Tether and Stablecoins

Tether’s growing US Treasury holdings and strong financial performance position it for continued success in the stablecoin market. As the regulatory landscape becomes clearer, stablecoins like USDT are likely to play an increasingly important role in the global financial system.

Looking ahead, Tether’s focus on transparency, stability, and regulatory compliance will be crucial to maintaining its leadership position and fostering trust among its users.